The trading session was very volatile after Russia attacked Ukraine. Therefore, commodities rose sharply with oil, aluminum, palladium, nickel and the agricultural market showing strong gains

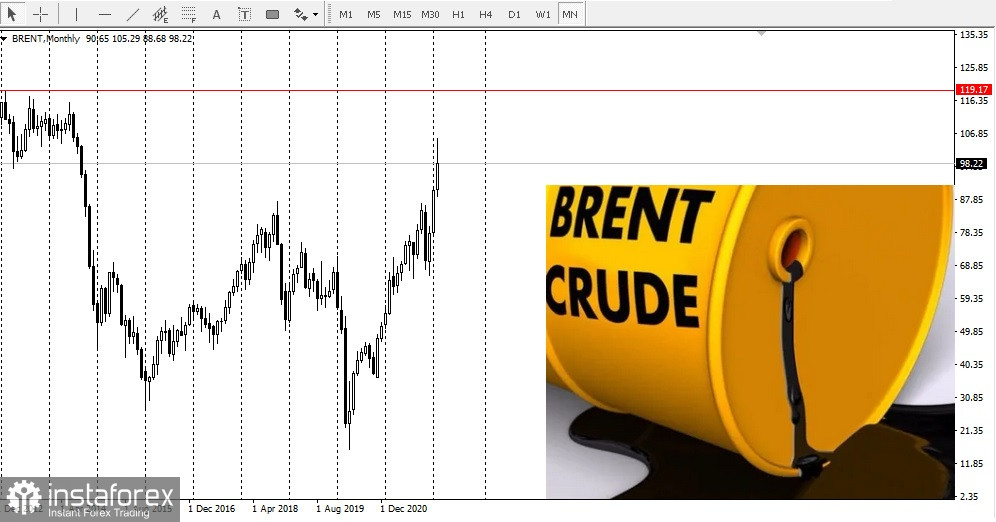

Taking into account supply problems and the fact that Russia is the third-largest oil producer and the second-largest oil exporter, analysts expected oil prices to rise in response to the military conflict between Russia and Ukraine.

If the situation continues to develop in the same vein, Russian oil exports will halt.

Moreover, gold prices could surge above $120 a barrel.

Russia invaded Ukraine by land, air, and sea. This issue has become one of the most serious security crises in the EU since World War II. Some Ukrainian cities came under missile, artillery, and air attacks as Russian troops entered Ukraine from Russia, Belarus, and the Black and Azov seas.

Russia accounts for about 10% of global crude oil exports, nearly 50% of EU coal imports, and about 30% of EU natural gas imports. If the situation escalates into a more serious and widespread conflict between Russia and the West, commodity prices may rise even higher.

According to JPMorgan, the first issue is supply disruptions. JPMorgan reported that stocks of base metals had been almost depleted, supplies from Russia were in question.

Other commodities also rose amid this news: EU natural gas prices jumped by more than 40%. Aluminum surged to a record high of $3,450 a ton, up more than 3%.

Nickel traded at its all-time high for more than a decade, around $25,000 a ton. Wheat hit a nine-year high due to supply problems.

Palladium jumped over 6% during the day, and platinum was up 2%:

while platinum was up 2%:

Russia's Nornickel is the world's largest palladium producer. Last year, it produced 2.6 million troy ounces of palladium or 40% of global output.

Russia's Nornickel is the world's largest palladium producer. Last year, it produced 2.6 million troy ounces of palladium or 40% of global output.

Russian President Vladimir Putin gave a speech on Thursday. He called on Ukrainian troops to surrender and warned NATO not to interfere.

According to Bloomberg, US President Joe Biden had to impose more severe sanctions against Russia.

Markets should expect a long period of high volatility, high commodity prices and growing risks of stagflation around the world...

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română