The EUR/USD currency pair recovered very quickly on Friday. At least during the day, the quotes managed to recoup most of Thursday's losses. Thus, the euro/dollar pair managed to update its 14-month lows but is currently recovering quite quickly. Unfortunately, these movements do not mean anything in the context of determining even a short-term perspective. The market is in a state of "storm". Every new message concerning geopolitics can be taken very seriously by the market. For example, it is already known that almost all European countries have closed their airspace to Russian aircraft, a decision has been made to disconnect from SWIFT some of the Russian banks that have already been sanctioned. Also today, it was reported that Germany may refuse to purchase Russian gas and import energy from the United States.

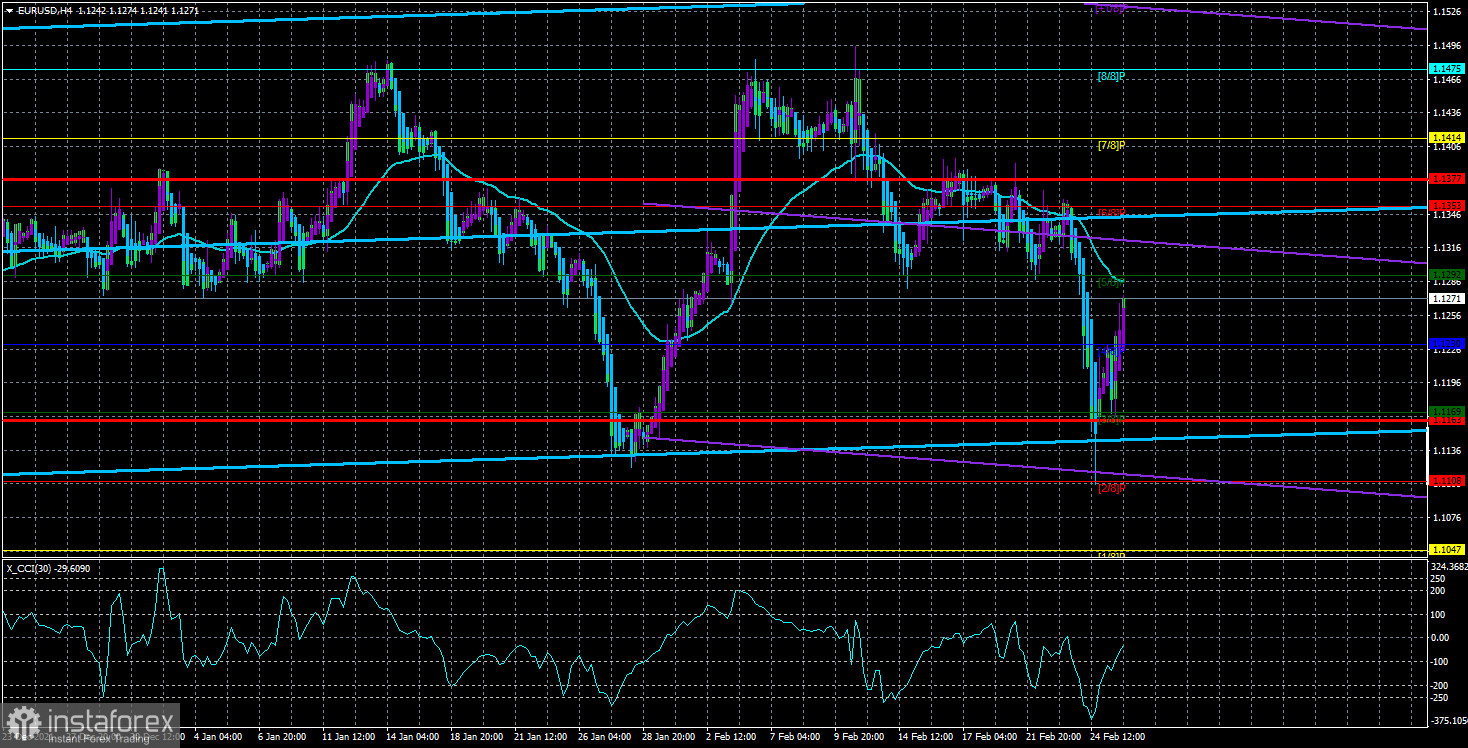

As we said earlier, the modern economy is a very complex system where all countries are interconnected in one way or another. That is, if sanctions are imposed against one country, then those who impose sanctions also suffer. Their economy is suffering. Thus, it is foolish to assume that the Russian economy will experience problems, and the European one will thrive on these problems. Thus, it is also impossible to conclude that there will be no reaction on the foreign exchange market or stock exchanges. The end of last week has already shown that this is not the case. Therefore, as unfortunate as it may be, this week, all attention will again be turned to geopolitics. As for the technical picture, formally, a downward trend has now been formed, but on Monday, the price may go again above the moving average line. Even with the naked eye, it can be seen that now there are "swings" on the 4-hour TF. It's just not the "swing" that we are used to. A longer-term "swing". Therefore, the price can move in any direction.

There is little hope for important reports from the EU and the USA.

