The EUR/USD currency pair was trading much more calmly on Wednesday, but still with a downward bias. In principle, the situation for the euro and the dollar has not changed at all over the past day. During the past day, nothing happened that could radically change the mood of traders in the market. We said earlier that the US dollar now has much more grounds for medium-term growth, but this does not mean that now only the dollar will grow every day. It so happened that yesterday was a "pause day". No more, no less. Thus, the technical picture on the 4-hour TF has not changed at all now. The price remains below the moving average line, so the fall continues. The European currency remains a riskier currency compared to the dollar. The Fed's monetary plans remain much more hawkish than the ECB's monetary plans.

At the same time, traders continue to ignore any macroeconomic statistics. For example, an important inflation report for February was published in the European Union yesterday, according to which the acceleration continues and exceeds all acceptable forecasts. Now the consumer price index in the EU is 5.8% y/y However, there was no particular reaction to this report. If you don't respond to such important reports, then what should you respond to at all? The fact of the matter is that now the market is in a state close to panic. Therefore, only the general mood of the market and important geopolitical news matter. And what is the general mood of the market now? This is easy to understand by looking at the movements since last Thursday. Several times the bulls tried to seize the initiative, but they failed. Bears rule the ball. Thus, we assume that the pair may be adjusted, and may even be strongly adjusted, but in the near future sellers will be at the head of the parade.

What's in Ukraine?

Unfortunately, no new and positive data is being received from Ukraine right now. The second stage of negotiations on the Belarusian border began late last night, but there are no results yet. There is not even any information about it. At the same time, a full-scale war continues in Ukraine. And a full-scale sanctions war continues all over the world. In the last few days alone, a huge number of companies have left Russia, including Apple, automakers, and manufacturers of sports equipment. Sanctions are being applied against Russian banks, they are being disconnected from SWIFT, the ruble exchange rate against the dollar and the euro has gone to heaven. Sponsorship contracts with Russian companies are terminated, Russian sports are banned, Russian oligarchs have their property frozen abroad. Thus, there is no peace anywhere right now. Naturally, in this scenario, all markets are in a state of "storm".

Moreover, the whole world is now talking about the possible beginning of a nuclear, third world war. Of course, I don't want to believe it, I don't even want to talk about it, but Russian President Vladimir Putin, in response to the "unfriendly statements of Western countries," ordered the "deterrent forces" to be put on alert. How should traders and investors behave if even such news is already coming to the media? The world is on the verge of a new world war and so far it is even difficult to say how it can be avoided? The fact is that now there are even several possible reasons for its beginning. As we all know, Moscow's main demand is not the expansion of NATO to the East of Europe. However, in addition to Ukraine, Finland can join NATO, in whose parliament a corresponding petition from citizens of this country has been registered. Ukraine itself continues to remain faithful to its "Western course", so if not NATO, then the European Union. For almost the first time in their history, EU countries openly supply weapons to one of the parties to an armed conflict. Moreover, even the entire European Bloc as a whole buys weapons for supplies to Ukraine. What can I say if Switzerland, which has been neutral since 1815, imposed sanctions against the Russian Federation? Thus, there is no question of any de-escalation now. There is no question of any relief of tension now.

