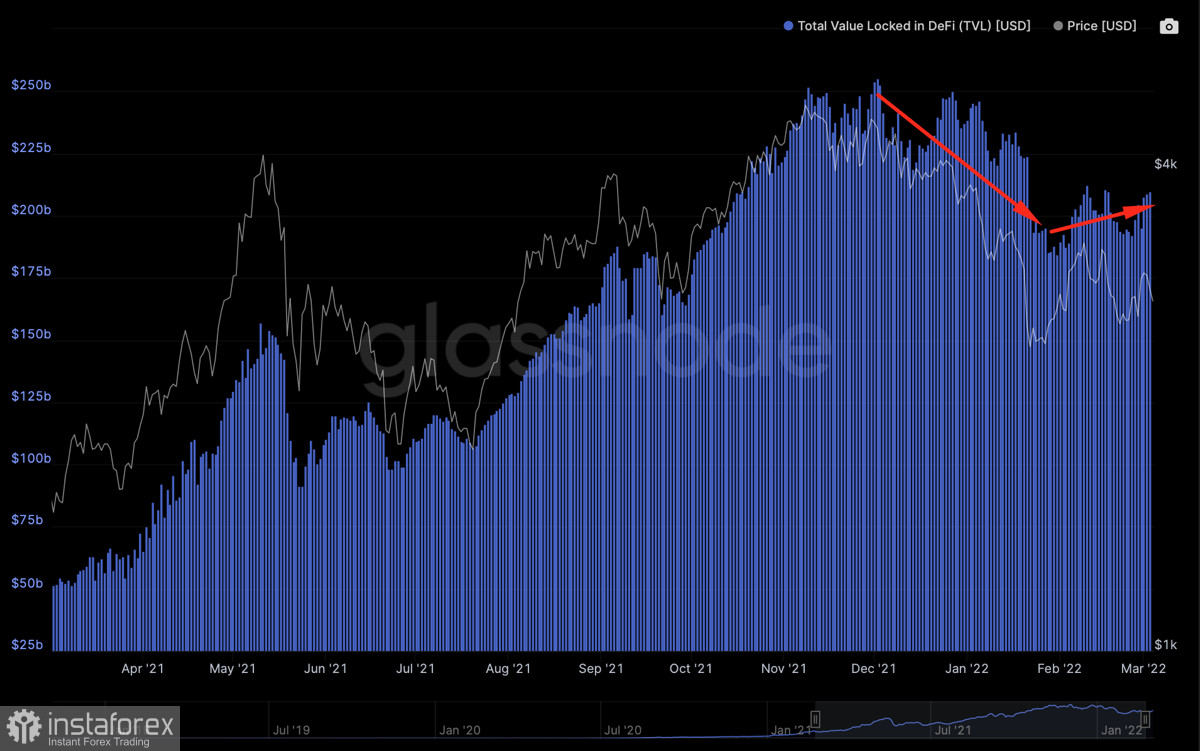

Over the past week, the global economy has plunged into chaos, and the main fiat funds have lost their former stability. At the same time, the main cryptocurrencies showed a reverse trend and began to grow in price. But related sectors of the cryptocurrency market showed low liquidity in February 2022.

