The latest PMI data shows that inflation is still a concern, despite the figures being close to expectations as it can be. It seems that the cold weather greatly affected several regions, especially their service sector. Not only did it lower demand and increased supply very sharply, but also damaged the business operations of many companies.

In the UK, service PMI rose to 60.5 in February, from 54.1 in January. This is slightly below the original estimate of 60.8 points. Andrew Harker, director of economics at IHS Markit, said that although the figure is encouraging, economic growth may still be limited because the impact of the war in Ukraine remains to be seen.

As for the US, business activity is almost equal to the forecasted value of analysts. It was just off 0.9 points, and is slightly below the previous value of 51.1 points. In terms of PMI, the data for February fell to 56.5%, down from 59.9% in January.

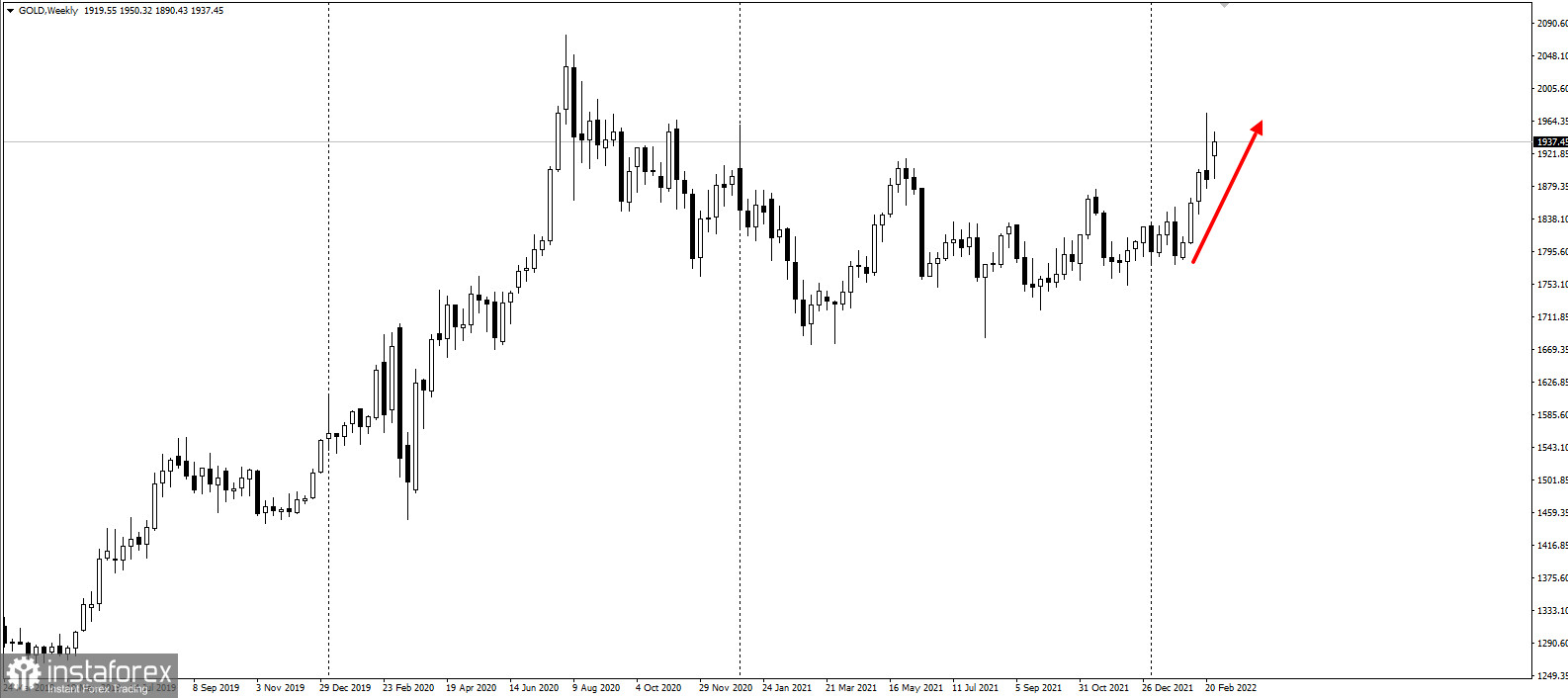

Because of these, the gold market continues to see strong demand, despite the conflict in Ukraine.

The report also said business activity showed a reading of 55.1%, down from January's reading of 59.9. At the same time, new orders fell to 56.1%, down from the previous value of 61.7%.

Data in the labor market fell as well, with the employee index dipping from 52.3% to 48.5% .

All these are positive for gold as they point to rising inflationary pressures. These are also why the price index rose from 82.3% to 83.1%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română