EUR/USD dropped a little after reaching 1.0588 today's high. Now, it's trading at 1.0540 at the time of writing. It is fighting hard to rebound after its sell-off. As you already know, the bias remains bullish as the Dollar Index is in a corrective phase, it remains under pressure.

Today, economic data had a big impact. The US PPI rose by 0.3% exceeding the 0.2% growth expected, Core PPI surged by 0.4% beating the 0.2% estimated, while Prelim UoM Consumer Sentiment came in at 59.1 points far above 56.9 expected. In addition, Final Wholesale Inventories came in better than expected as well.

EUR/USD Retesting The Buyers!

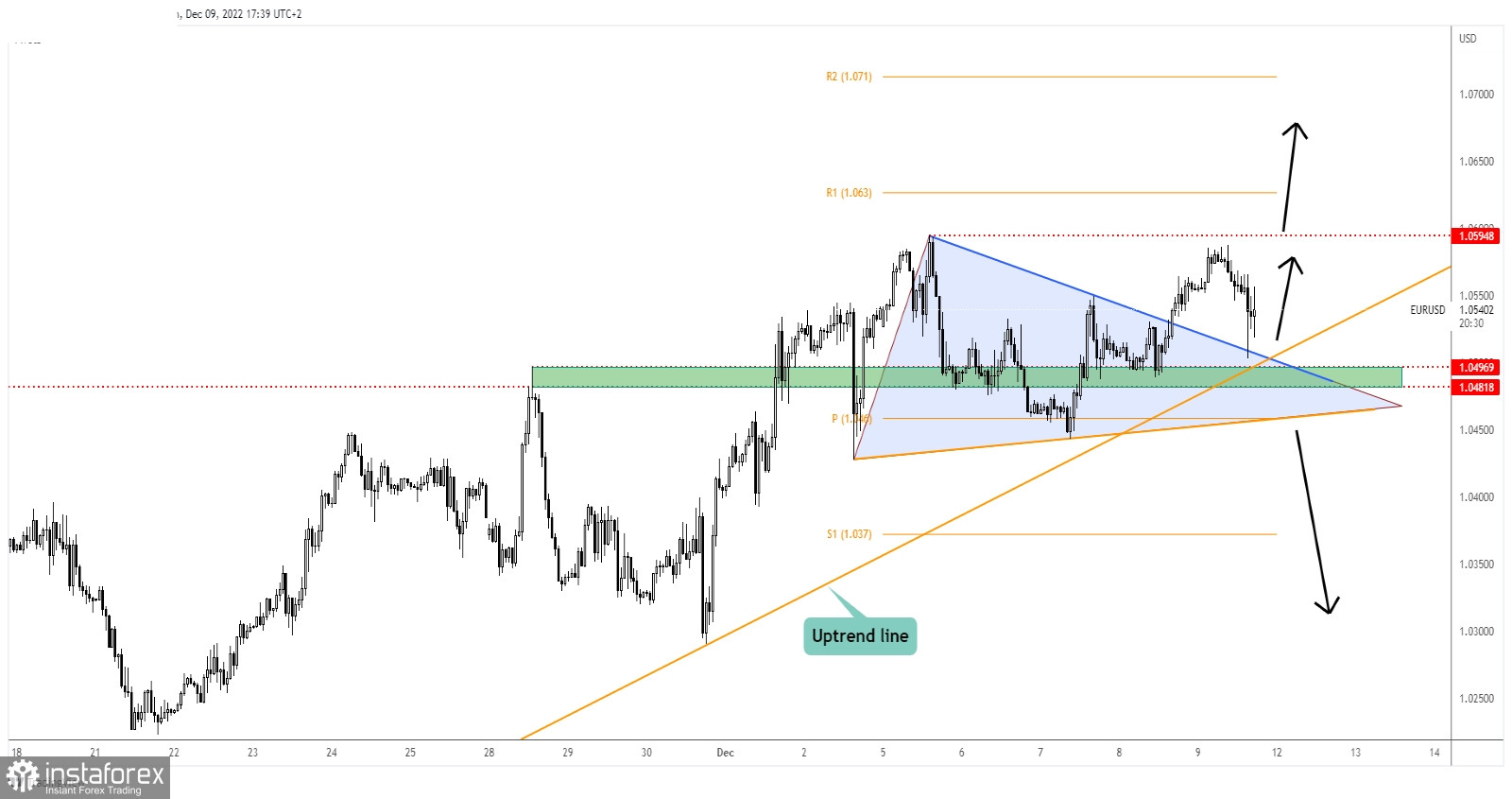

As you can see on the H1 chart, the rate dropped as much as 1.0566 after the economic data, but the bias remains bullish as long as it stays above the uptrend line. The 1.0496 - 1.0481 area represents an important support zone as well.

In the short term, EUR/USD could move sideways. 1.0594 represents a static resistance. After registering a false breakdown with great separation through the triangle's upside line, the upside pressure remains high.

EUR/USD Forecast!

The bias is bullish as long as it stays above the uptrend line. Testing and retesting this line, registering only false breakdowns may signal a new bullish momentum and could bring new longs.

Also, a new higher high, a valid breakout through 1.0594 brings new buying setups as well. Only dropping below the uptrend line and under 1.0481, dropping below the triangle's downside line could open the door for more declines.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română