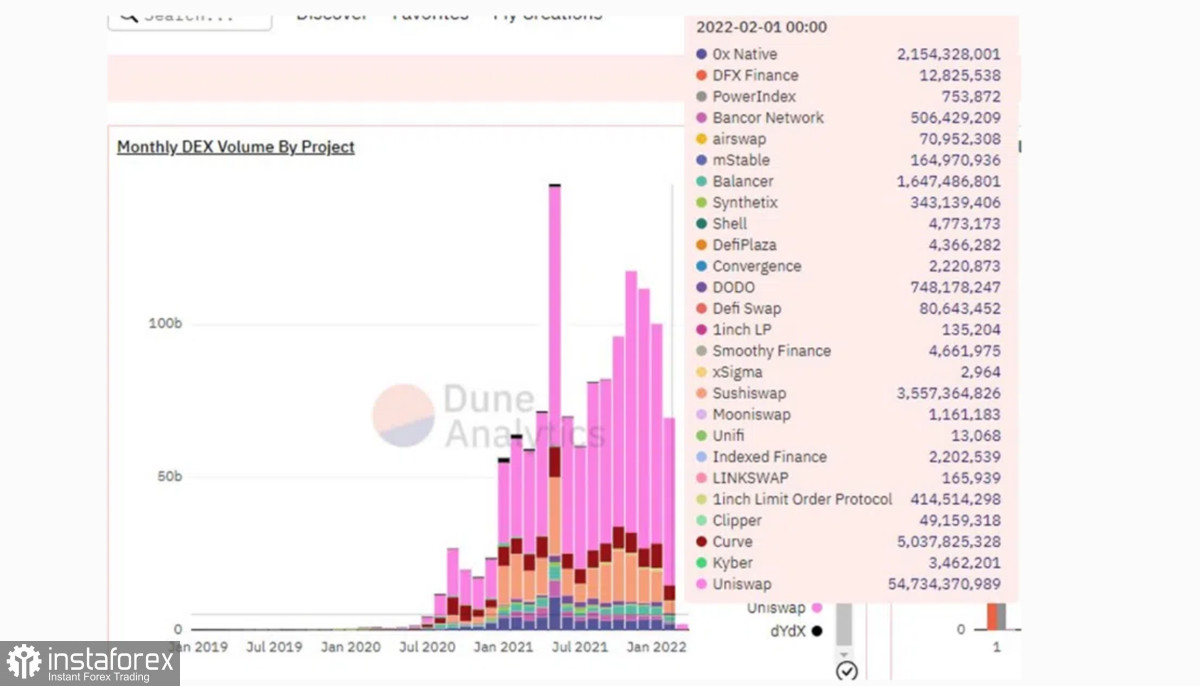

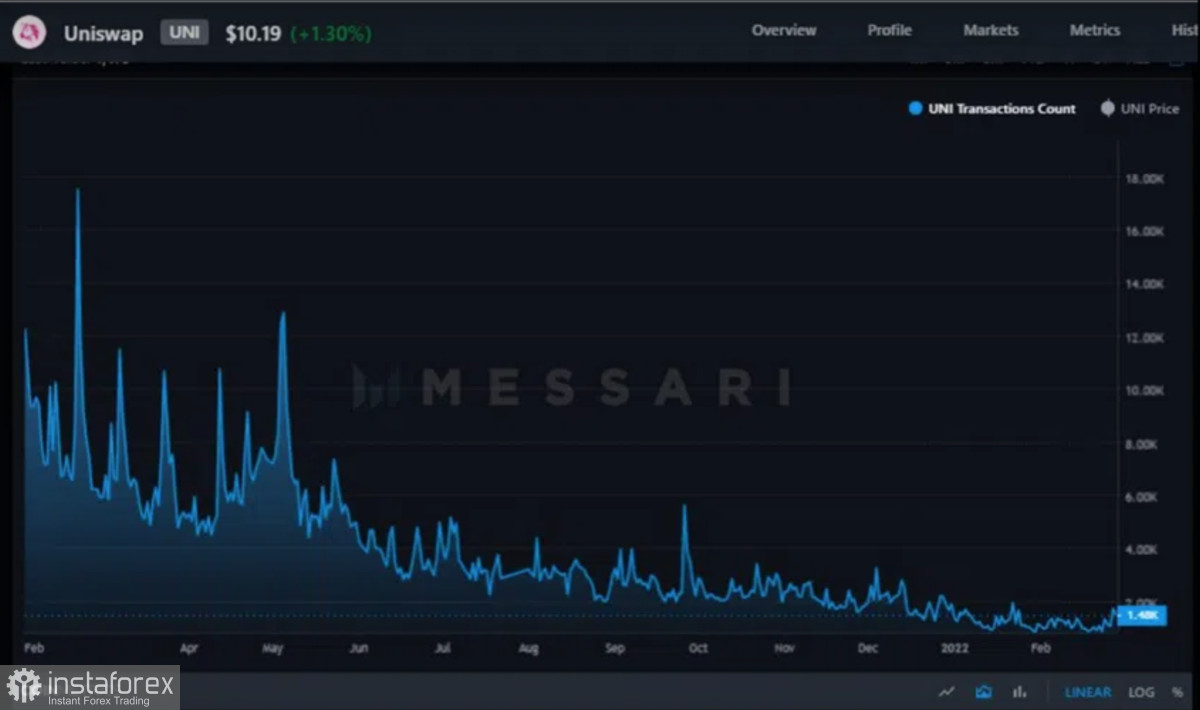

First of all, we are talking about DeFi and NFT, which lost up to a third of their liquidity in February. The largest losses were shown by the decentralized platform Uniswap. By the end of February, the site lost 29% of liquidity, and trading volumes barely reached $54 billion. In just one month, DEX lost $28 billion. Similar dynamics can be seen on other decentralized platforms.

Among the probable reasons for the decline in liquidity, it is worth noting the investment obsession with gold during the aggravation of relations between Ukraine and Russia. The crypto industry has taken a backseat, with investors primarily trying to save capital. Against the backdrop of a fall in overall investment in cryptocurrencies, investments in the decentralized sector also decreased.

