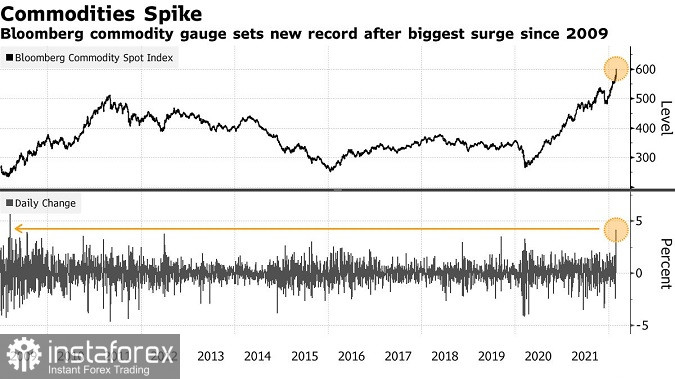

US stocks continued to decline on Wednesday as the conflict in Ukraine prompted a record surge in commodity prices. That dampened the economic outlook and boosted demand for sovereign bonds.

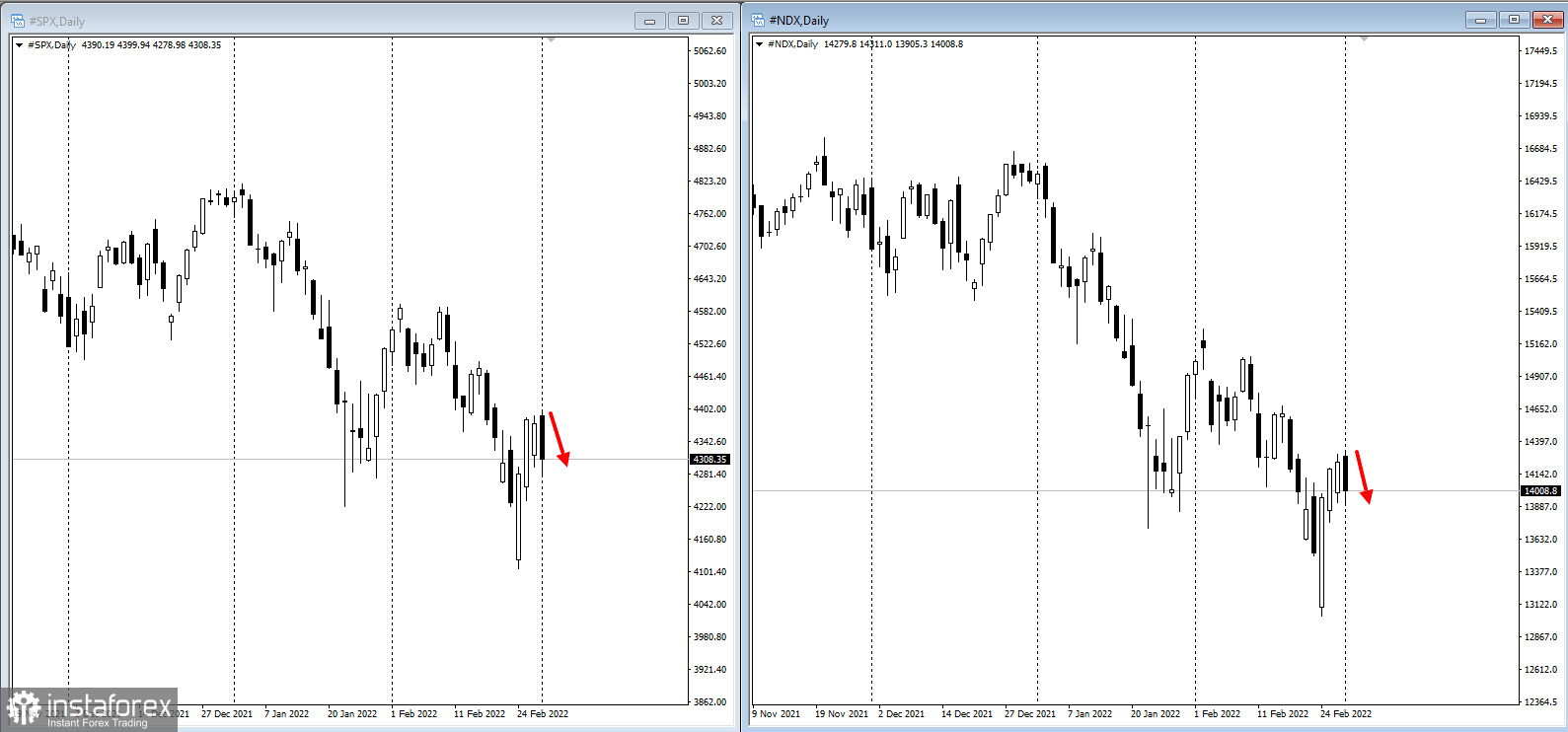

The S&P 500 fell 8,600 pips, while the tech-heavy Nasdaq 100 lost 2,900 pips.

