Conditions to open long positions on EUR/USD:

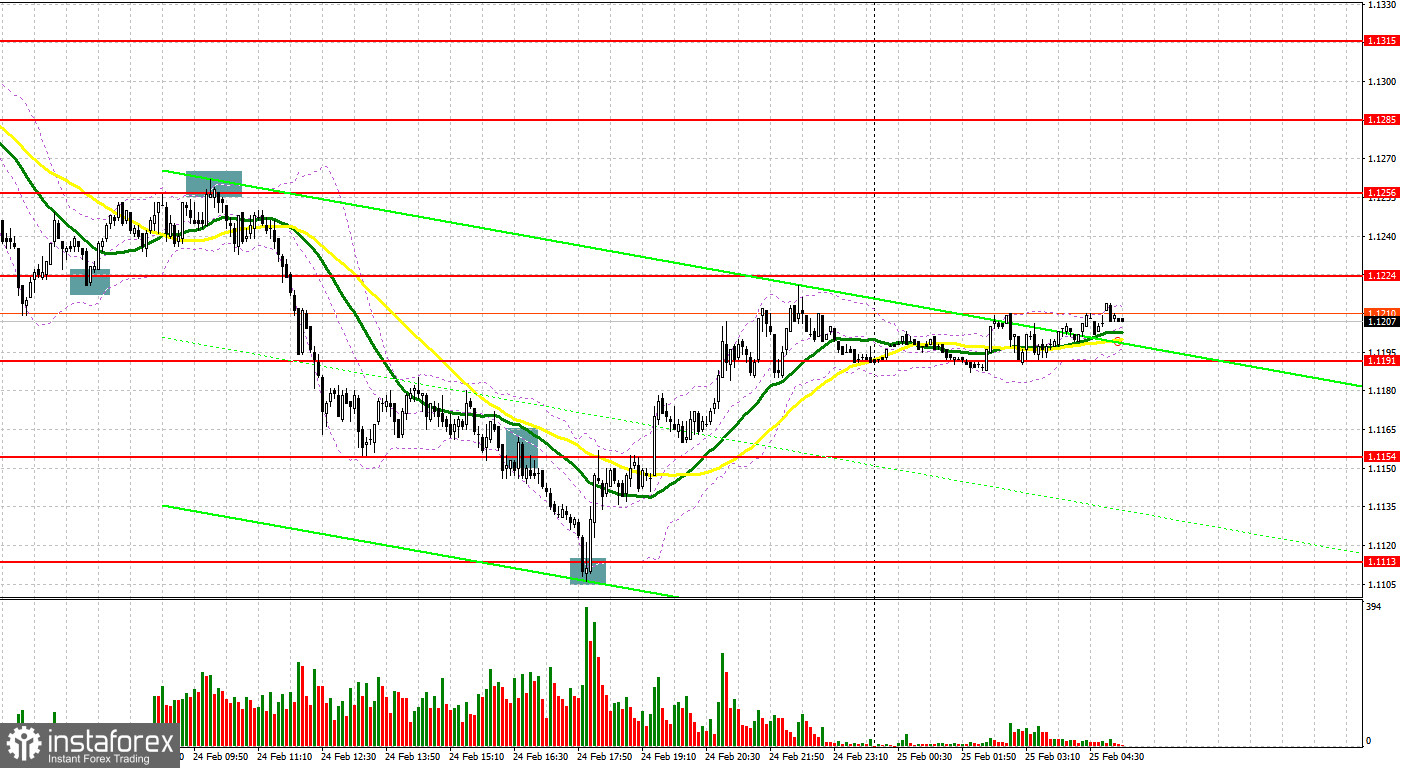

Yesterday, there were a lot of signals to enter the market. Let us take a close look at the 5-minute chart and analyze the market situation. Early today, I recommended focusing on several support and resistance levels. The euro was under significant pressure caused by the military conflict in Ukraine. A false break of 1.1224 led to a buy signal, thus boosting the euro to the resistance level of 1.1256. However, the pair failed to go higher and returned to the level below 1.1256. As a result, traders received a signal to open short positions. After that, the pair slumped to 1.1154. There, the bearish impulse was stopped. A downward break of the mentioned level provided traders with a new short signal. As a result, the euro/dollar pair tumbled to 1.1113. A false break of the level led to a signal to buy the euro.

High volatility of the euro/dollar pair could be explained by military actions on the territory of Ukraine. The situation is getting worse. Some experts suppose that Kiev, the capital of Ukraine, could be occupied soon. The Ukrainian authorities will hardly meet the requirements or make concessions. The conflict has a significant influence on risky assets. The situation will hardly change until both parties come to the negotiating table. Although this day is rich in fundamental data from the eurozone, including the speech provided by Christine Lagarde, risky assets are likely to remain under the pressure from the geopolitical factors. Traders will be focused on Russia's actions and measures taken by the EU and the US. It is better to avoid long positions. Bulls should primarily protect the support level of 1.1163.