Although all traders' attention is now focused on the Ukrainian-Russian conflict, macroeconomics cannot be ignored forever. In the new week, a fairly large amount of macroeconomic information will be published in the European Union, so certain reports may be followed by a reaction. On Tuesday, the index of business activity in the manufacturing sector for February will be released. The final value is unlikely to be any different from the previous one. This is a weak report. On Wednesday, the consumer price index for February will be known. According to experts' forecasts, inflation will continue to accelerate and will amount to 5.2-5.3% y/y. This is a strong report. The business activity index for the services sector and the unemployment rate will be released on Thursday. These are weak reports and it doesn't even make sense to consider them in the current circumstances. On Friday, a secondary report on retail sales in January. Thus, we see that only the inflation report next week will deserve attention. Of course, during the week, there may be a speech by Christine Lagarde and even more than one. However, what can it tell the market in the current situation? Since the beginning of this year, we have repeatedly heard that the ECB is not going to raise the rate, and the GDP reports clearly showed that the ECB does not have the desire to do this, but also the opportunity.

Recall that an increase in the key rate will inevitably lead to a slowdown in the economy. If a minimal increase was recorded in the fourth quarter, then with the tightening of monetary policy, this increase may evaporate, and the economy will begin to shrink. Thus, the ECB simply cannot take such a step in the near future. Separately, I would like to note that a Nonfarm report will be published in the States this week. We will talk about it in more detail in the article on the pound/dollar. However, it is this report that has the greatest number of chances to be reflected on the chart of a currency pair. In general, we believe that the new week may be, if not "stormy", then at least unpredictable. The mood of traders can change very quickly.

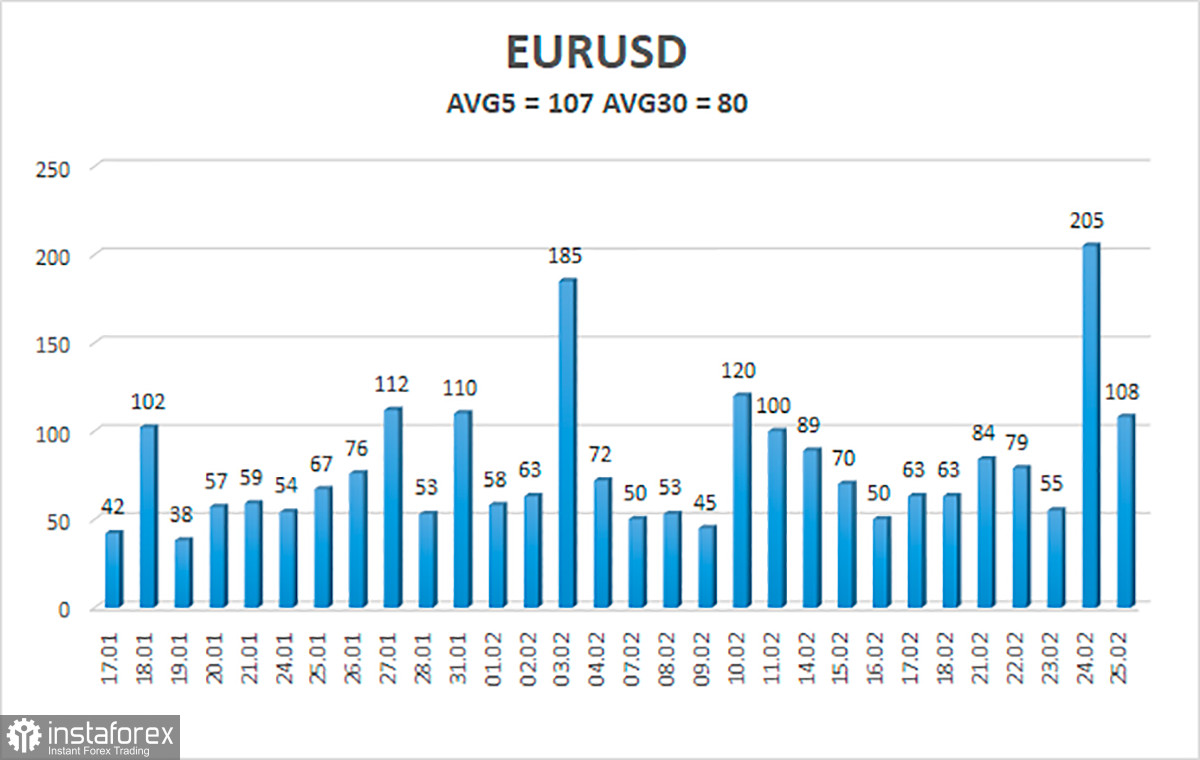

The volatility of the euro/dollar currency pair as of February 28 is 107 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1163 and 1.1377. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.1230

S2 – 1.1169

S3 – 1.1108

Nearest resistance levels:

R1 – 1.1292

R2 – 1.1353

R3 – 1.1414

Trading recommendations:

The EUR/USD pair started an equally powerful correction after a strong collapse. Thus, now we can consider new short positions with targets of 1.1230 and 1.1169 in the event of a price rebound from the moving average. Long positions should be opened no earlier than the price-fixing above the moving average line with targets of 1.1353 and 1.1377.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română