Reportedly, demand for safe-haven assets supported the global fixed-income rally, with 10-year US Treasuries yielding about 1.72%. Gold, on the other hand, weakened, but remained near a 13-month high.

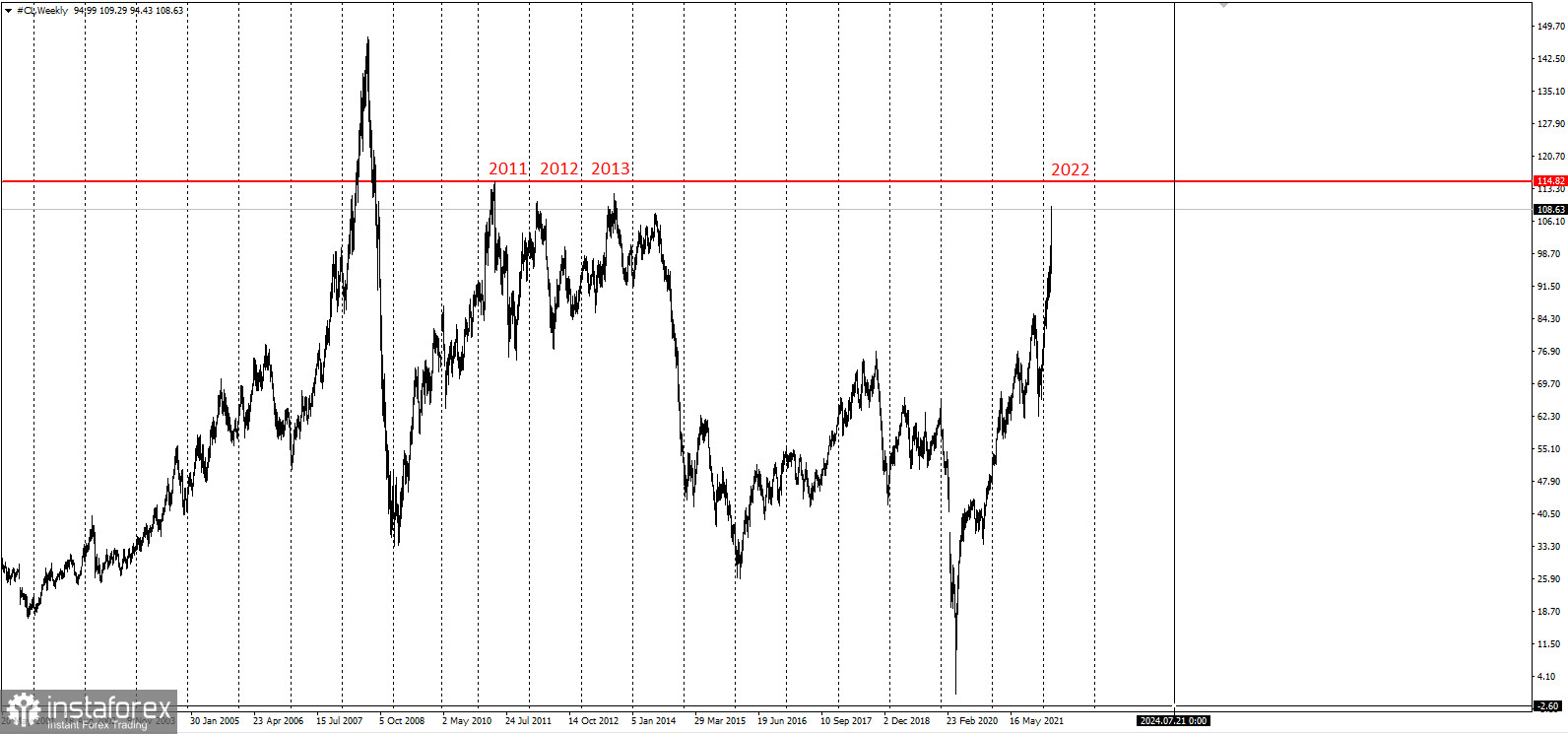

Nevertheless, the commodity index jumped to a record high, its largest surge since 2009.

The intrigue of the month is how much the Federal Reserve will raise interest rates. Markets have priced in any risk of a half-point rise in March. The task of central banks is to contain inflation without suppressing growth.

"The Fed is going to have to continue to tamp down inflation, which I think is invariably going to get worse before it gets better," said Kathryn Rooney Vera, head of global macro research at Bulltick LLC. "We said stagflation is the biggest risk this year and that's going to be the case."

Another key event for this week is the speech of Fed Chairman Jerome Powell on Wednesday.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română