When to open long positions on EURUSD:

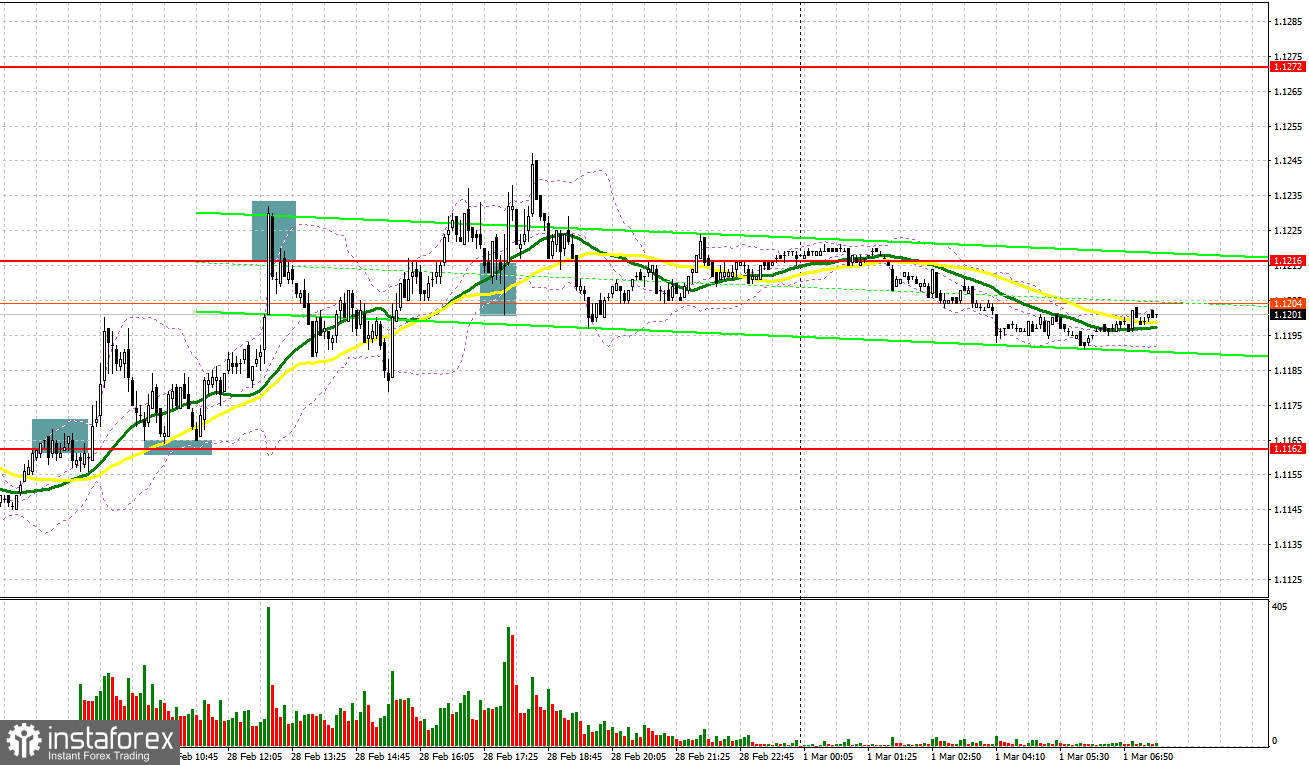

Quite a lot of signals to enter the market were formed yesterday. Let's analyze the M5 chart to understand what happened. In my previous analysis, I paid attention to the level of 1.1162 and said you could consider entering the market from it. A false breakout at 1.1162 in the first half of the day triggered a signal to sell the euro. Risk assets were under tremendous pressure after a sell-off in the Asian session. The peace talks between Russia and Ukraine contributed to the strengthening of the pair. A breakout at 1.1162 and a retest of this mark top-bottom created a nice buy entry point, and the price rose by about 70 pips. Bulls encountered resistance at 1.1216. A false breakout there made a strong signal to sell the pair, and the euro tumbled by 35 pips. In the second half of the day, bulls attempted to regain control over 1.1216 and even settled above it. The move produced a buy signal. Eventually, the price went up by 30 pips.