A false break of the level will provide traders with the first long signal with the target at 1.1218. However, to push the euro/dollar pair higher, buyers should become more active and break the resistance level of 1.1218. Announcements made by Christine Lagarde, strong data on Germany's and France's GDP as well as a rise in the eurozone consumer sentiment index will allow the pair to break 1.1218.

An upward break of the mentioned level will give an additional signal to buy the trading instrument. This will allow the pair to recover to 1.1259. If the pair breaks this level, the bearish trend is likely to stop. In this case, the pair will have a chance to rise to the highs of 1.1290 and 1.1325, where it is recommended to lock in profits. It will be better to buy the asset after a false break of 1.1180. Buy positions could be also initiated from the lows of 1.1070 and 1.1034 with a possible rise of 20-25 pips.

Conditions to open short positions on EUR/USD:

Yesterday, sellers were very active. However, attractive prices forced big players to return to the market. They expect a rapid rise in the euro when the conflict ends. Today, bears should protect the resistance level of 1.1218. A false break of the level, worsening of the Russia-Ukraine conflict, and sanctions from the EU and the US may provide a signal to open short positions with the target at 1.1163. A downward break of the level may take place amid traders' negative reaction to the data from the eurozone. This will give an additional signal for short positions with the target at the low of 1.1108. In this case, the pair may slide deeper to 1.1070 and 1.1034, where it is better to lock in profits. If the euro rises and bears fail to show activity at 1.1218, traders should not sell the asset. It is better to open sell orders after a false break of 1.1259. It is also possible to sell the euro from 1.1290 or 1.1325, expecting a possible drop of 15-20 pips. As I have already mentioned, the fundamental data will be overshadowed by the geopolitical situation. That is why traders should rely on technical analysis.

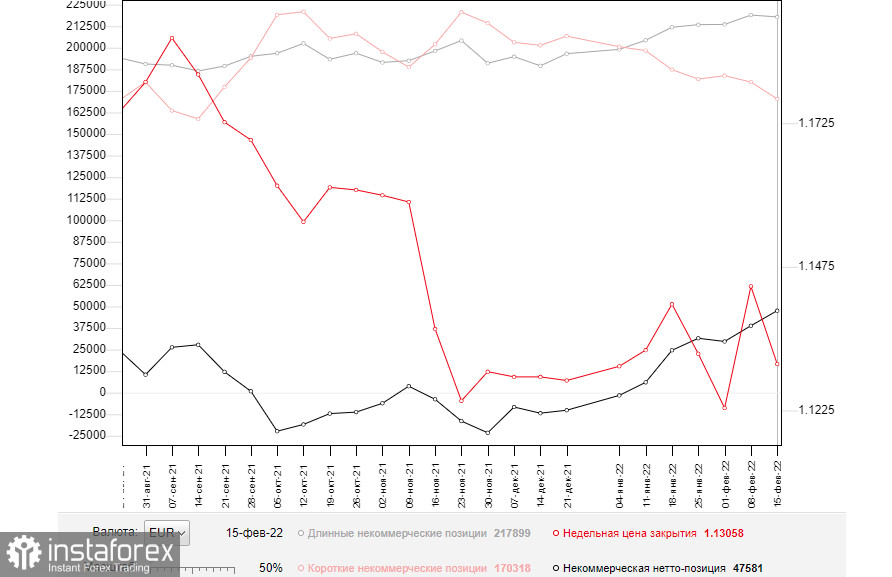

Commitment of Traders Report

According to the COT report from February 15, the number of long and short positions dropped. The unclear policy of the ECB has baffled investors. The fact is that not so long ago, Christine Lagarde announced the necessity to switch to a more aggressive approach if inflation accelerated. However, last week, she changed her mind. Nevertheless, the euro slumped in the given period amid the military conflict in Ukraine. Recently, the Russian authorities recognized the independence of two breakaway Ukrainian regions. The euro's depreciation could also be explained by the Fed's intention to raise the benchmark rate. According to the protocol of the Fed's meeting held in February, the regulator may choose a more aggressive policy and raise the interest rate by 0.5% in March instead of 0.25% as planned earlier. It is a bullish signal for the US dollar.

The COT report reads that the number of long non-commercial positions declined to 217,899 from 218,973, while the number of short non-commercial positions decreased to 170,318 from 180,131. Thus, the number of both buyers and sellers is falling. It seems that traders decided to take the wait-and-see approach due to the current events. Thus, the total non-commercial net position increased slightly to 47,581 against 38,842. The weekly closing price collapsed to 1.1305 compared to 1.1441 a week earlier.

Signals of indicators:

Moving Averages

Trading is conducted just below the 30- and 50-day moving averages, which indicates that bears are still controlling the market. .

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair rises, the upper limit of the indicator at 1.1240 will act as resistance. If the euro falls, the lower limit at 1.1120 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands (Bollinger Bands). The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total long position opened by non-commercial traders.

- Short non-commercial positions is a total short position opened by non-commercial traders.

- The total non-commercial net position is a difference between the short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română