The yellow asset continues to strengthen on the back of the current situation. The escalating conflict in Ukraine is extremely advantageous for the gold bulls. It is now their main trump card against the upcoming Fed rate hike.

Moscow's attack on Kiev boosted gold prices last month. The metal, considered the best defensive asset at a time of geopolitical tensions, gained almost 6% in February. The bullion has not seen such a strong monthly trend since last May.

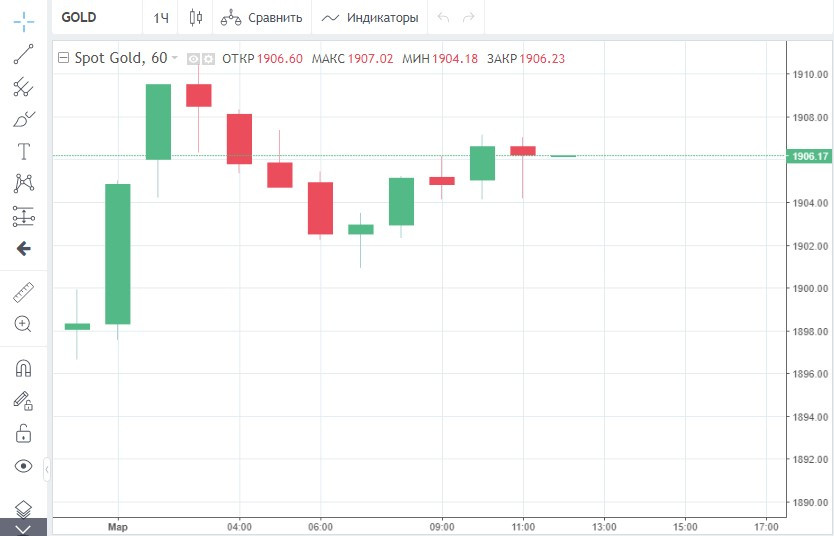

The asset also finished on the last day of the winter on the upside. Prices jumped back above $1,900 yesterday after falling sharply last Friday.

Gold futures for April delivery rose 0.7%, or $13.10, to $1,900.70 on February 28, although quotations hit an intraday high of $1,935.20 during the session.

The precious metal rose amid another escalation of the Russia-Ukraine conflict and its aftermath. On Monday, investors assessed news over the weekend. Much of it focused on the sanctions the West adopted against the Kremlin following its full-scale invasion of Ukraine.

Markets are now concerned that a total isolation of Russia will seriously undermine the global economy. Stagflation and inflation are expected to be the logical extension of such unprecedented measures against Moscow.

Until recently, Russia was considered a key supplier to global markets of oil, gas, aluminium, palladium, nickel, wheat and corn. Economists predict that countries that are political opponents of the Russian Federation will face a sharp rise in the prices of these commodities in the near future.

Russia is also among the world's largest producers of the asset. Its gold reserves total 2,298.53 tonnes. According to analysts at US bank The Goldman Sachs, Moscow will use the precious metal as its main leverage under sanctions. This could lead to a significant increase in bullion prices.

The bank said in a statement that gold's unique role as the currency of last resort will become apparent when the Russian Central Bank, whose foreign exchange reserve is frozen, begins to use its large domestic reserves of the precious metal to continue foreign trade, most likely with China.

Russia's isolation has been the saving straw for gold bulls, who have long wanted to repeat the 2020 price record. Last year, expectations of Fed policy tightening were the main obstacle to bullion growth.

With only a few weeks to go before the first interest rate hike, the yellow asset could again come under pressure from the hawkish sentiment of the US regulator. However, the geopolitical factor was much stronger than the macroeconomic one.

Investors are frightened not only by possible price increases due to Russia's economic blockade, but also by the serious migration crisis that Europe is facing.

Analysts believe that the gold bulls will try to make the most of the current environment and will speculate for the rise until the Fed's monetary policy meeting in March.

In the coming days, they will try to raise the cost of the yellow asset above $2,000, experts predict. If bullion cannot overcome this barrier before the Fed meeting, most likely, many investors will want to lock in profits. In that case, a sharp drop in gold prices awaits us on the eve of an important meeting.

Market strategist Peter Spina also warns that precious metal prices could be extremely volatile in the short term because of traders' need for liquidity.

However, long-term investors in gold should thrive given growing concerns over further military escalation. The Goldman Sachs estimates that the price of gold will reach $2,150 in the coming months.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română