Oil prices continued to rise after the US Energy Information Administration (EIA) reported that crude oil inventories fell by 2.6 million barrels in a week. This is compared to a previous rise of 4.5 million barrels, which also failed to change the direction of oil prices

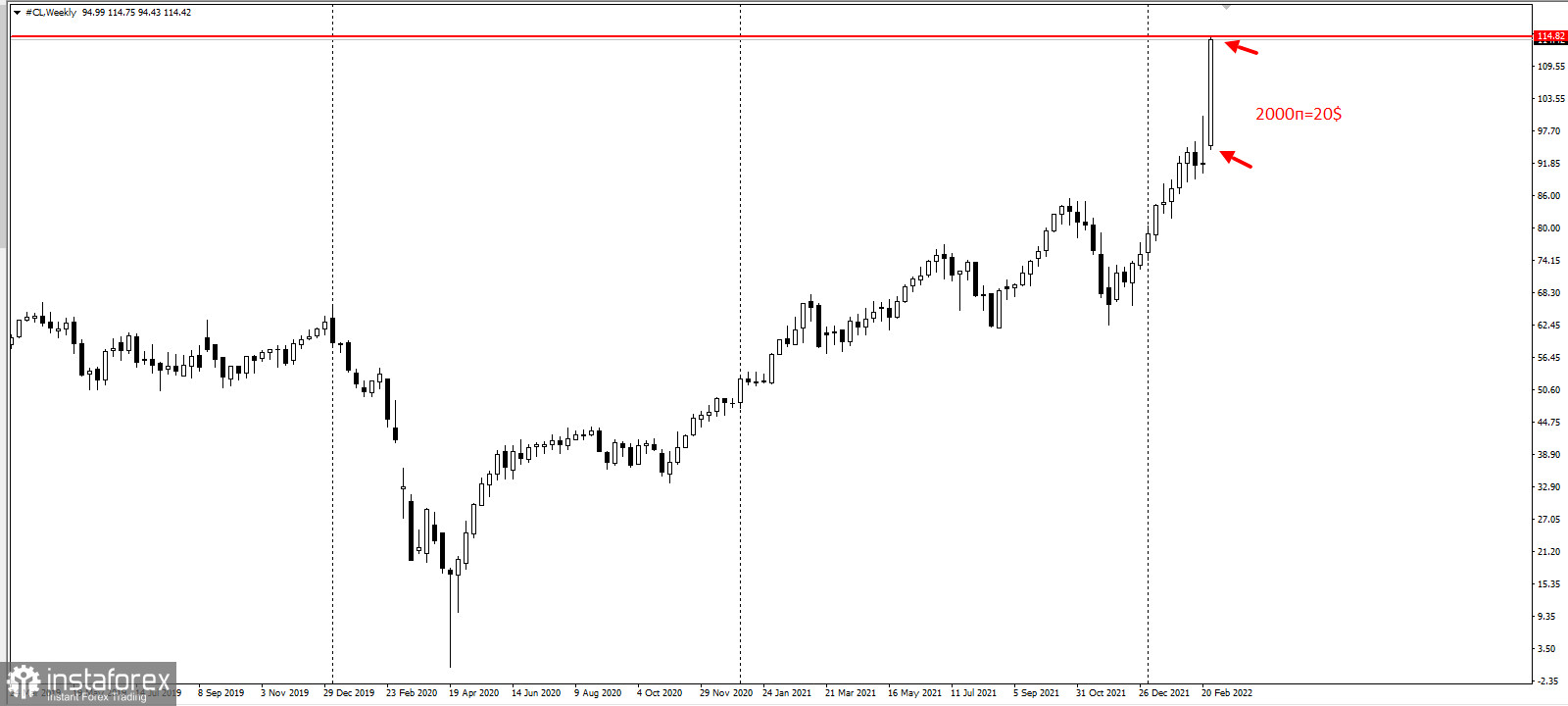

Prices were already high earlier as geopolitical tension in Ukraine drove them up. Just this week, it increased by $20, the fastest weekly gain in history.

The EIA also reported a decrease in gasoline stocks and middle distillates. For gasoline, the authorities estimated a 500,000 bbl drop in inventories in the last week of February, with production expected at 9.3 million bpd. This is compared to a 600,000 bbl reduction in inventories the previous week and production of about 9.3 million bpd.