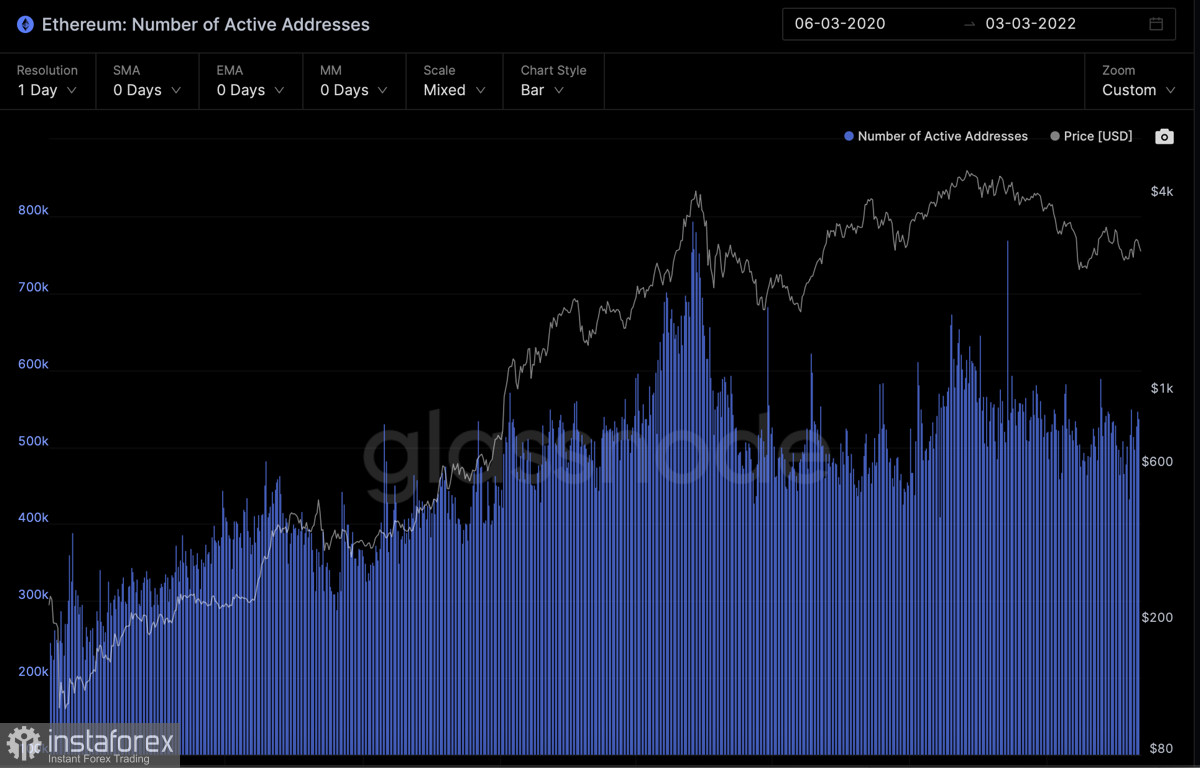

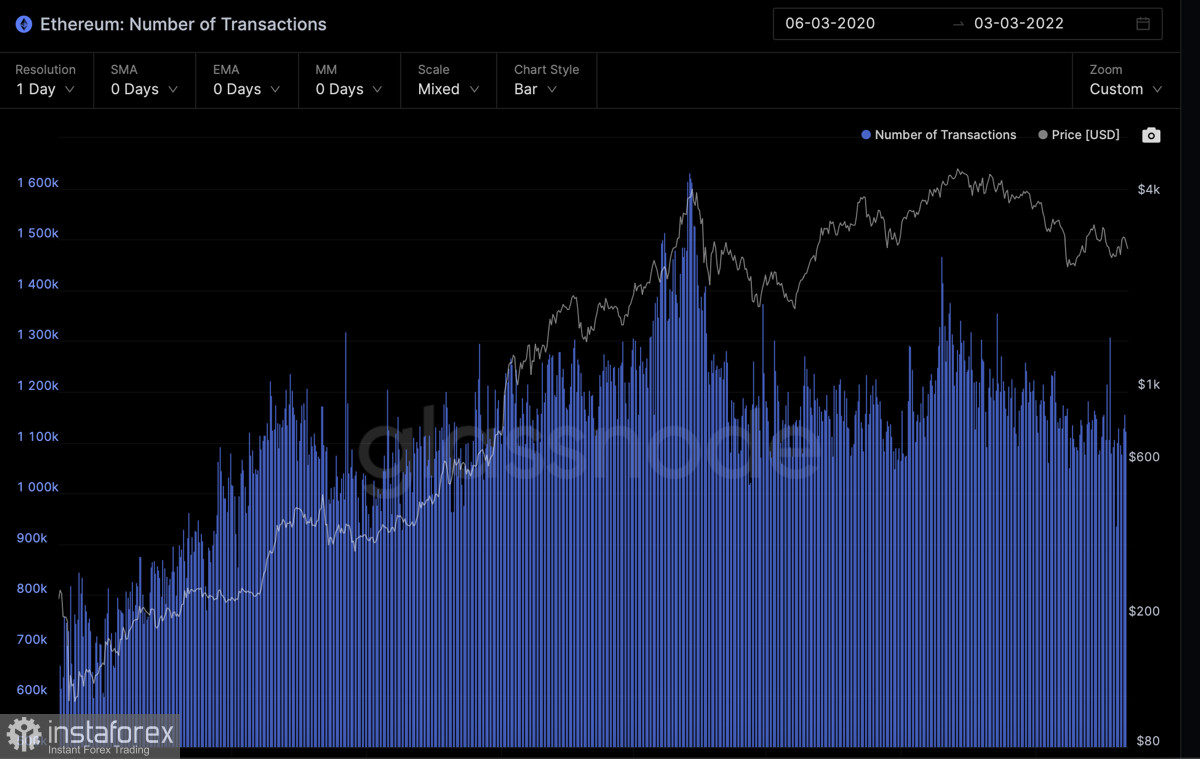

It is also important to highlight the downward trend in the number of transactions since October 2021. And despite the fact that the decrease in the number of transactions was only 3%, this is also one of the reasons for the drop in liquidity on decentralized platforms.

