The euro/dollar pair showed a steady bearish movement on Thursday. The technical picture on EUR/USD has not changed. The pair has not shown any steep falls in recent days, which comes as no surprise. Despite a fully-fledged armed conflict in Ukraine, markets cannot massively sell off the euro and buy out the dollar. The pair may well plunge in the future. However, it is unlikely to do so every single day. Unfortunately, geopolitical risks are now weighing on markets strongly, while macroeconomic data have almost no influence. Traders expressed no interest in practically all recent reports. All that matters now is the geopolitical situation. So, all traders are left to do is closely follow news related to the conflict and interpret it like most market participants do.

Overall, the euro trades near its 14-month lows. Moreover, there is a high likelihood that the price will fall even further. In other words, the euro has great downside potential as the greenback remains a global reserve currency. In addition, bitcoin's rally in recent days may could have been a coincidence. It could have been triggered by increased demand for digital assets in Russia where many banks will be banned from SWIFT by March 12. The Russian ruble is rapidly incurring losses along with the stock market. Investors in Russia are massively selling off Russian risk assets, and, since there is a shortage of dollars in the country and it is no longer possible to make foreign exchange transfers, they shift to cryptocurrencies. This factor could have become the main driving force for bitcoin but not other altcoins. For instance, ether showed modest increase, while litecoin showed none at all.

What about Chairman Powell's testimony

Fed Chair Jerome Powell gave testimonies on Wednesday and Thursday. Mr. Chairman is usually very cautious about what he says and never gives really hawkish statements. This time, his neutral stance was indeed justified. Before the armed conflict in Ukraine, markets mainly speculated about the Fed's rate hikes in 2022. Initially, they believed there would be 3-4 increases. Later, they already foresaw 5-6 rate hikes with a 0.5% rise in March. Mr. Powell, however, made it clear that the military conflict was a game changer and the regulator would proceed carefully along the lines of the plan. The chairman noted that the labour market had recovered to the pre-pandemic level and the American economy was feeling well. In other words, the US central bank is likely to tame inflation slowly and steadily.

In general, Powell hinted that interest rates would be raised by just 0.25% in March and future decisions would be made depending on the economic and geopolitical situations. Consequently, there might be less than 7 rate hikes in 2022. However, while Powell and his colleagues will be considering possible moves, inflation will be growing as it is not going to wait for the end of the conflict in Ukraine. So, there is still a chance there will be 7 rate hikes. In February, consumer inflation may hit 8%. Therefore, the Fed should hurry if it wants to tame it. The greenback reacted to Powell's testimony with a fall. However, the bull run eventually resumed. In other words, the neutral statements of Powell had practically no effect on the market. Who cares about rate hikes in the face of a war? A trend movement is now seen in 4-hour and lower time frames. In any case, a trend is always better than a flat.

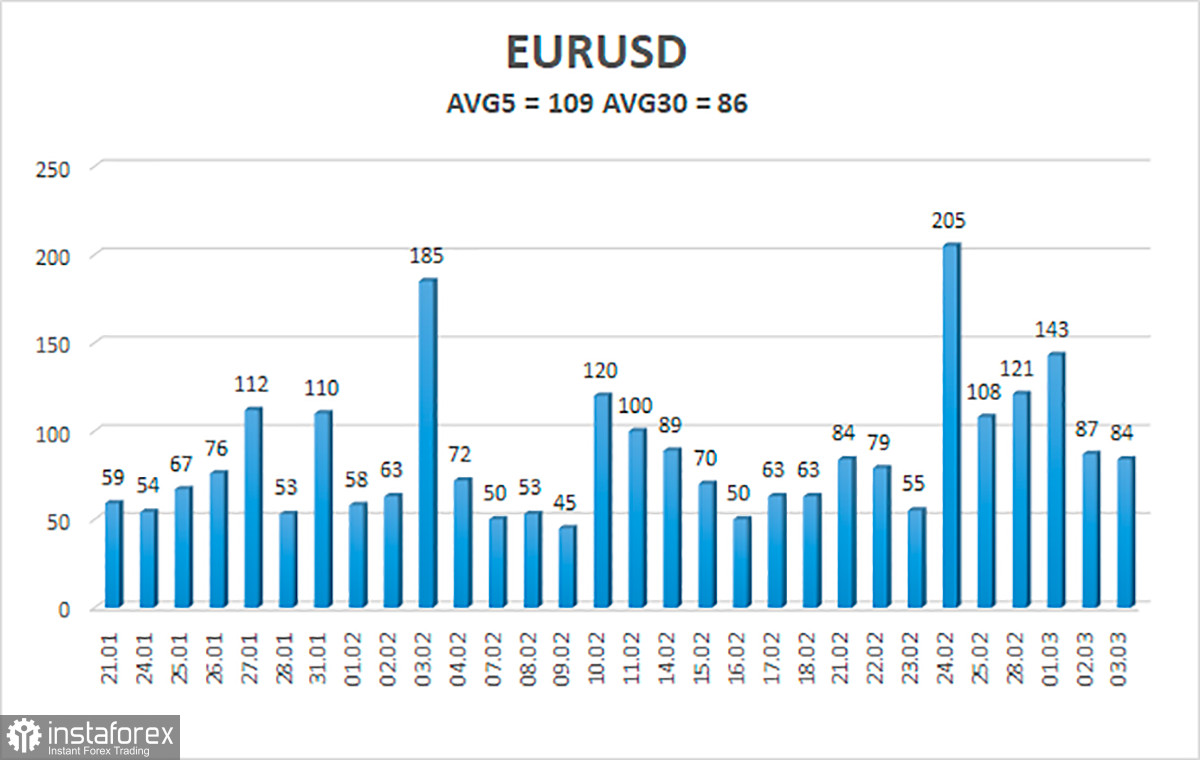

On March 4, the volatility of EUR/USD totals 109 pips and is evaluated as high. Today, the pair is expected to move in the range between 1.0942 and 1.1160. Heiken Ashi's upward reversal will indicate the start of a corrective move.

Closest support levels:

S1 – 1.1047

S2 – 1.0986

S3 – 1.0925

Closest resistance levels:

R1 – 1.1108

R2 – 1.1169

R3 – 1.1230

Outlook:

The EUR/USD pair keeps moving in the bearish trend. So, short positions could be held with targets at 1.0986 and 1.0942 until Heiken Ashi reverses. It would be wise to open long positions after consolidation above the moving average with targets at 1.1230 and 1.1292.

Indicators on charts:

Linear Regression Channels help identify the current trend. If both channels move in the same direction, a trend is strong.

Moving Average (20-day, smoothed) defines the short-term and current trends.

Murray levels are target levels for trends and corrections.

Volatility levels (red lines) reflect a possible price channel the pair is likely to trade in within the day based on the current volatility indicators.

CCI indicator. When the indicator is in the oversold zone (below 250) or in the overbought area (above 250), it means that a trend reversal is likely to occur soon.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română