As for middle distillates, stocks were at 600,000 barrels for the week, with an average production of just over 4.7 million barrels per day. This compares to a drawdown of 600,000 barrels in the previous week and production of 4.7 million barrels per day in the last week of February.

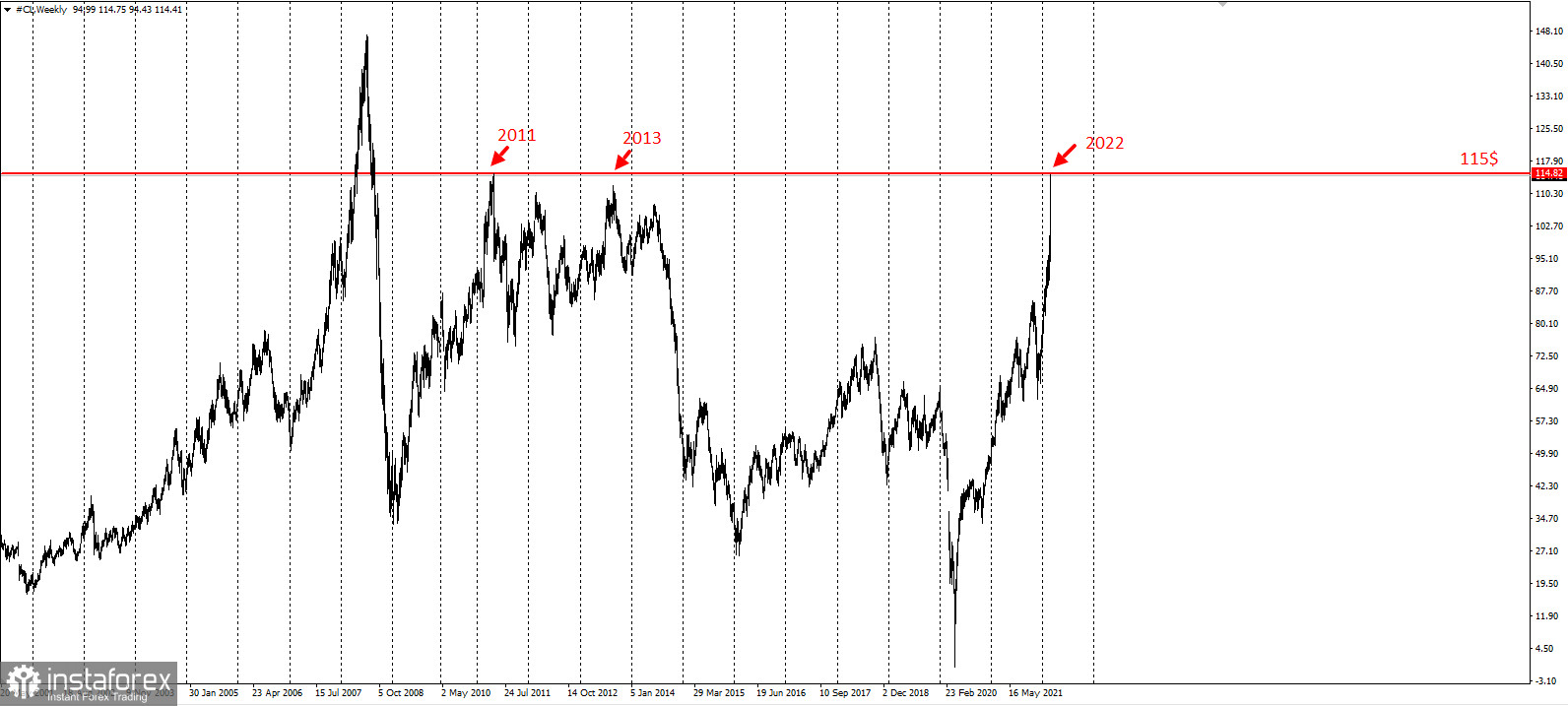

All in all, amid the growing turmoil in energy markets, Brent hit $119 a barrel, while WTI topped $109 a barrel. WTI rose by as much as $20 this week.

It also currently stands at the highs of 2011-2013.

But in a tight supply situation, prices could only move in one direction. This is why the US called on its allies and fellow members of the IEA to coordinate the release of oil stocks to influence benchmarks.

The agreement was reached on Tuesday, when several members of the IEA, led by the US, said they would release a total of 60 million barrels of oil. However, analysts say the move is unlikely to have much of an impact on global prices, given that the previous release of oil from strategic reserves fell short of its goal of lowering oil prices.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română