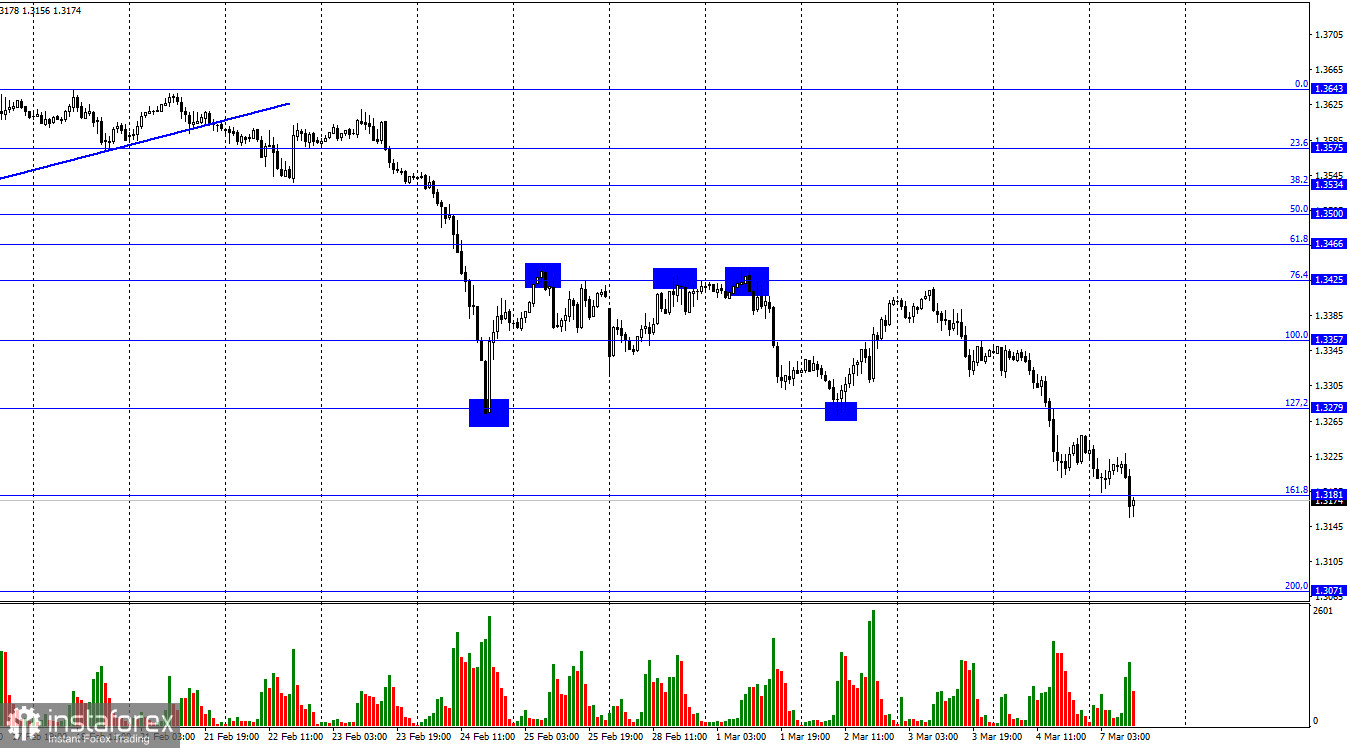

According to the hourly chart, the GBP/USD pair fell by 120 points on Friday, and by another 70 on Monday. Thus, the British dollar has fallen by the same 200 points over the past day and a half as the euro currency. The massive sale of European currencies continues. As I said earlier, the dollar now looks like the most stable currency, and the main reason for its strong growth can be considered geopolitics. To my great regret, there is no progress in the negotiations between the Ukrainian and Russian delegations. The third stage should pass today, but the absolute majority of experts believe that no progress can be achieved today. It should be borne in mind that progress can now be called a truce or at least a temporary ceasefire. And since the positions of the parties are at different poles, it is unlikely that any of them decided to abandon their demands in a few days.

On Friday, by the way, the dollar was also growing thanks to strong statistics from America. The Nonfarm Payrolls report turned out to be much better than traders' expectations and showed the creation of more than 600 thousand new jobs outside agriculture. The unemployment rate also dropped to 3.8%, and this news gave new strength to bear traders who were already going to fix part of the profits on their past deals. But not this time. Why take profit if the pair has unlimited potential to fall? This week, important economic news will be only in the UK and only on Friday. The calendar of US economic events is almost empty. However, I believe that traders can continue to sell the euro and the pound, as the geopolitical background continues to deteriorate. Moreover, sanctions are imposed on both sides, and it is noteworthy that the "second side" is not Ukraine, but the United States and the European Union. In general, nothing good is happening now either in the world or in the markets. However, you can earn "nothing good" on this, since the pair moves almost only in one direction.

On the 4-hour chart, the pair performed a new drop to the corrective level of 61.8% (1.3274) and closed below it. Thus, the fall in quotes can be continued in the direction of the next Fibo level of 76.4% (1.3044). There are no emerging divergences today, and it is very difficult to count on any growth of the British now.

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed dramatically again over the last reporting week. The number of long contracts increased in the hands of speculators by 7,128, and the number of short contracts increased by 2,046. Thus, the general mood of the major players has become more "bullish", but at the same time, in the category of speculators, there is now equality in the number of long and short contracts. Thus, I conclude that the mood is now more neutral than "bearish" or "bullish". But even this does not matter much, since geopolitical factors can continue to have a very big impact on the British rate. Already it turns out that the mood is "neutral", and the pound is falling.

News calendar for the USA and the UK:

On Monday, the calendars of economic events in the UK and the US are empty. Nevertheless, the new fall of the Briton began at night and can persist all day even without an informational background.

GBP/USD forecast and recommendations to traders:

At this time, I would recommend selling the British dollar with targets of 1.3071 and 1.3044, as the closing was made under the level of 1.3181. I do not recommend buying a Brit today, since all factors remain in favor of the dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română