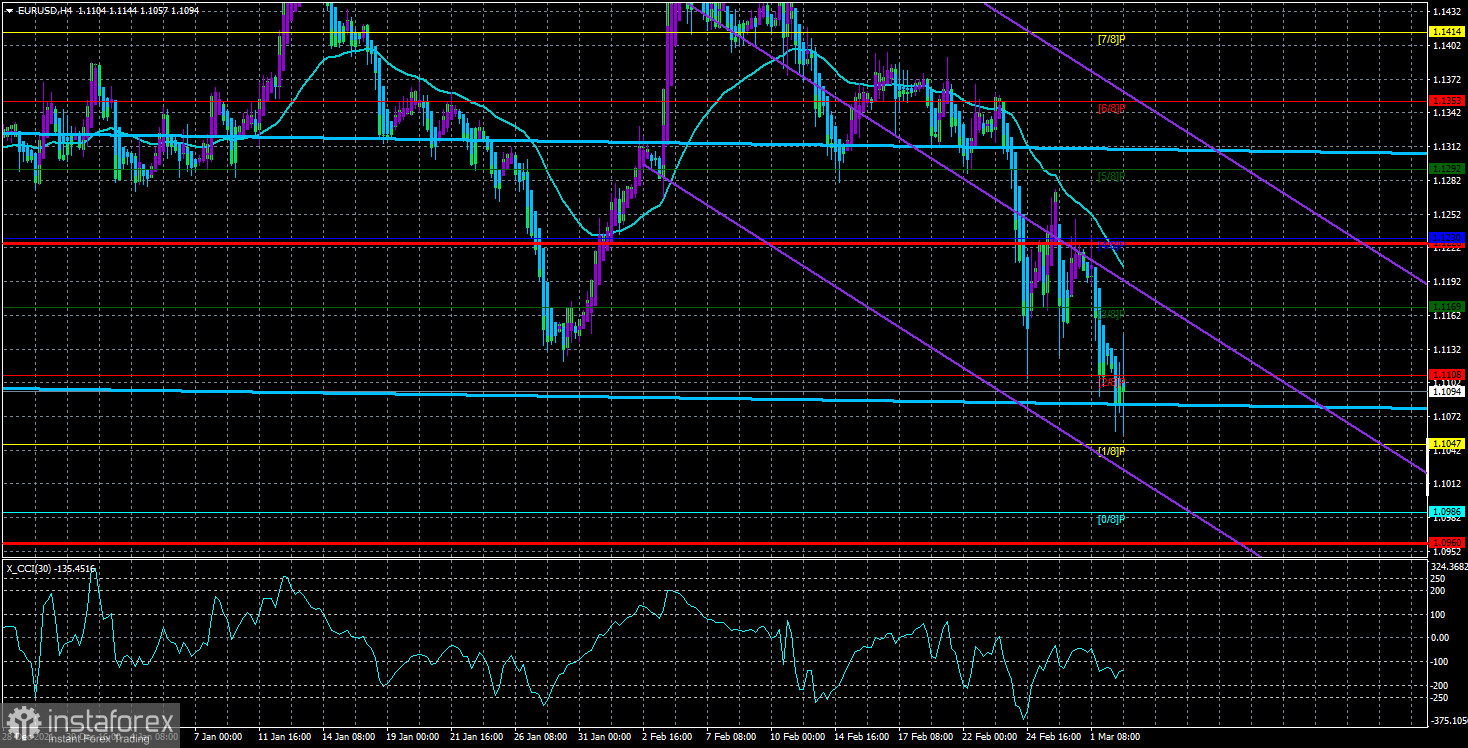

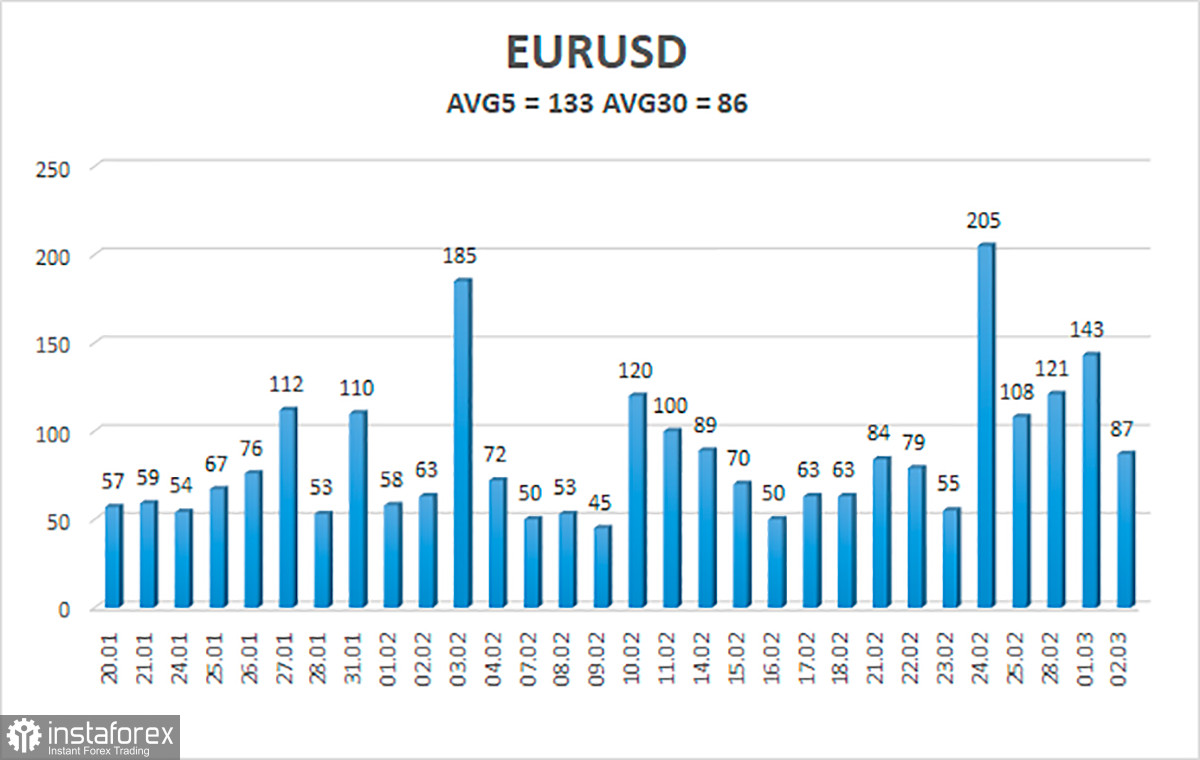

The volatility of the euro/dollar currency pair as of March 3 is 133 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0960 and 1.1226. A reversal of the Heiken Ashi indicator upwards will signal a new round of corrective movement.

Nearest support levels:

S1 – 1.1047

S2 – 1.0986

S3 – 1.0925

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1169

R3 – 1.1230

Trading recommendations:

The EUR/USD pair continues its strong downward movement. Thus, it is now possible to stay in short positions with targets of 1.1047 and 1.0986 until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than the price is fixed above the moving average line with targets of 1.1230 and 1.1292.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română