Nonfarm payrolls were highly significant

Hello, dear traders!

The GBP/USD pair showed a downward trend at the end of last week's trading session. However, first the GBP/USD bulls were optimistic as the pair was rising and reached the level of 1.3435. However, the US nonfarm payrolls were highly significant. Moreover, it would be more reasonable to provide the US labor market data as not only nonfarm payrolls were better than analysts estimated. Besides, the US unemployment rate has fallen dramatically. Although US labor reports are traditionally considered one of the most significant macroeconomic indicators, the military conflict between Russia and Ukraine is also relevant. I think it is the key factor that greatly affects market sentiment. Moreover, the sentiment is not favorable to risky assets. Currently, the US dollar has an advantage over the British pound as it is both the world's major reserve currency and a safe haven asset. Moreover, it is highly possible that the Federal Reserve may raise the federal funds rate for the first time since the COVID-19 pandemic at its next meeting on March 15-16. Senior Fed officials said that the rate hike could currently reach 2.5% with soaring inflation. However, the Bank of England may raise its main interest rate up to 1%.

As for the economic calendar, there will be no important reports this week. However, Friday will be the most significant day for the British currency as GDP, trade balance and industrial production data will be released. US relevant reports will be published during this week. Further details will be provided on the day of their release. There are no key macroeconomic events scheduled for today. Therefore, it is better to discuss the GBP/USD price chart.

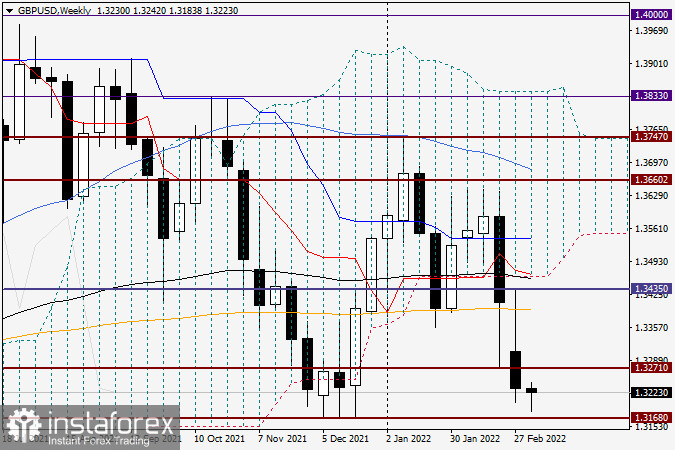

Weekly

As mentioned above, the situation has changed dramatically after the pair reached 1.3435. Then, the GBP/USD pair reversed in the southern direction. It is likely that the orange 200 exponential moving average, which provided a strong resistance, triggered this reversal. Consequently, the support level of 1.3271 with the lows of the week before last was broken. The extremely long upper shadow of the last weekly candlestick indicates that the bulls have failed to reach their target. The pair is dominated by bearish sentiment. In this case, the next target of the bears may be the support level of 1.3168. A possible breakout of this level will further strengthen the position of sellers of the British pound.

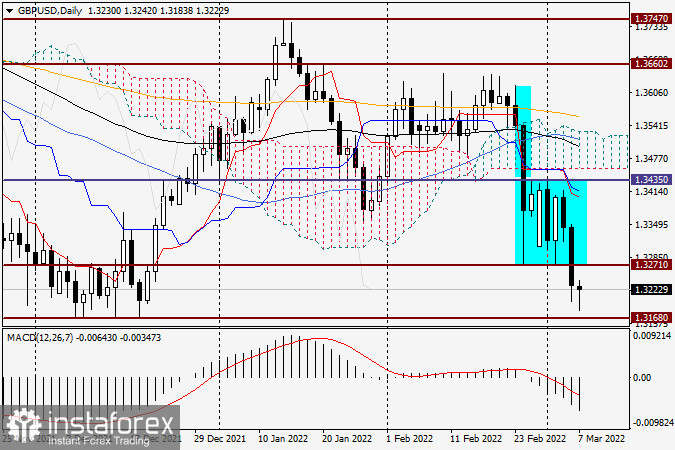

Daily

A bearish pattern is also observed on the daily chart. Moreover, the inverted flag pattern of the technical analysis makes it more reliable. Notably, it is not a reversal pattern, but a continuation pattern. As seen on the chart, after some consolidation and formation of the flag pattern, the pair has broken its lower boundary and strives for further decline. However, the pound is unpredictable. Therefore, the pair can return to the range of 1.3435-1.3271. Besides, the GBP/USD pair should consolidate below 1.3271. Then, it is advisable to sell it after the pair pulls back to this level. If the GBP/USD pair continues to decline to the support level at 1.3168 with candlestick signals for buying at this level or on smaller charts, it is possible to take advantage of it, taking into account the correction. Moreover, I believe the main trading idea for the GBP/USD pair is to sell it after corrective pullbacks to the price area of 1.3270-1.3300.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română