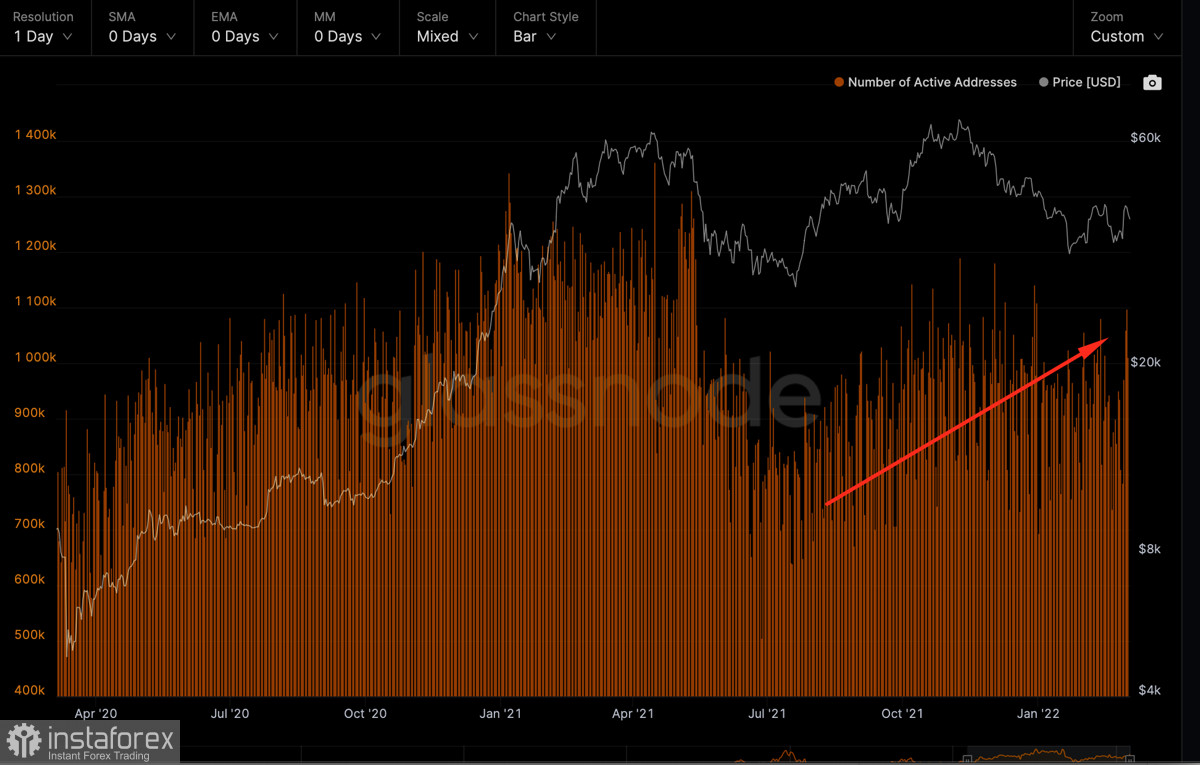

In the long term, there is no reason to believe that the DeFi and NFT industries will continue to lose liquidity. Since the beginning of the military invasion of the Russian Federation on the territory of Ukraine, crypto funds have managed to attract more than $50 million in investments. The number of projects with blockchain technologies also continues to grow. The on-chain activity of Bitcoin also continues to grow, which confirms the growing interest of investors in crypto assets.

Given the reorientation of investors to the cryptocurrency market and Bitcoin, in the near future, we should expect an increase in the number of transactions and, accordingly, liquidity on decentralized platforms.

This is also evidenced by the growth of Ethereum network activity. The number of unique cryptocurrency addresses has acquired an upward trend. The number of transactions is also starting to increase, which indicates the imminent growth of liquidity in the DeFi and NFT sectors. As for the technical picture, which also affects investor interest in DEX, it is less positive.

ETH continues to be within the downward trend from December 1, 2021. All attempts to break through the $3k level failed. At the same time, a triangle pattern has formed on the daily chart, which can be broken in any of the directions in the coming week. Technical indicators point to a temporary downside, with RSI and Stochastic in bullish territory but declining, suggesting increased selling and strong bearish support near $3k. With this in mind, in the near future, the DeFi sector will experience liquidity problems, but first of all, this will concern small projects.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română