Analysis of Wednesday's trades:

30M chart of EUR/USD

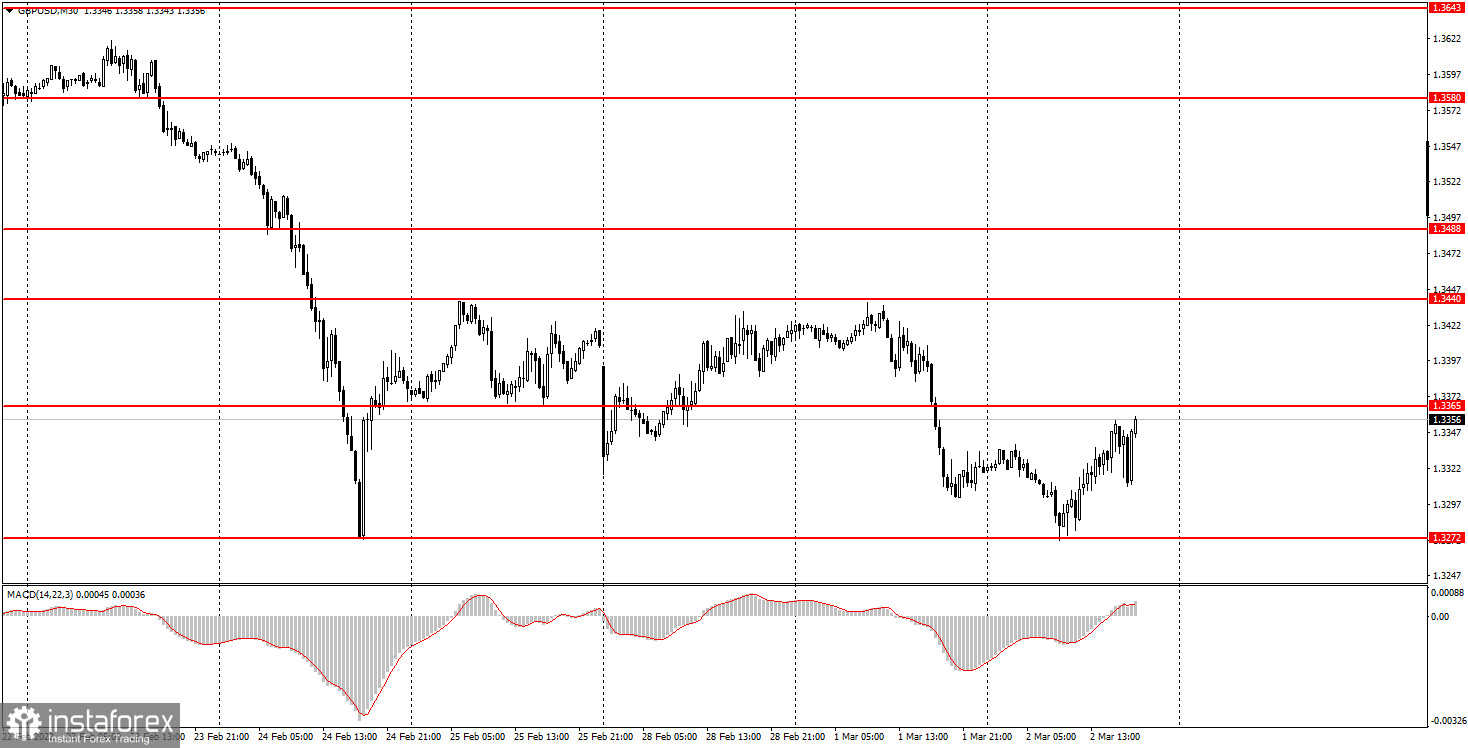

The trend movement of GBP/USD on Wednesday was not as strong as on Tuesday. However, the sterling failed to break through the swing low and then rebounded from it. This means that the market may enter an upward correction. At the same time, the quote's attempt to consolidate above 1.3365 was unsuccessful. Therefore, the pound is still weaker against the US dollar. The market is now in a downtrend although there is no trend line or a channel. The price may rapidly change its movement due to high volatility. Moreover, the market shows no reaction to macroeconomic data. On Wednesday, only Fed Chairman Powell's speech was able to somehow affect market sentiment intraday. At the same time, it does not mean it will have a long-lasting effect. The bearish trend may resume already on Thursday. Unfortunately, the trend is now in the hands of the geopolitical background, not macroeconomics.

