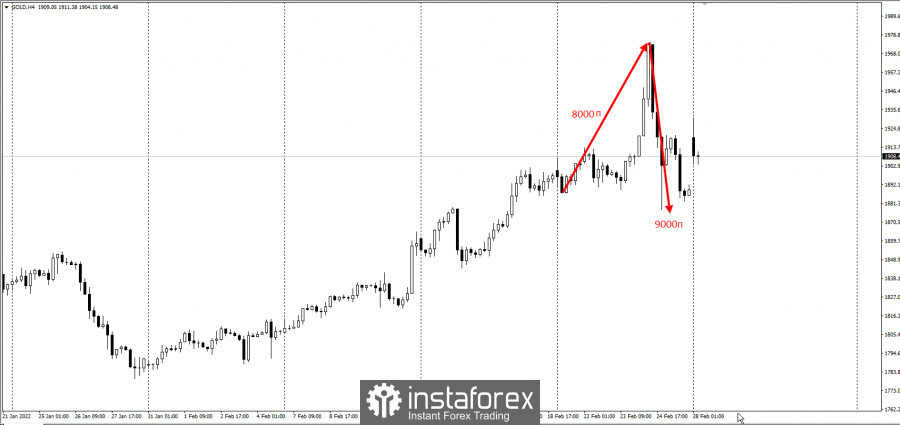

The gold market disappointed many investors last Thursday because of the strong intraday fluctuations. Back then, prices soared to a session high of $1,976.50, the highest level in 1.5 years.

But some analysts say that there are risks of using gold as a geopolitical refuge, so investors should look at gold in the long term instead of focusing on daily volatility.

There is no doubt that the ongoing conflict in Ukraine will greatly affect the global economy, especially since the country is the third largest exporter of wheat and is an important player in the energy market. The tension is threatening global food and energy supply chains, potentially driving up inflation.

High inflation is the one that drove gold prices up long before the conflict started.

Reportedly, US consumer prices rose higher-than-expected on Friday, with core PCE, the Federal Reserve's preferred indicator of inflation, rising to 5.2%.

Consumer prices in Canada also hit a new 30-year high, while rising prices in Europe could lead to a new recession.

Meanwhile, purchasing power is constantly decreasing, which means that consumption will fall.

Inflationary pressure also drives up interest rates, with 10-year bond yields hovering around 2%. This environment will add additional volatility to the stock markets, forcing investors to reduce risk.

At the moment, the problem investors face and the question they ask is where to invest their capital. Even though bond yields rose to 2%, this is still a loss of money in real terms at 5.2% inflation.

Gold is one of the last pillars of security in the global financial market. It is uncorrelated with stocks and carries no counterparty risk, making it an important diversification tool. So as disappointing as gold's daily price action may be, it is still an important asset for investors.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română