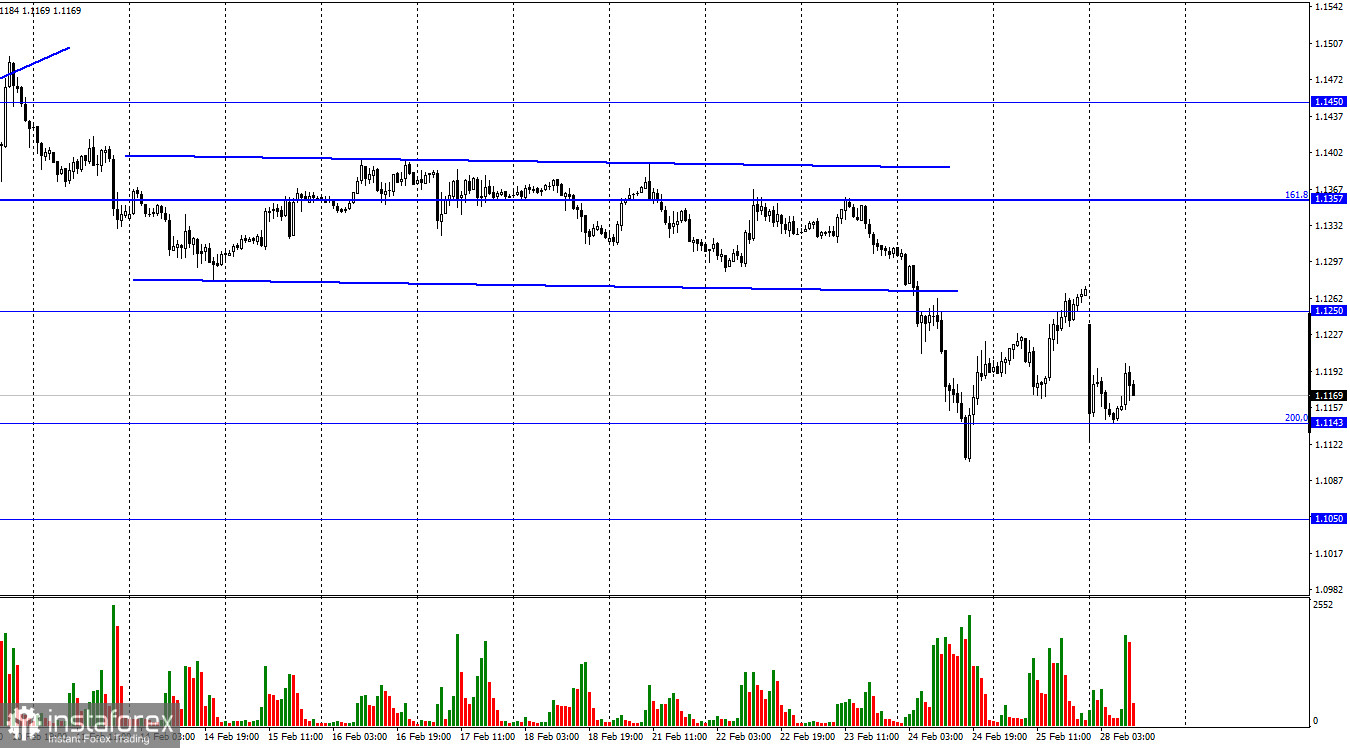

EUR/USD was bullish all day on Friday and even made a consolidation above the 1.1250 level. However, with the opening of trading on Monday, the situation changed dramatically, and the pair started to decline. It is trading around the retracement level of 200.0%, 1.1143. Such traders' activity is due to the fact that no one in the world was off this weekend. The fighting continues in Ukraine, while EU and Western countries have been implementing new sanctions against Russia. Thus, at the opening, the markets immediately began to move. The Russian rouble renewed its historic lows against the dollar, exceeding 100 roubles. The Russian stock market and stocks of Russian companies on international stock markets are falling, while the US dollar and gold are rising. There are all the signs of panic in the market. I would now like to look at Friday's economic reports or chart picture. However, is that really the point right now?

