The military conflict in Ukraine continues to affect the global markets. The most striking example is the reaction of investors to the latest data on the US economy. Although the reports on jobless claims, business activity and industrial orders exceeded expectations, the markets remained bearish.

According to the data released on Thursday, jobless claims in the US fell to 215,000 last week, lower than the estimated 226,000. Industrial orders, meanwhile, rose by 1.4% in January, against 0.7% in December. Business activity also increased from 51.1 points to 56.5 points.

The stock market initially grew because of these positive data, but due to the conflict in Ukraine, fell back under pressure. Indices in Europe and Asia dipped as well.

Today, the focus of the market will be the US employment data from the Department of Labor. Analysts forecast that new jobs increased to 400,000 in February. The unemployment rate is also expected to decrease from 4.0% to 3.9%.

If the real figures exceed expectations, then stock indices will grow. However, it will be limited because of the situation around Ukraine. In any case, dollar demand will surge, especially amid the potential interest rate hike this month, following the Fed's monetary policy meeting.

Forecasts for today:

EUR/USD remains under pressure. A drop below 1.1010 will lead to a fall to 1.0935.

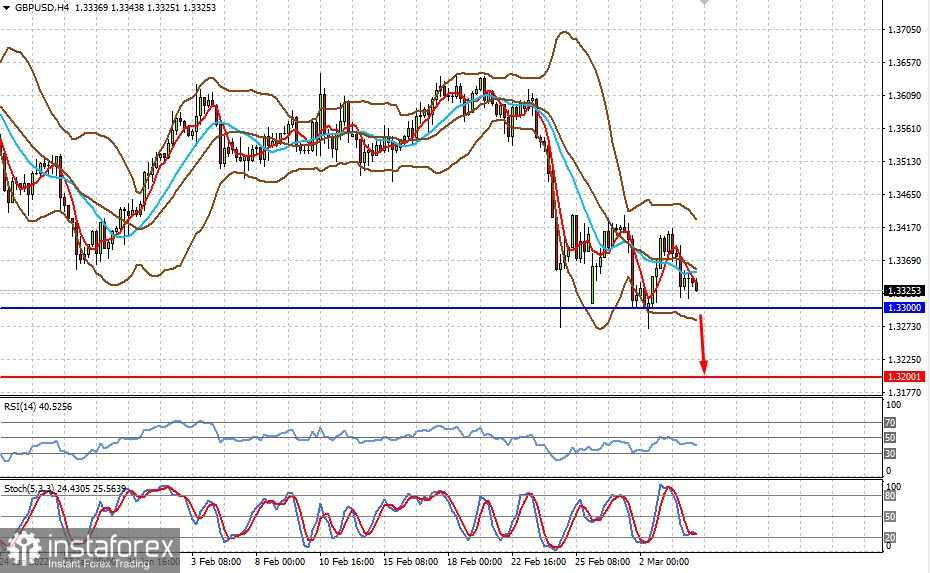

GBP/USD is currently consolidating above 1.3300, but if it pulls back and dips below the level, the quote will decline to 1.3200.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română