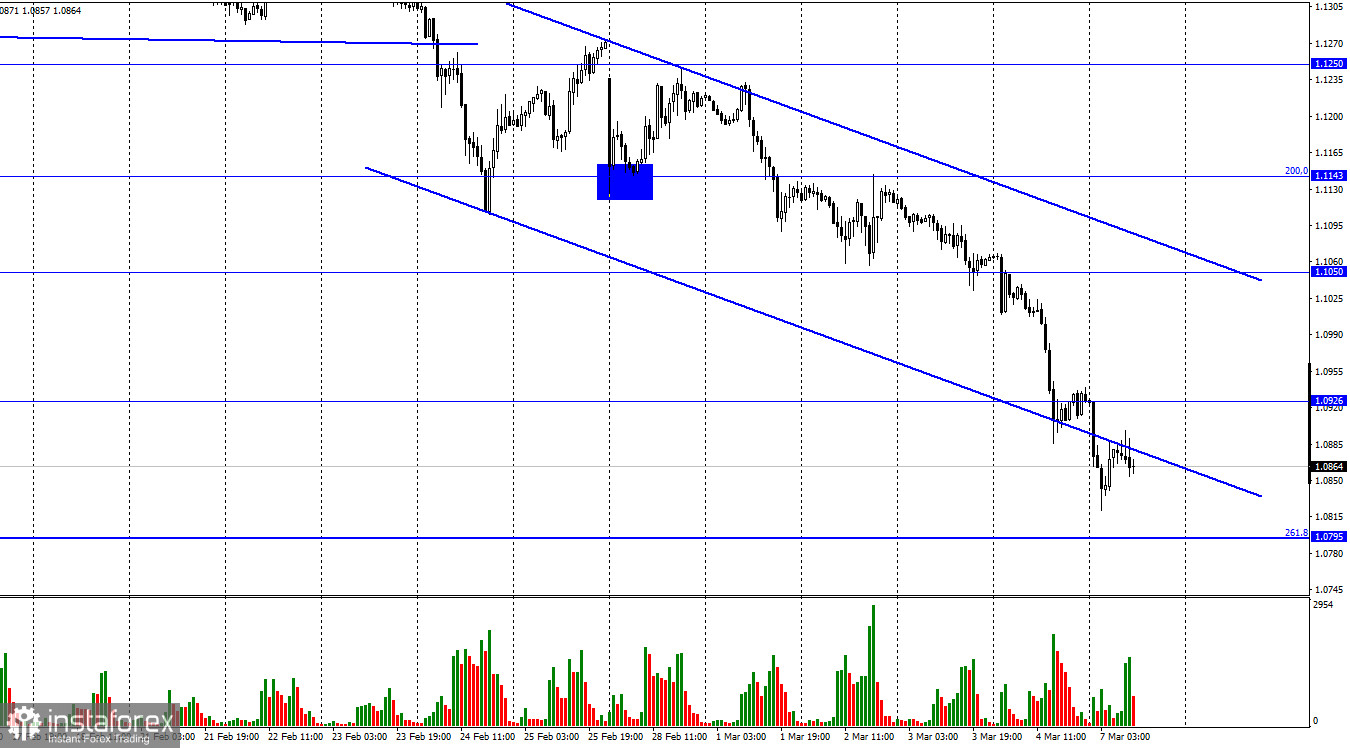

The EUR/USD pair resumed its fall on Friday, then consolidated below the level of 1.0926. On Monday, the downward movement resumes. In total, since the opening of Friday, the quotes of the European currency have already fallen by 200 points. From my point of view, taking into account all the movement since February 24, this can only be called a collapse.

In total, the U.S. dollar has already grown by 450 points and is unlikely to stop there. Demand for the dollar continues to grow as the geopolitical situation in Ukraine does not improve from the word "completely." Thus, the war is in full swing, the sanctions are in full swing, the stock markets are falling, and the news for the market, traders, investors, and ordinary people of any country is only gloomy. Today it became known, that starting from March 11, Russia can "cut off" the entire external Internet.

