When to open long positions on EURUSD:

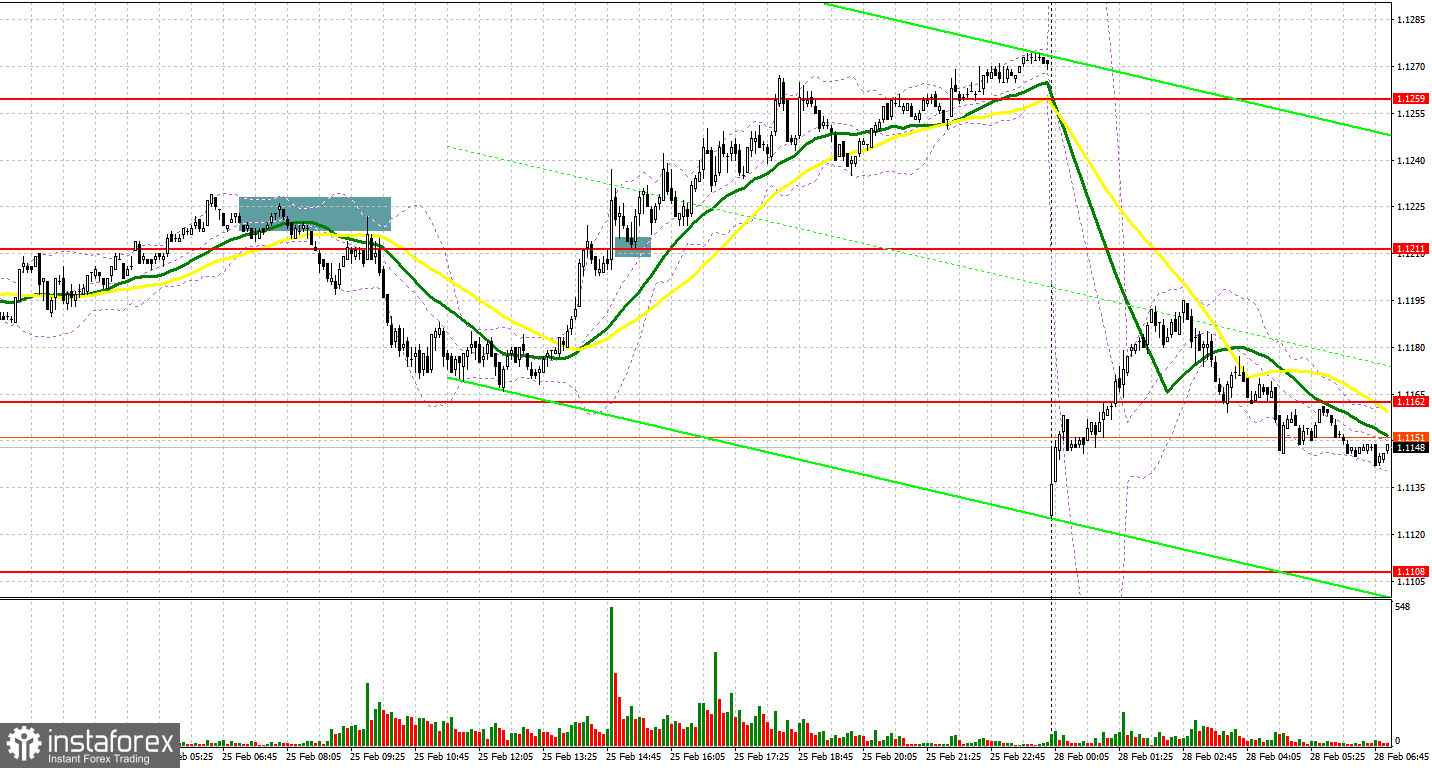

A few entry points were formed on Friday. Let us analyze the M5 chart to understand what happened. In my previous analysis, I paid attention to the level of 1.1218 and said you could consider entering the market from it. A false breakout at 1.1218 in the first half of the day triggered a sell signal resulting in a mass sell-off and bringing a 40 pips profit. The level of 1.1163 served as a target. In the second half of the day, bulls regained control over 1.1211 and tested it top-bottom. Eventually, a buy signal was produced. The likelihood of easing Russia-Ukraine tensions came as a contributor to a stronger euro, allowing traders to yield a profit of 50 pips.

