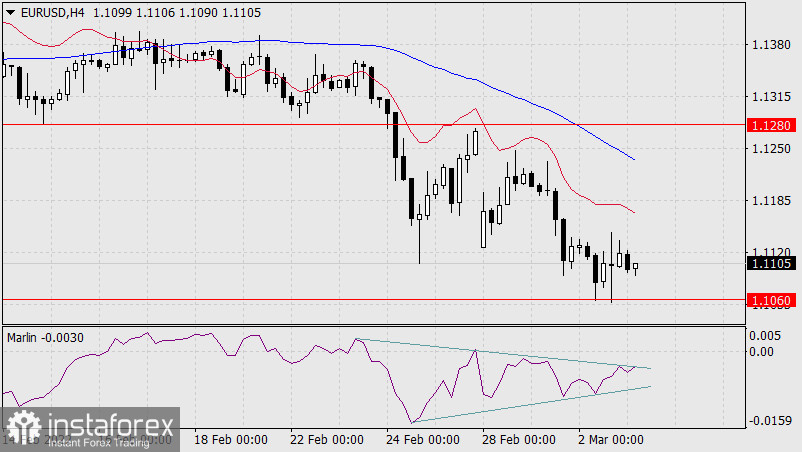

The euro reached the target level of 1.1060 on Wednesday, although the day was closed inexpressibly - a decline of 9 points. The bears' uncertainty is explained by the fact that the signal line of the Marlin Oscillator touched the lower border of its own channel and turned up from it.

Today we expect good PMI indicators for Europe and the United States, and tomorrow we have more important data on employment in the United States, they are also expected to be good - unemployment may decrease to 3.9% from January 4.0%. The main obstacle to dollar strengthening may be an increase in the Federal Reserve rate by 0.25% on March 16 as insufficient expectations of investors. European Central Bank officials have already stated that they will not raise the rate this year. A difficult question is whether the current euro rate is taken into account in the Fed's rate hike by a quarter point? Opinions in the media differ. Calculations of the euro (or dollar) exchange rate relative to other instruments (bond yields, raw materials, balance sheets, etc.) in the current hot geopolitical situation are very conditional.

On the technical side, there are two unclosed gaps left in a row – on February 25 and 28. At what point will the price go to close them - now, after reaching the target level of 1.1060, or later, with the lower level of 1.0910 worked out? Current events incline to the second option, which is closer in terms of timing to the Fed meeting. A small touch – when the price reaches the target level of 1.0910, the Marlin Oscillator will be in the oversold zone, which will also contribute to a reversal.

At the moment, we are still waiting for the continuation of consolidation at the level of 1.1060. On Friday and in the following days, the price may go down on perceptions of a stable US economy.

The signal line of the Marlin Oscillator clearly fits into a triangle on the four-hour chart. There may be a strong movement with the exit from the triangle. With a 55% probability, this exit is expected to go down.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română