The Reserve Bank of Australia left the key rate at a record low of 0.10% at its meeting on Tuesday and reiterated that it will not tighten policy until inflation stabilizes in the target range of 2%-3%. The bank also noted that the crisis in Ukraine has further clouded the prospects of the global economy.

"The war in Ukraine is a major new source of uncertainty," said RBA Governor Philip Lowe. "The prices of many commodities have increased further due to the war in Ukraine. Inflation in parts of the world has increased sharply due to large increases in energy prices and disruptions to supply chains at a time of strong demand."

Now market participants, especially those who follow the quotes of commodity currencies, will prepare for tomorrow's meeting of the Bank of Canada. CAD is receiving significant support from rising oil prices, which again exceeded $100 per barrel on Tuesday. Given the hostilities in Ukraine and large-scale Western sanctions against Russia, many oil market analysts expect further growth in energy prices. On the one hand, this will support the quotes of the Canadian dollar, and on the other hand, it will accelerate inflation in the global economy, putting pressure on central banks in the direction of tightening monetary policy.

If the RBA has decided not to chase other key central banks for the time being, many of which have already started raising rates or have signaled imminent policy tightening, then the Bank of Canada may raise interest rates during tomorrow's meeting.

Unemployment has risen in Canada in recent months, partly amid massive coronavirus-related business closures and layoffs. Unemployment rose from the usual 5.6% - 5.7% to 7.8% in March and already to 13.7% in May 2020. Unemployment in the country rose to 6.5% in January from 6.0% in December, while employment declined sharply (the number of jobs in January decreased by 200,100 compared to the previous month after rising almost 55,000 in December). These are negative factors for CAD.

However, they will not prevent the Bank of Canada from raising interest rates tomorrow, as expected by 0.25%, to 0.50%. Theoretically, an increase in the interest rate has a positive impact on the quotes of the national currency. However, the market reaction may be mixed given the high geopolitical tensions in Europe.

As for today's news regarding the CAD and the USD/CAD pair, one should pay attention to the publication of Canadian GDP data at 13:30 GMT. According to data released by the National Bureau of Statistics, Canada's GDP in the 2nd quarter decreased by -3.2% (year-on-year), while economists had forecast its growth by 2.5%. The data for the 3rd quarter turned out to be much better: the annual GDP growth amounted to +5.4% (against the forecast of +3.0%). Nevertheless, many economists have lowered their forecast for the growth of the Canadian economy in 2021. The final data for the 4th quarter will be presented in March, and preliminary data indicate an annual GDP growth of +6.2% in the 4th quarter.

The negative effects of the coronavirus on the Canadian economy and the country's labor market, as well as the weakness of the housing market, still put pressure on the Bank of Canada to maintain an easy monetary policy. However, the bank is expected to raise interest rates by 0.25% at its Wednesday meeting to 0.50%. If the Bank of Canada signals the need for loose monetary policy, the Canadian currency will decline.

Today, volatility will pick up again at 15:00 GMT when the U.S. manufacturing business activity index (PMI) is released, which is an important indicator of the state of the U.S. economy as a whole. Forecast: 58.0 in February (against 57.6 in January, 58.7 in December, 61.1 in November, 60.8 in October, 61.1 in September, 59.9 in August, 59.5 in July, 60.6 in June, 61.2 in May, 60.7 in April, 64, 7 in March, 60.8 in February, 58.7 in January 2021).

The index is above the 50 level and has a relatively high value, which is likely to support the dollar. The data above the value of 50 indicate an acceleration of activity, which has a positive effect on the quotes of the national currency. If the indicator falls below the forecast and especially below the value of 50, the dollar may sharply weaken in the short term. The relative decline of the indicator is also not very positive for the USD.

The American currency remains one of the most volatile assets on the world market and actively reacts to any changes in the fundamental background. After the confirmation of an additional package of sanctions against leading Russian banks, the Ministry of Finance and the National Wealth Fund, the U.S. currency began to depreciate sharply and has now fallen to 96.66 in the DXY index.

Investors are concerned that serious restrictions against leading Russian economic institutions may affect the structure of the global raw materials supply market and create difficulties with currency conversion when paying for imports from the Russian Federation.