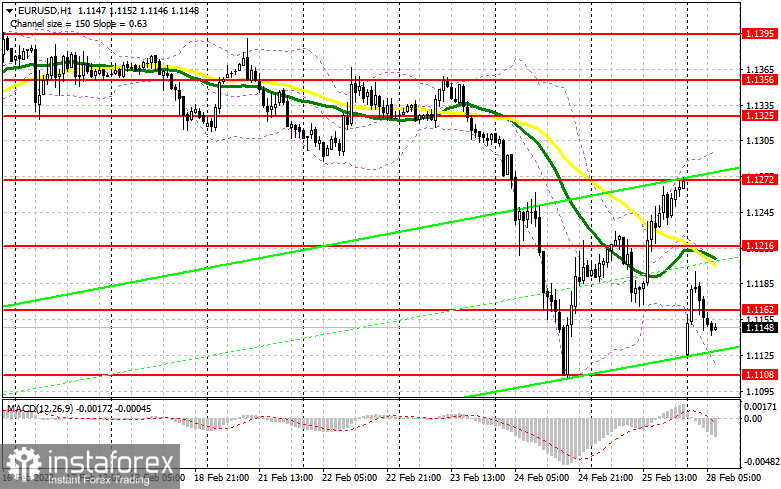

The euro/dollar pair traded 140 pips lower from the Friday closing early today. Amid rising geopolitical tensions traders are turning to the US dollar for capital protection in case of a serious armed conflict. Russia will hold talks with Ukrain today, and its outcome should be closely followed. Therefore, there is no need to rush to buy the instrument. Bulls will try to protect the support level of 1.1108, the weekly low, today. A false breakout there could generate the first entry point to buy the euro with the target at 1.1162. The upward movement is likely to extend if the pair breaks through resistance. Today's macroeconomic calendar is empty and speeches by the ECB's executive board member Panetta and President Lagarde are highly unlikely to somehow affect the market in the face of war. The pair may recover to the region of 1.1216 where bearish moving averages go if the price breaks through 1.1162 and tests it bottom-up. If so, the bearish trend will end and the quote may head towards the highs of 1.1272 and 1.1325. You should consider taking a profit there. If geopolitical risks mount further, demand for the greenback will only increase. It would be wise to buy the pair after a breakout at 1.1070 and to sell it on a rebound from the lows of 1.1034 and 1.0994, allowing a 20-25 pips correction intraday.

When to open short positions on EURUSD:

Bears immediately returned to the market. The destiny of the whole world is now in the hands of Russia and Ukraine. Bears will try to protect resistance at 1.1162 that formed on Friday. A false breakout there could make a signal to sell the pair due to possible aggravation of the armed conflict between Russia and Ukraine and retaliatory measures from the US and the EU. If so, the level of 1.1108 will stand as the target. A breakout of this mark and its retest bottom-up could happen instantly, sending an additional signal to sell the pair with the targets at 1.1070, 1.1034, and 1.0994 where you should consider taking a profit. In the event of a stronger euro and a decrease in bearish sentiment at 1.1162, you should wait to sell the instrument. It would be wise to go long after a false breakout at around 1.1216. You could go long as soon as the price bounces off 1.1272 or 1.1325, allowing a 15-20 pips correction intraday. Neither fundamentals nor speeches by ECB representatives will be as important as the events unfolding in the world today. Therefore, you should build your trading tactics today based solely on technical analysis.

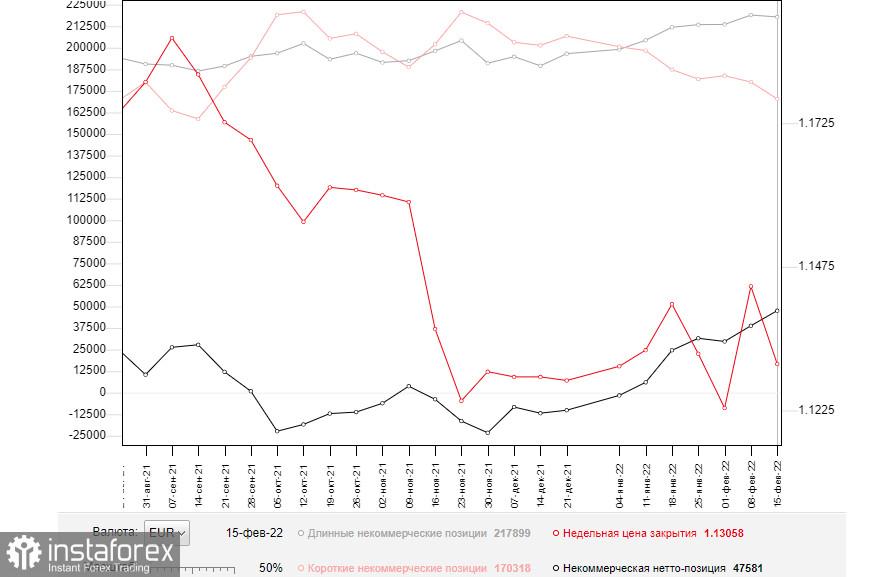

Commitments of Traders:

The COT report for February 15 logged a decrease in both long and short positions, which led to an increase in the positive delta. The ECB's uncertain stance on monetary policy startles investors. President Christine Lagarde used to say the regulator should act aggressively if inflationary pressure increased. Last week, however, she changed her rhetoric. Despite a rise in the positive delta, the euro tumbled in the reporting period. A plunge came due to the conflict between Russia and Ukraine. Global geopolitical risks accelerated after Russia had recognized the independence of the two separatist regions in Ukraine. The Fed's stance on interest rates is an additional reason for a weaker euro. According to the FOMC Minutes for February, the central bank may raise rates by 0.5% in March. Initially, a 0.25% hike was expected, which is a bullish signal for the US dollar. The COT report revealed a decrease in long non-commercial positions to 217,899 versus 218,973 and a drop in short non-commercial positions to 170,318 from 180,131. This suggests that traders are now less willing to either sell or buy the euro. The total weekly non-commercial net position rose slightly and amounted to 47,581 versus 38,842. The weekly closing price plummeted to 1.1305 from 1.1441 a week earlier.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, indicating a bearish market.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance and support stand at 1.1215 and 1.1120 respectively.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română