On Thursday, amid the ongoing Russian military operation in Ukraine it became clear that it is limited and it will most likely not to spread to the nearest regions

The stock markets definitely collapsed amid the rising geopolitical tensions in Ukraine. The US dollar and other safe haven assets such as the yen rose. Moreover, government bonds of economically developed countries and gold prices followed suit. The Russian stock market was hit the hardest as speculators and investors, shocked by the new economic sanctions, started to sell off ruble assets. It resulted in the collapse of the Russian currency.

However, a significant event occurred yesterday. It may ease the tensions in the financial markets and even contribute to their partial recovery. Firstly, Putin and Macron came to an agreement to continue negotiations on Ukraine and other important issues for Russia. Secondly, US President Joe Biden did not state any significant facts about imposing new economic sanctions against Russia. In fact, he expressed the Western weak stance concerning Russia. Moreover, Biden confirmed that the US was unwilling to interfere in the war between Russia and Ukraine.

The markets reacted to his words strongly. The demand for US shares recovered significantly, the volume of government bond purchases dropped, the dollar, the yen, and gold prices declined. Oil prices also corrected downwards.

Why did markets react this way and what can happen next week?

The development of events in Ukraine, actions of Russian army and special forces detachment confirmed that Russia would not plan to occupy Ukraine and would implement the policy of its "demilitarization" and "denazification". These facts disoriented the West. Besides, Biden failed to impose new sanctions against Russia. Therefore, the current situation showed that Russia was not planning to spread its military operation to other countries and regions. It was a reason why investors started buying risky assets again.

The release of US economic data was another positive aspect for the markets. The reported GDP numbers for the fourth quarter were in line with the consensus estimate of 7.0% with the deflator jumping to 7.2% versus expectations of a decline to 6.9%. Besides, last week's initial jobless claims figures were positive. They corrected downwards last week to 232,000 versus 249,000 with a forecast of 235,000.

Taking into account the current situation, market volatility will likely remain high. If there is no news about civilian casualties in Ukraine, the Western powers will be open to negotiations. Moreover, in case the whole military operation is carried out within a very short period of time, the geopolitical tensions will noticeably reduce, and investors will definitely take advantage of buying cheaper assets, resulting in a stock demand recovery. At the same time, weak demand for the dollar, gold and government bonds of economically developed countries as safe-haven assets is possible. It could happen next week.

Daily outlook:

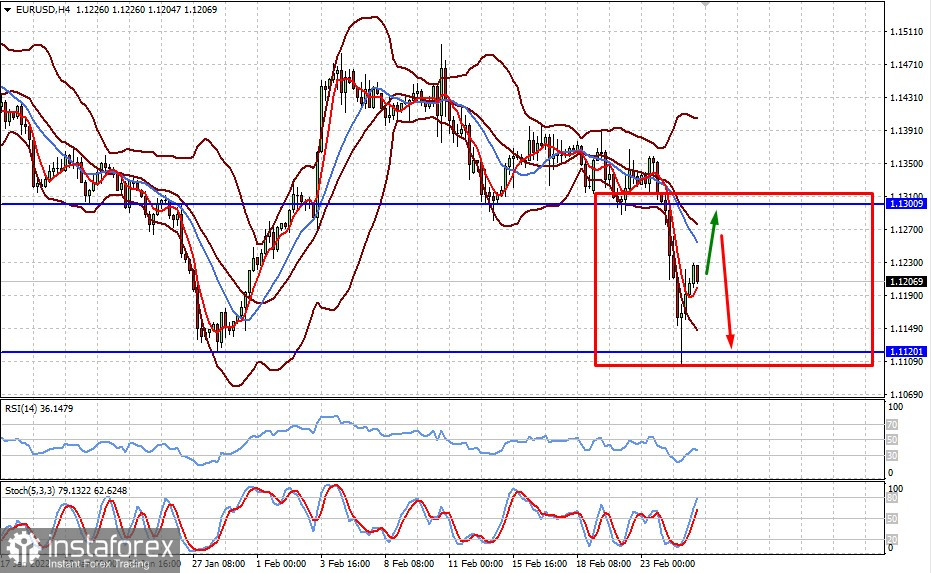

Today, the EUR/USD pair is likely to remain in the range of 1.1120-1.1300 in anticipation of news from Ukraine. If tensions between the US and Russia subside slightly, a limited pair's growth to 1.1300 is possible. However, the pair is likely to remain in that range.

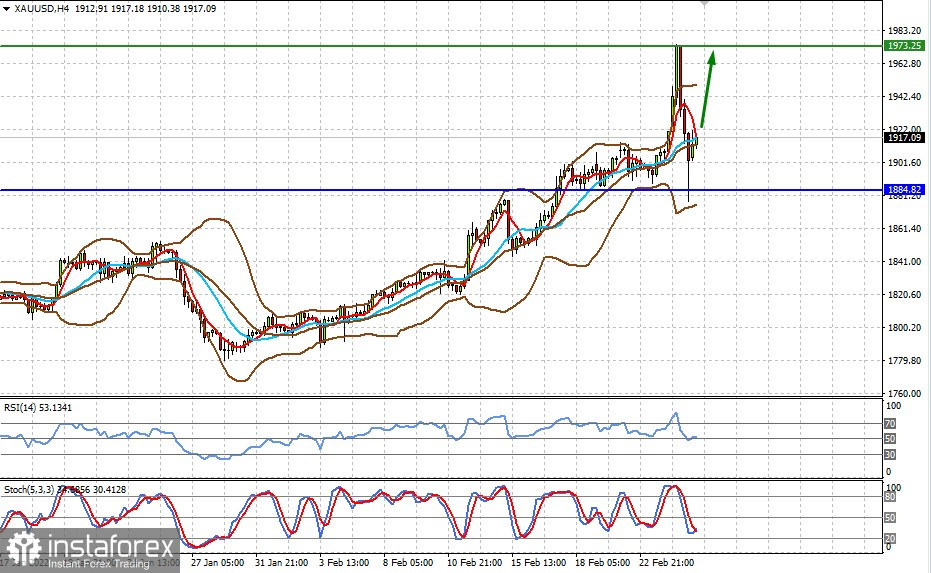

Gold prices are sensitive to Ukraine's issue. Today, gold will likely try to test the 1973.25 mark again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română