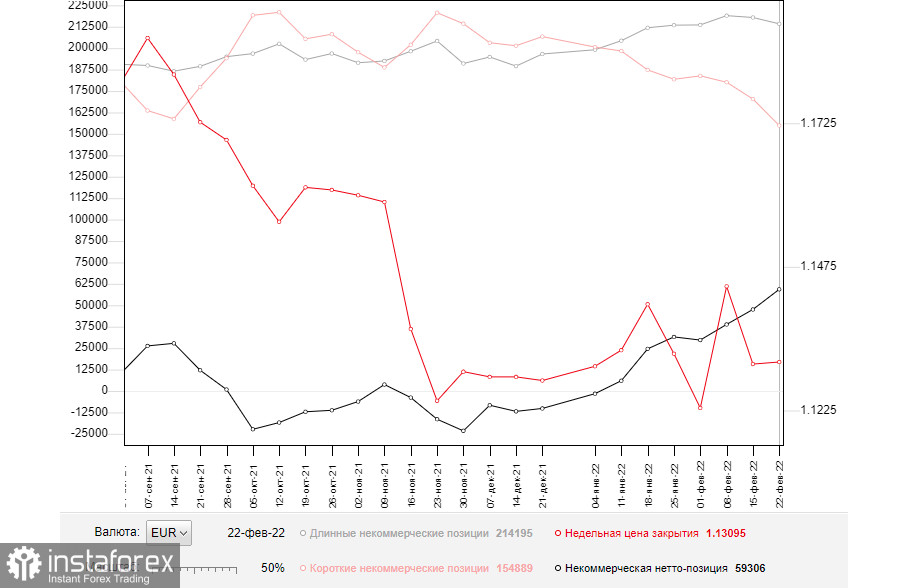

Before we proceed with EUR/USD, let's analyze the Commitments of Traders report for February 22 that logged a decrease in both long and short positions, which, in turn, led to an increase in the positive delta. In the face of war, neither the ECB's nor the Federal Reserve's stance on monetary policy matters. Russia and Ukraine have agreed to hold peace talks. A lot will depend on the outcome of these meetings. Under the current circumstances, the COT report might seem less accurate given its minor importance for traders. You should be cautious enough when trading risk assets and buy the euro if only tensions between Russia, Ukraine, the EU, and the US ease. Any new sanctions against Russia will have dire economic consequences and harm financial markets. They will also seriously affect the euro. It might happen if Russia retaliates with sanctions against the EU. This will exert additional pressure on the euro. The COT report revealed a decrease in long non-commercial positions to 214,195 versus 217,899 and a fall in short non-commercial positions to 155,889 from 170,318. This suggests that traders are less willing to both sell and buy the euro. They prefer to stay aside in the wake of the current events. The total weekly non-commercial net position rose slightly and amounted to 59,306 versus 47,581. The weekly closing price stayed firm at 1.1309 from 1.1305 a week earlier.

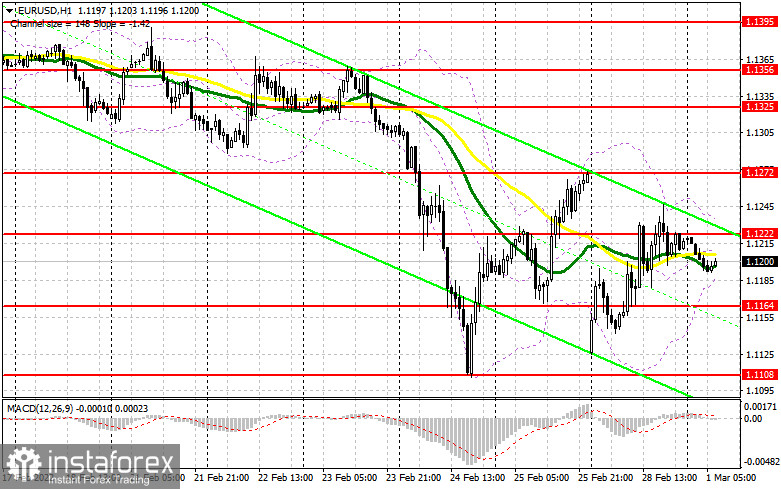

EUR bulls have practically no reasons to feel optimistic, and today's business activity data in the manufacturing sector of the eurozone countries is unlikely to affect the euro. The armed conflict in Ukraine will continue weighing on the currency. Technically, you could go long if the pair heads back to 1.1164 in the first half of the day. But I think that it is actually a bad idea to enter long positions at all under the current circumstances. A false breakout at 1.1164 along with a strong manufacturing PMI and a sharp rise in inflationary pressure in Germany, Italy, and France, would create a buy signal, allowing a correction in the first half of the day. In addition to a false breakout, the pair should also show active upward movement. If bullish activity decreases when the price tests 1.1164, long positions should be postponed. A breakout there could cause another sell-off, especially if the Ukrainian conflict escalates. In such a case, EUR/USD could be bought as soon as the next support level of 1.1108 - the weekly low - is updated and a false breakout occurs. You could go long as soon as the price bounces off the 1.1070 low or 1.1034, allowing a 15-20 pips correction intraday. Bulls will also try to establish control over 1.1222 that formed yesterday. Demand for risk assets could increase if the price breaks and consolidates above this range and macro reports in the eurozone come in strong. If so, a nice buy entry point will be formed with targets at the 1.1272 and 1.1325 highs. The market will turn bullish if the price goes above the range and hits 1.1356 where you should consider taking a profit.

When to open short positions on EURUSD:

Bears are now in control of the market, and any further escalation of geopolitical tensions would exert even more pressure on risk assets. Therefore, it would be wise to sell the instrument today. A false breakout at 1.1222 would create a nice sell entry point in the first half of the day, with the target at 1.1164. In the event of weak macro results in Germany and a decrease in inflation in Italy, the volume of short positions is likely to increase. A breakout and a retest of the 1.1164 level top-bottom would make an additional entry signal and the pair would head to the 1.1108 low with the target at 1.1070, where you should consider taking a profit. The bearish trend could accelerate if the price tests this point. If the pair retraces up in the European session, and bearish sentiment decreases at 1.1222, you could go short after a false breakout at 1.1272 or on a bounce from the 1.1325 and 1.1356 high, allowing a 15-20 pips correction.

Indicator signals:

Moving averages

Trading is carried out in the range between the 30-day and 50-day moving averages, indicating uncertainty in the market.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

A breakout at 1.1190 is likely to cause a fall in the euro. In the case of bullish bias, resistance will stand at 1.1235, the upper band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română