The conflict in Ukraine is surprisingly not reflected in the financial markets. Demand for raw materials remained high, with oil trading near $100 a barrel. There is, however, no growth in demand for gold, and the price of gas at the Dutch hub has dropped to $1,100/1,000 cubic meters. Treasury yields of European countries are also under slight pressure, and their decline does not go beyond the usual volatility. Stock indices of the US and European countries also closed in the red zone on Monday, while the indices of Asia-Pacific countries showed strong growth on Tuesday.

It is safe to assume that the biggest geopolitical crisis in Europe is much less of an irritant for the markets than the upcoming US Federal Reserve meeting. It should also be noted that the United States takes a significantly more restrained position than European countries, so it is possible that a solution will be found and the conflict in Ukraine will return from the military phase to diplomacy.

NZD/USD

The RBNZ raised the rate by a quarter of a point to 1.0%. They also announced the start of bond sales, that is, the launch of a quantitative tightening program. The RBNZ predicts that inflation will peak at 6.6% in the first quarter, but due to recent events in Ukraine, there are concerns that this forecast needs to be revised. Oil prices may rise, which will push inflation above 7%, and maybe even 8%. If that happens, then the RBNZ is likely to become more hawkish.

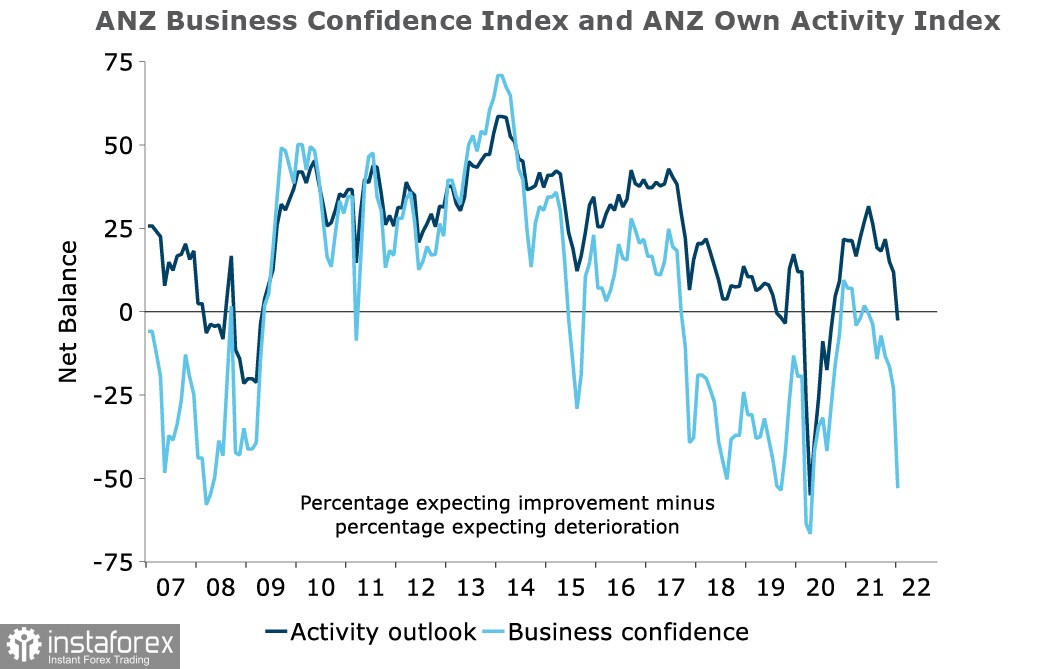

Meanwhile, the business activity report for January showed a strange result. Overall business confidence dropped 28 points at once, falling back to the lows of the beginning of the covid hysteria.

Preoccupation with omicron is cited as a reason, and the ANZ Bank assumes that the risks of a rate hike is now 0.5% higher. This change in expectations helped boost demand for NZD.

