Analysis of yesterday's trades and trading tips

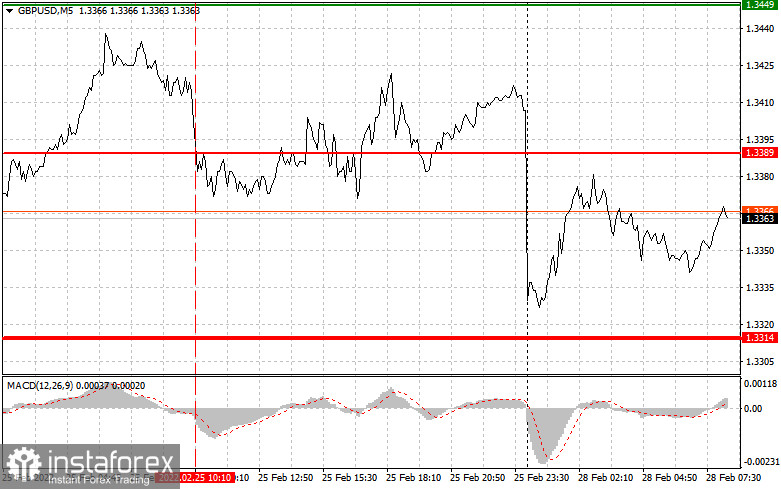

Yesterday, the pound sterling tried to break through the 1.3389 level. I recommended making trading decisions with this level in focus. However, at the time of testing this level, the MACD indicator had already dropped significantly from the zero mark and was in the oversold area. It limited the short-term downward potential of the pair. For this reason, traders refrained from selling the pound sterling. There were no other entry points.

Today, the pound sterling decreased by more than 1% against the US dollar. Currently, prospects for further growth are dubious. Friday's speech by BoE policymaker Hugh Peel did affect the pair. US household income and expenditures data had also no impact on the US currency. Yet, there was a sharp increase in spending due to soaring inflation. However, traders are less interested in inflation now as they are monitoring news about the war in Ukraine. Besides, the conflict continues to escalate. Today, the economic calendar for the UK is empty. So, I advise you to focus further on the development of the Russia-Ukraine conflict. In the afternoon, the UK will unveil its trade valance data as well as the wholesale report. Investors are likely to ignore the release of the Chicago PMI index. This is why I recommend opening long positions on the US dollar as a safe-haven currency. Market turbulence will not ease in the near future.

Buy signal

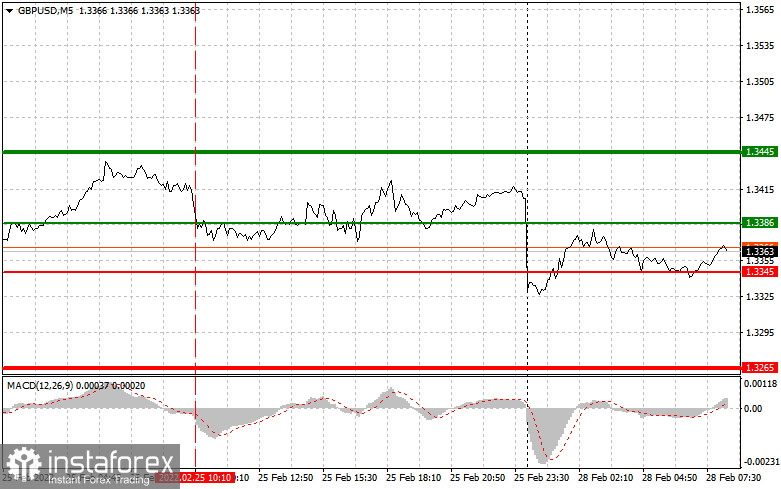

Scenario No.1: you can buy the pound sterling today if the price reaches 1.3386 (green line on the chart) with an upward target of 1.3445 (thicker green line on the chart). I recommend closing long positions at 1.3445 and opening short ones in the opposite direction, keeping in mind a 15-20 pip correction from the given level. The pound sterling is unlikely to rise significantly in the first half of the day, especially amid political tensions. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started to grow from it.

Scenario No.2: it is also possible to buy the pound sterling today if the price approaches 1.3345. At this moment, the MACD indicator should be in the oversold area, which will limit the downward potential of the pair. It may also trigger an upward reversal. The pair is expected to climb to the opposite levels of 1.3386 and 1.3445.

Sell signal

Scenario No.1: it is recommended to sell the pound sterling today if the price hits 1.3345 (the red line on the chart), which may cause a rapid decline of the pair. The target level is located at 1.3265 where I recommend closing short positions. It is better to open long ones in the opposite direction, keeping in mind a 15-20 pip correction from the given level). The British currency is projected to drop due to the escalation of the conflict and the reaction of Western countries. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario No.2: it is also possible to sell the pound sterling today if the price reaches 1.3386. At that moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also trigger a downward reversal. The pair is expected to decrease to the opposite levels of 1.3345 and 1.3265.

Description of the chart

The thin green line shows the entry point to open long positions on the trading instrument.

The thick green line is the estimated price where you can place a Take profit order or lock in profits manually as the price is unlikely to rise above this level.

The thin red line shows the entry point to open short positions on the trading instrument

The thick red line is the estimated price where you can place a Take profit order or lock in profits manually as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions on entering the market. Before the release of important fundamental reports, it is better to stay out of the market to avoid losses due to sharp volatility. If you decide to trade during the news release, then always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan like the one I presented above. Relying on spontaneous decision-making based on the current market situation is a losing strategy of an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română