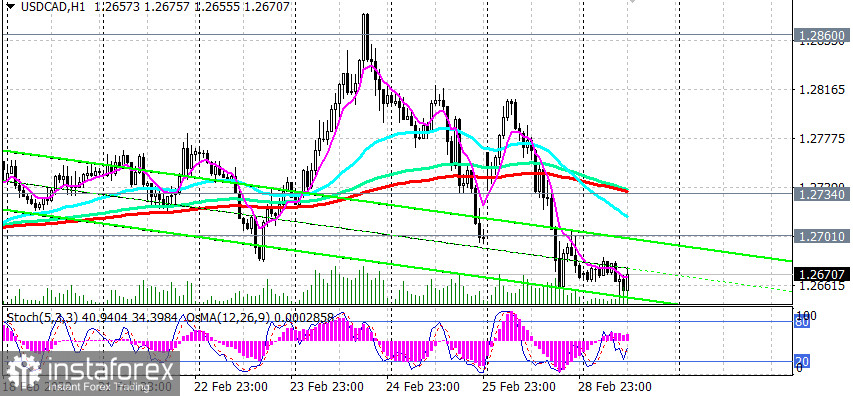

As for the USD/CAD pair, it is trading mainly in the bear market zone, below the key resistance level 1.2860, as well as below the important short-term resistance levels 1.2734, 1.2701. A break of the key support level at 1.2640 will finally move USD/CAD into a long-term bear market.

Technical analysis and trading recommendations

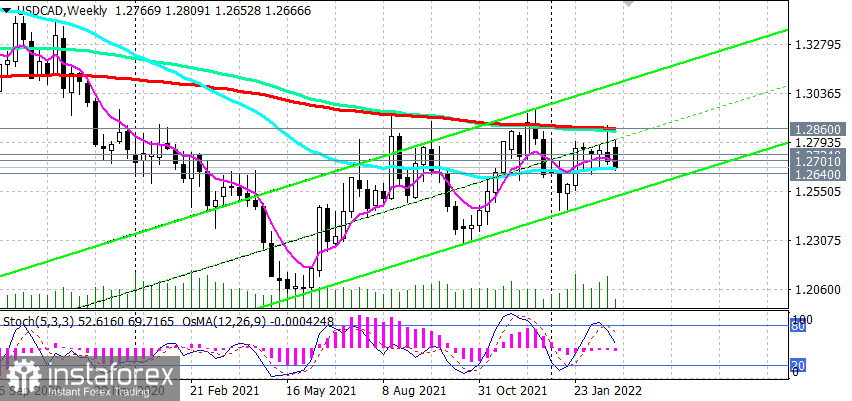

As we noted above, USD/CAD is currently trading mainly in the bear market zone, below the key resistance level of 1.2860 (200 EMA on the weekly chart). USD/CAD is also below the important short-term resistance levels 1.2734 (200 EMA on the 1-hour chart), 1.2701 (200 EMA on the 4-hour chart).

Technical indicators OsMA and Stochastic on the 4-hour, daily, weekly charts also recommend short positions.

In case of breakdown of the key support level 1.2640 (200 EMA on the daily chart), USD/CAD will finally move into the zone of a long-term bear market.

In an alternative scenario, the first signal for resuming purchases will be a breakdown of the resistance level of 1.2701, and a confirming one - a breakdown of the resistance level of 1.2734 with the nearest target at the resistance level of 1.2860.

Due to many multidirectional factors, it is still difficult to determine the direction of the longer-term USD/CAD dynamics.

Probably, closer to mid-March, the Fed meeting and its future plans will again come to the fore. But here, too, there may be unexpected decisions in the light of the aggravated geopolitical tensions in Europe. In the meantime, the movement of USD/CAD in the range between the levels of 1.2640 and 1.2860 seems to be the most probable.

Support levels: 1.2640, 1.2600, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Support levels: 1.2640, 1.2600, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Resistance levels: 1.2701, 1.2734, 1.2785, 1.2800, 1.2860, 1.2900, 1.2960, 1.3100

Trading scenarios

Sell Stop 1.2635. Stop-Loss 1.2710. Take-Profit 1.2600, 1.2540, 1.2455, 1.2290, 1.2165, 1.2010

Buy Stop 1.2710. Stop-Loss 1.2635. Take-Profit 1.2734, 1.2785, 1.2800, 1.2860, 1.2900, 1.2960, 1.3100

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română