M5 chart of GBP/USD

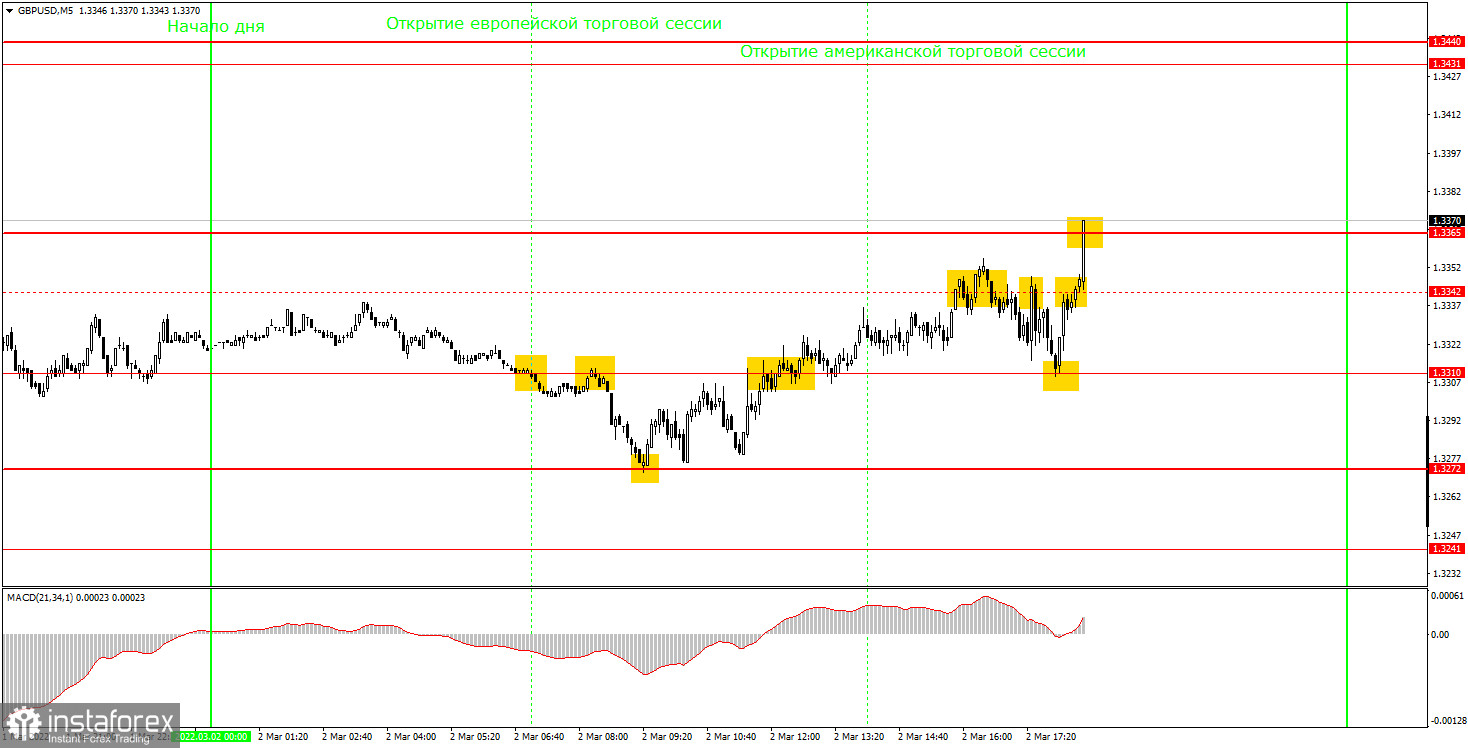

In the M5 time frame, quite accurate signals were produced. So, two sell signals were generated near 1.3310, and the price then went down to 1.3272 and rebounded from it. Thus, beginner traders had a clear entry point as well as a clear exit point. That trade could have brought them about 20 pips of profit. When the quote retraced up from 1.3272, it was the time to go long. However, this trade most probably closed at the breakeven point after a stop-loss order had triggered. The price plunged twice before reaching 1.3310 and breaking through it. A row of mixed signals was produced near that point. Eventually, this level was erased from the chart. Those mixed signals were hard to interpret as they were formed with a time gap of 5 to 10 to 15 minutes. Therefore, the decision to close long positions and exit the market would have been the perfect solution. Chairman Powell's testimony then started. Technically, there was one more buy signal after a rebound from 1.3310. It was clear and accurate, but it should have been ignored to avoid possible risks.

Trading plan for Thursday:

In the 30M time frame, the price rebounded from 1.3272 twice. So, the bearish trend stopped for a while. If traders break through 1.3356, the bullish trend is likely to extend. Otherwise, the quote may fall to 1.3272. The target levels in the 5M time frame are seen at 1.3241, 1.3272, 1.3310, 1.3365, and 1.3431-1.3440. A stop-loss order should be set at the breakeven point as soon as the price passes 20 pips in the right direction. The services PMI is scheduled for release in the United Kingdom on Thursday. In the United States, Fed Powell's testimony will continue, and the ISM services PMI will be published. This is going to be an important report, unlike the one to be released in the UK. So, traders should pay attention to the events to unfold in the US. Of course, the geopolitical situation will be weighing on the pair on Thursday.

Basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to interpret charts:

Support and resistance levels can serve as targets when buying or selling. You can place Take Profit near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginner traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management is the key to success in long-term trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română