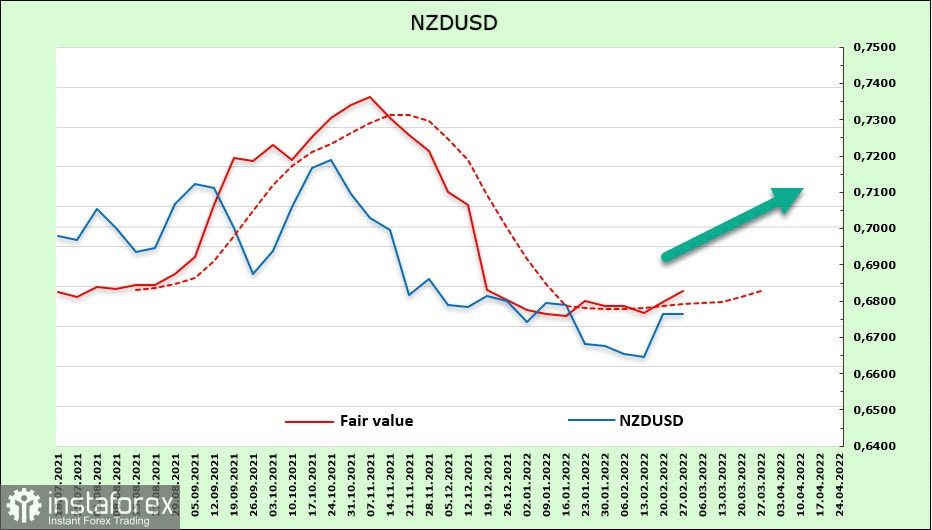

In terms of the latest CFTC report, net short positions rose 158 million to -778 million. But other indicators (yields and dynamics of stock indices) say the kiwi is starting to regain its initiative, giving grounds to continued growth.

0.6820/30 and 0.6886 remains relevant as long as the kiwi is still within the boundaries of the bearish channel. But the probability of the NZD/USD pair climbing up has become higher.

AUD/USD

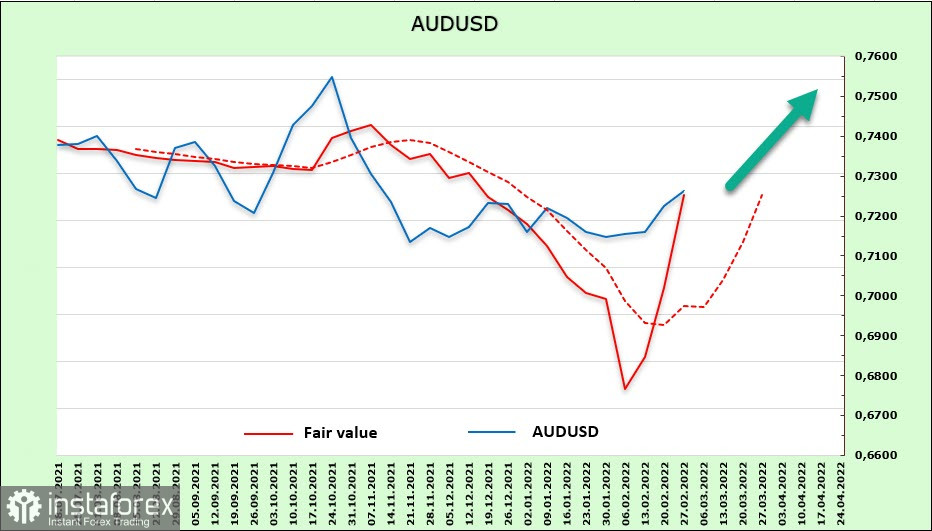

The RBA left the interest rate at 0.1%, stressing that it maintains an expansionary monetary policy. This decision is out of the general trend, but it should be noted that the conditions in Australia differ from other countries. In particular, inflation is noticeably lower than in the USA, New Zealand and Great Britain.

The market reacted with a slight increase, undoubtedly because low rates with approximately the same level of return gives Australia an advantage over other countries. The net short position, as follows from the CFTC report, corrected slightly to -6.07 billion. The bearish edge is significant, but there is a reversal trend.

Most likely, the pair will rise above 0.7300/20 in the very near future, and may even hit 0.7440/60.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română