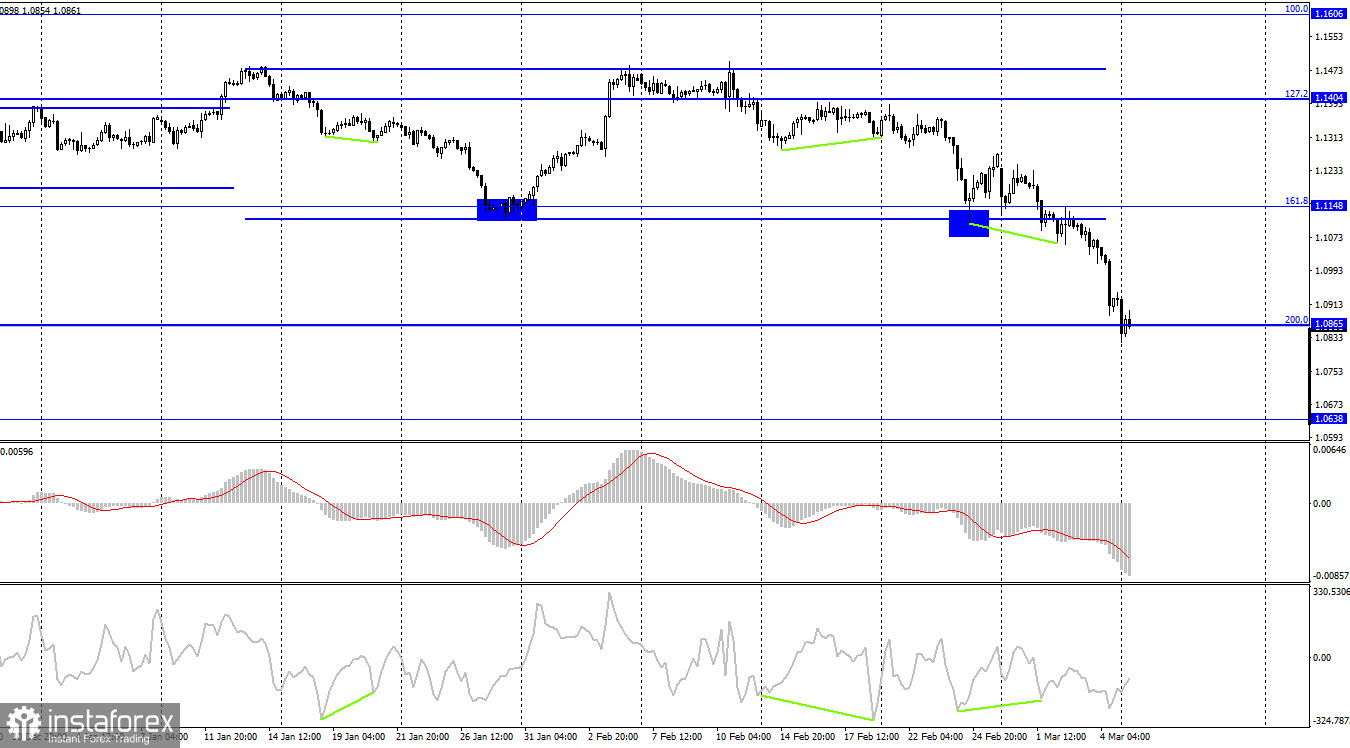

On the 4-hour chart, the pair fell to the 200.0% retracement level at 1.0865. The rebound of quotes from this level will allow traders to count on a reversal in favor of the EU currency and some growth of the pair in the direction of the corrective level of 161.8% - 1.1148. A close below 1.0865 would only increase the chances of further fall towards the next level at 1.0638. There are no emerging divergences today.

