Russia's military operation in Ukraine has driven volatility to its highest level in a year, commodity prices have experienced their biggest weekly price spike since 1974, and covid-induced logistical problems are getting worse. Obviously, we should expect prices to rise and slow the pace of economic recovery.

It should also be noted that further deterioration in financial conditions will be seen by markets as equivalent to a tightening of monetary policy, which may force the Fed to slow down its rate hike, but will not help to solve the problem of rising inflation. And this means that the arrival of stagflation is becoming more and more real.

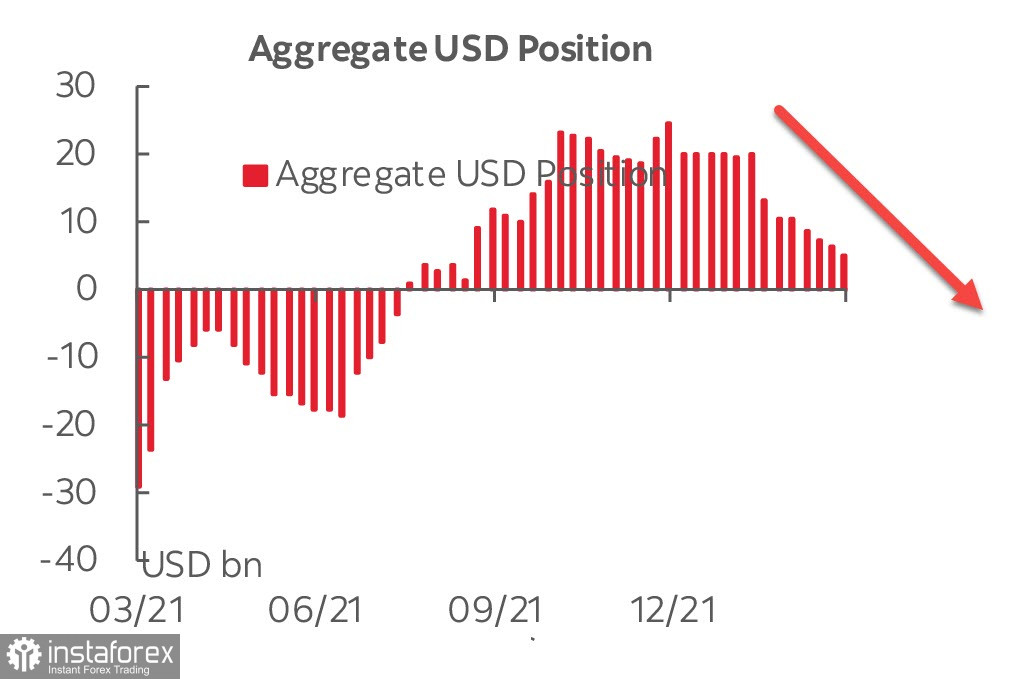

The CFTC report included, among other things, the first reaction of the market to the outbreak of hostilities in Ukraine, and it should be noted that, despite the significantly increased risks, long-term investors did not react. The aggregate position of the U.S. dollar fell again by 1.1 billion to 5.1 billion, the lowest level since mid-August.

Moreover, despite the growth of risks, large short positions in the franc and yen were opened during the reporting week, that is, there were no signs of flight to safe-haven currencies.

As for the employment report, the markets did not get what they predicted at all – 678,000 new jobs were created in February (forecast +400,000), in addition, December and January were revised upward by 92,000. The unemployment rate dropped to 3.8%, the lowest since the pandemic, just 0.3% above two years ago, and labor force participation rose to 62.3%.

The non-farm data is contrary to the ISM report on the services sector, business activity in the sector and new orders decreased, with the employment sub-index falling to 48.5p instead of the expected increase to 53.5p. It is still unclear how to interpret this gap, when according to some data there is a steady increase in employment, while others interpret a fall, particularly in the key sector of the economy.

The key event of the week, if we forget about geopolitics, is the U.S. consumer inflation report on Thursday. Further rise in inflation is likely to require more decisive action from the Fed and support the dollar.

EURUSD

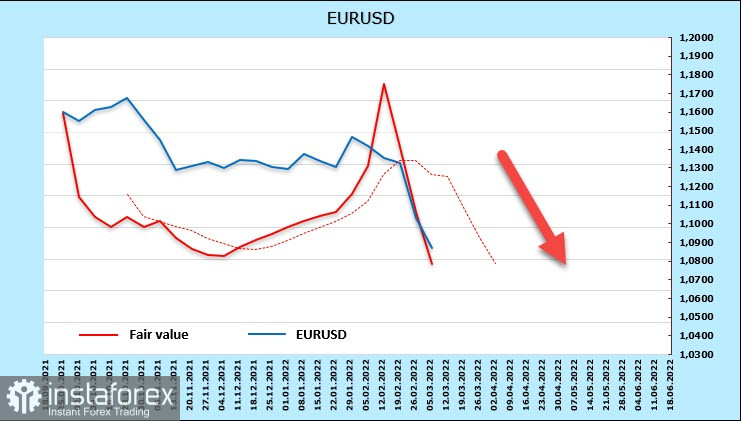

The European currency is under strong pressure, as it bears the greatest risks both from military operations in Ukraine and from a strong rise in commodity prices. It should also be noted that it is European countries that have shown the greatest activity in the conduct of anti-Russian sanctions, which means that it is European companies that will be most affected by Russia's response actions.

The euro fell below 1.09 for the first time since mid-2020 and is likely to remain under pressure ahead of Thursday's ECB meeting. The danger of stagflation for Europe has already been voiced by several banks in their analytical reviews.

The CFTC report for the euro is neutral, the net long position even rose slightly (+655 million) to 9.031 billion, but the settlement price went down sharply.

EURUSD found a shaky bottom, but did not reach the border of the bearish channel, which suggests that the momentum will continue until the support of 1.0636. An upward reversal can take place only if there are signs of de-escalation in Ukraine, which is unlikely in the current conditions.

GBPUSD

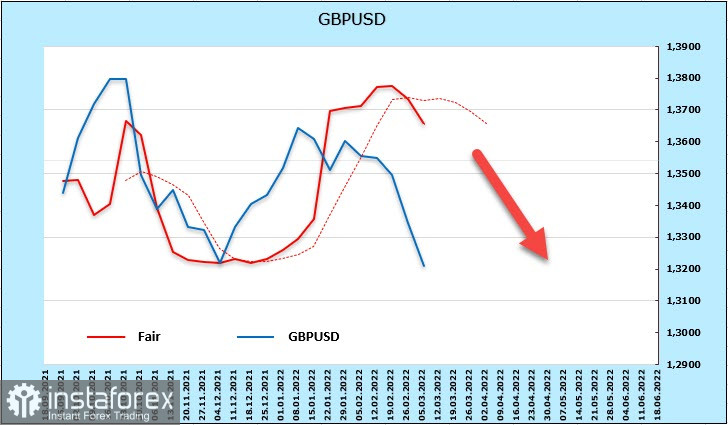

Forecasts remain moderate as the Bank of England meeting on March 17 approaches, the chances that the BoE will raise the rate immediately by 0.5% are approximately 20%, but the probability of the bank's easing position, on the contrary, is growing. Some things can be assumed more or less confidently, in particular, an increase in energy prices will lead to an increase in inflation and a decrease in real incomes, so a possible increase in the rate is now extremely unpopular among the subjects of the crown.

Positioning on the pound is neutral (-28 million), but the settlement price goes down for the same reasons as the euro.

The pound may test 1.32 in the very near future, then the target is 1.30.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română