Traders trade all pairs and instruments based solely on geopolitics. Thus, the US Durable Goods Orders report, which was released on Friday, is not important to anyone at the moment. The graphical picture is changing so fast that you just can't keep up. The market has collapsed several times already. There is no information about the number of such collapses in the future. Thus, it is quite difficult to trade almost any instrument now. There will be no information background on Monday. However, it is hardly related to geopolitical news. As I said, the EU and Western countries continue to impose more and more sanctions against Russian companies, individuals and banks. The more the geopolitical situation escalates, the more complex and unpredictable the movements of almost all trading instruments will be. Thus, I now believe that the situation should be closely monitored and hope for improvement.

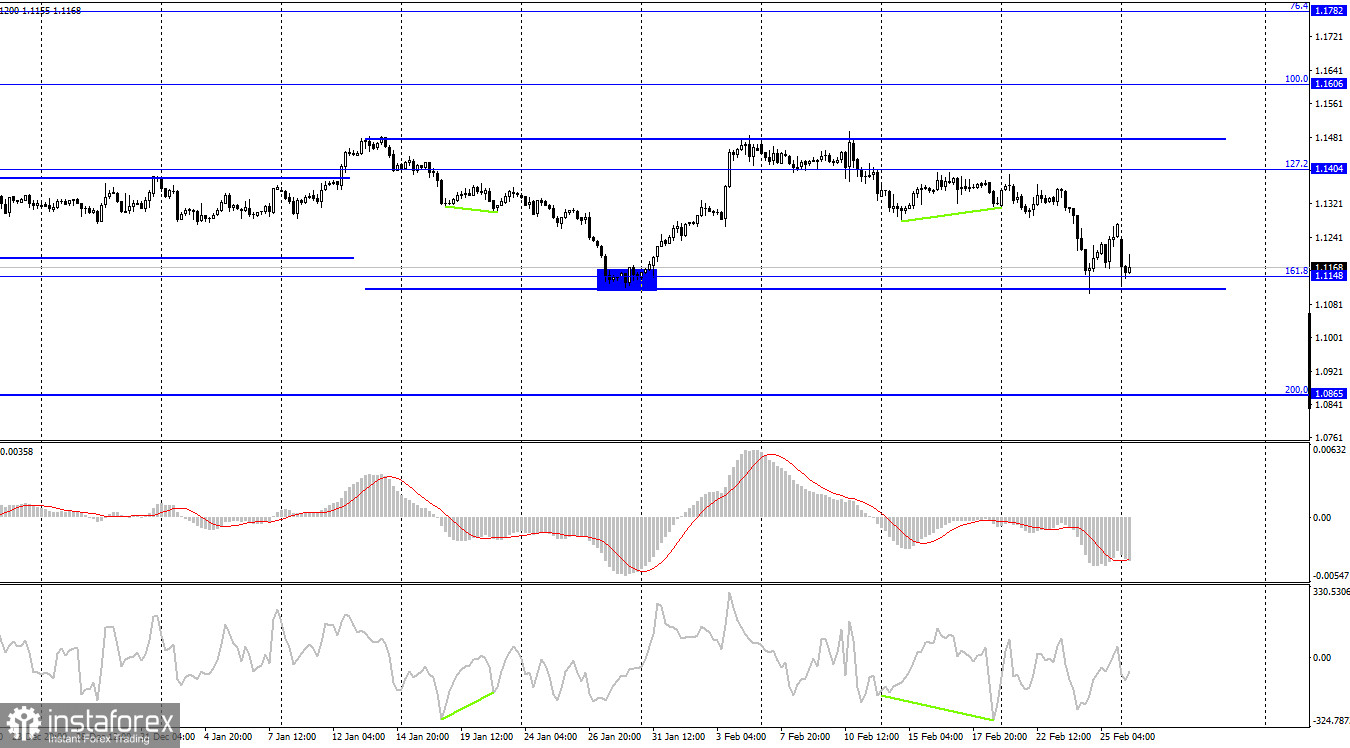

On the 4-hour chart, the pair dropped to the lower boundary of the sideways corridor, which still characterizes the current mood as flat. The rebound from this boundary triggered a rally, but given the ongoing military activity in Ukraine, the pair could consolidate below it and continue to fall towards the next retracement level of 200.0%, 1.0865. For now, the pair has a slight chance of growth.