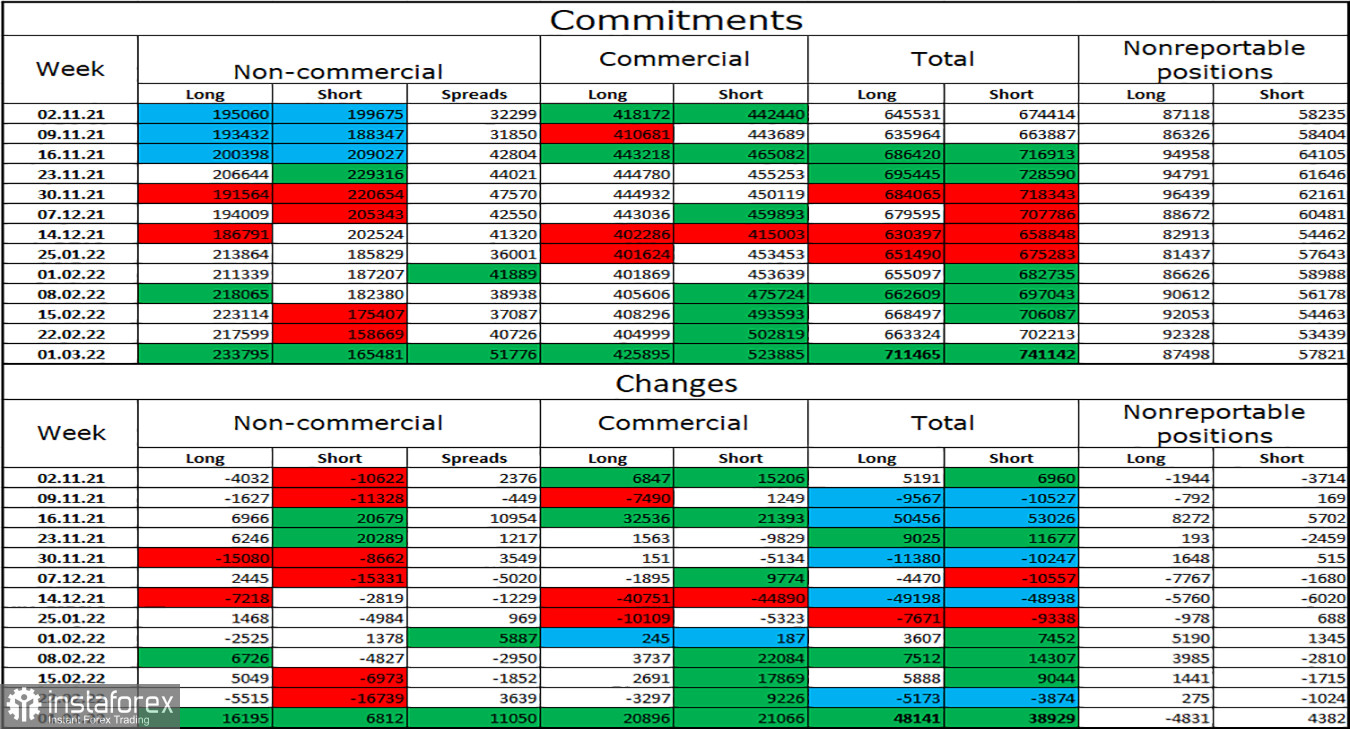

Commitments of Traders (COT):

Last reporting week, speculators opened 16,195 Long contracts and 6,812 Short contracts. This means that the bullish mood has intensified. The total number of Long contracts focused on their hands is now 233k and Short contracts are 165k. Thus, in general, the mood of the non-commercial category of traders is also characterized as bullish. This would enable the European currency to count on growth, if not for the information background, which now supports only the U.S. currency.

We are now witnessing a paradoxical situation: the bullish mood of major players is increasing, while the currency itself is falling. And it falls a lot. Thus, only geopolitics matters now.

News calendar for USA and EU:

On March 7, the calendar of economic events in the European Union and the United States does not contain a single interesting entry. However, political and geopolitical news may still come in during the day. Thus, a strong movement can continue.

Forecast for EUR/USD and recommendations for traders:

I recommended new selling of the pair with targets at 1.0926 and 1.0850 if a close under the sideways channel on the 4-hour chart is made. Both targets have been achieved. Those who are still selling can stay in them with a target of 1.0795. I do not recommend buying the pair, as the fall is too strong at present.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română