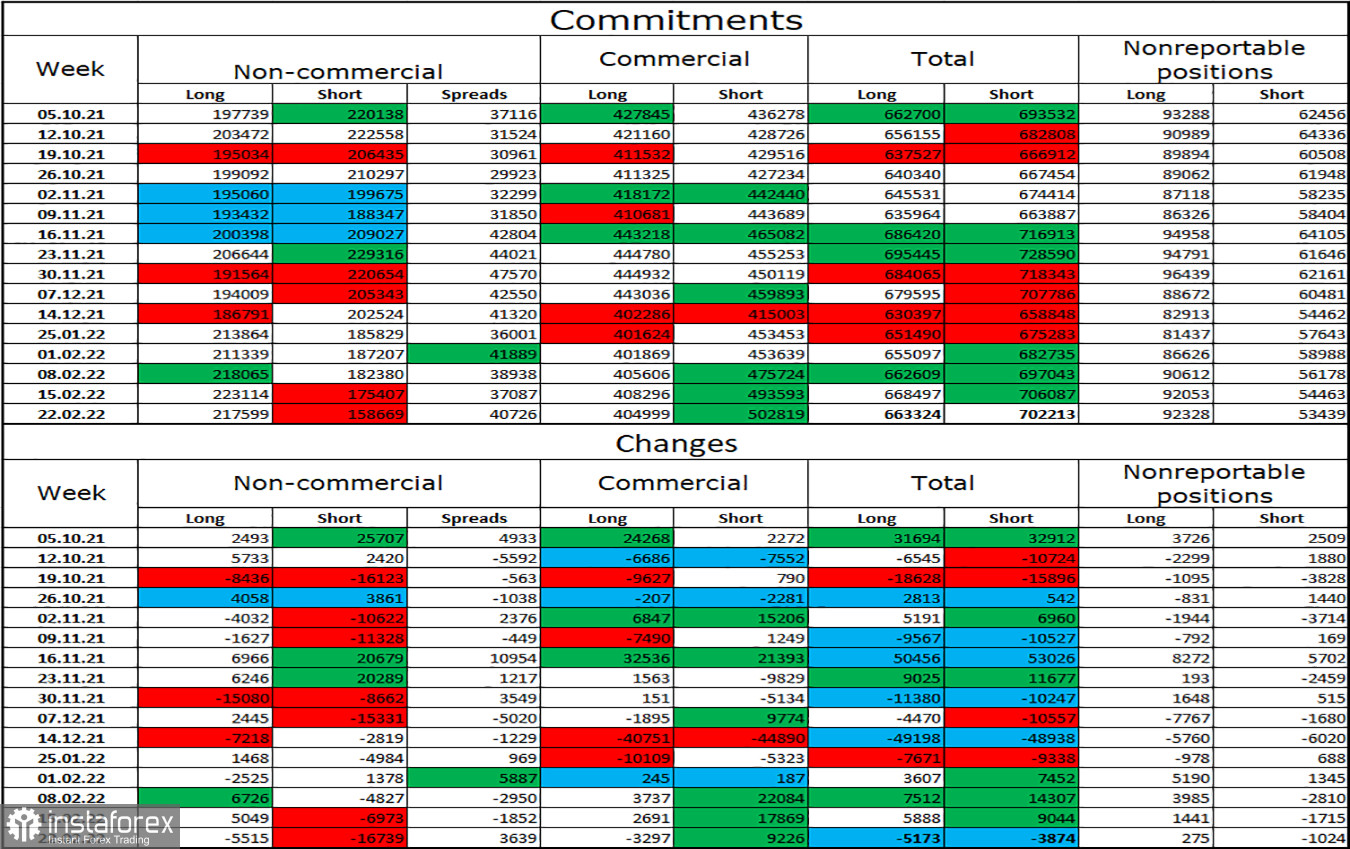

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 5,515 long contracts and closed 16,739 short contracts. This means that the bullish mood has intensified. The total number of long contracts now amounts to 217 thousand, and short contracts - 158 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is also characterized as "bullish". This makes it possible for the European currency to count on growth, if not for the information background, which now supports the American currency. I believe that now the data from the COT reports can be neglected since the situation in the world is tense and the mood of major players can change rapidly.

News calendar for the US and the European Union:

EU - Speech of ECB President Christine Lagarde (15-50 UTC).

On February 28, the EU calendar contains only a speech by the ECB president, while the US calendar has no events. No important information is likely to be provided. I believe that the information background will not affect traders' sentiment.

EUR/USD outlook and tips for traders:

I recommend opening short positions with targets at 1.1050 and 1.0865 if a close below 1.1143 on the hourly chart is executed. I do not recommend opening long positions as there is now a high probability of a new rise in the US currency, i.e. a fall in the euro-dollar pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română