The EUR/USD currency pair crashed down at the speed of light on Thursday. The euro started to fall a day earlier, but the day before yesterday this movement was within the horizontal channel in which the pair traded for more than a week. Last night, the euro and the pound fell, losing more than 100 points. This happened after an air attack was carried out on all major Ukrainian cities, and fierce battles between the Ukrainian and Russian armies began on all the borders of Ukraine. We warned earlier that the market does not react to geopolitics for the time being. If the conflict escalates, then very strong movements are quite possible. And so it happened. We have also repeatedly said that the dollar is highly likely to grow if the geopolitical situation worsens. Therefore, we are not surprised by what is happening in the foreign exchange market right now. What else could be expected if a full-scale war broke out between two once fraternal countries and peoples?

It is worth noting that not only the foreign exchange market reacts to it. The US stock market collapsed and it is unclear whether it promised to return. Oddly enough, only the cryptocurrency market showed a slight drop, although cryptocurrencies were, are and will be the most risky type of assets. Thus, at this time, a downward trend has formed for the euro/dollar pair, but it can hardly be called a "trend". It should be understood that yesterday's collapse was due to a specific event, and not because the market was eager to get rid of the euro and buy more dollars. Now the collapse can continue for as long as you want, but most likely, when the market moves away from the shock, the pair will still begin to recover. Now everything, unfortunately, depends on Kiev and Moscow. Only they can end this war.

There is no macroeconomics, but who needs it now?

We would love to write something about the macroeconomics of the European Union or the United States, or about the central banks of these countries, but at this time "macroeconomics" does not matter at all. A full-scale war has begun in Eastern Europe and it is completely unclear how long it will last now. Perhaps everything will be over in a few days, and the authorities of both conflicting countries will remember that diplomacy is better than war. Perhaps this will be a conflict for many years. It should be understood that Ukraine is currently a battlefield. Russian troops are fighting not on their own territory, and this war is generally beneficial to the West, since it can weaken Russia. Of course, Western countries support Kiev and in the coming days they may bring down new sanctions on Moscow, which will set its economy back a couple of decades. At this time, we are talking about disconnecting from SWIFT and complete isolation from the outside world. But will the United States and the European Union have the courage to impose these sanctions? Nevertheless, it should be recognized that Russia is a major figure on the world chessboard and its opinion will have to be taken into account.

It should also be remembered that Russia is a source of a huge amount of exports of various natural resources, oil and gas. The European Union is unlikely to give up Russian gas, because it simply has nothing to replace it with. Thus, most likely, the sanctions from the EU will be such as not to harm themselves. The states, of course, are more independent from the Russian Federation and can impose almost any sanctions they want. Moscow is already saying that any sanctions will be met with an equally harsh response, but analyzing the foreign exchange market, we would like to note that every subsequent action, whether from Moscow, Washington, or Brussels, which will not be done in the direction of de-escalation and diplomacy, will only harm the global economy. And therefore to harm each of its individual participants. In general, now we can only hope that this military conflict will end as quickly as possible.

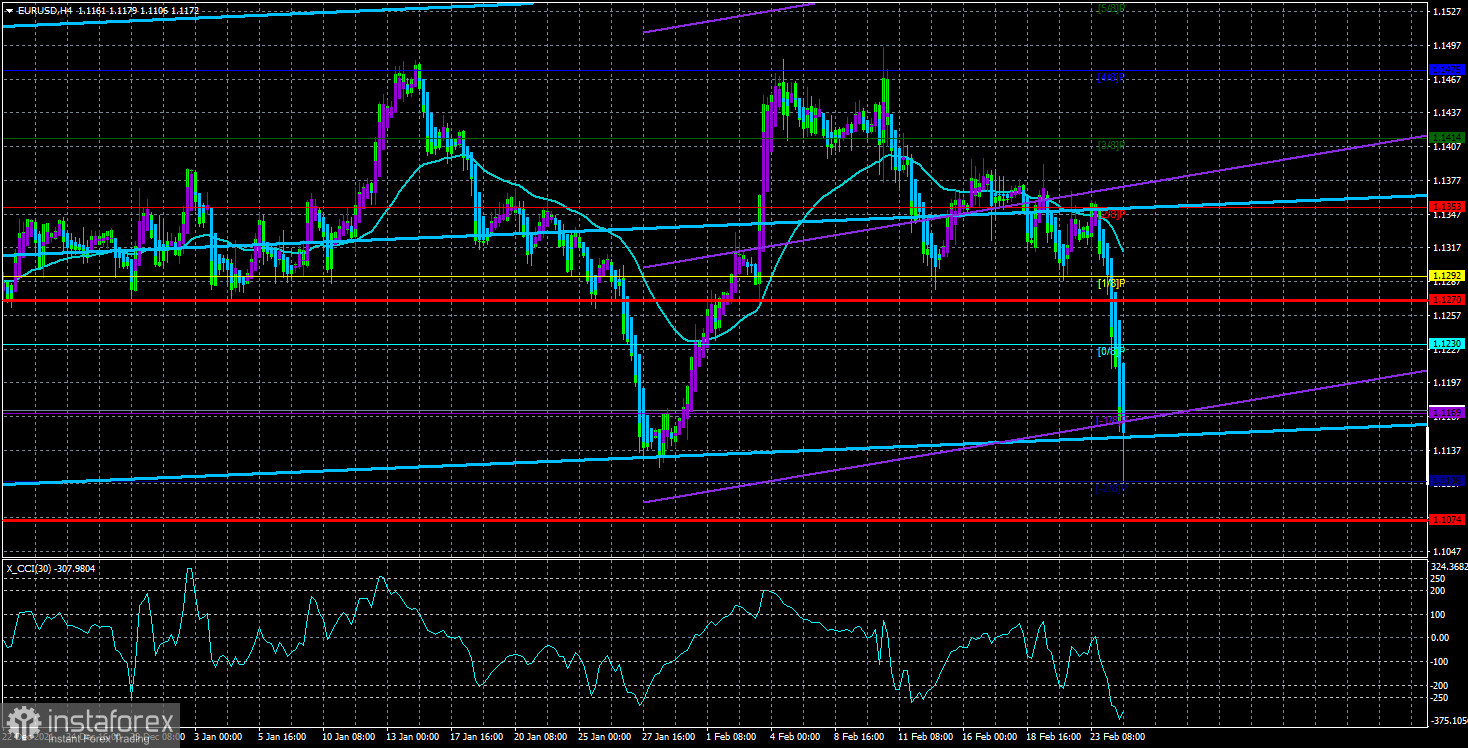

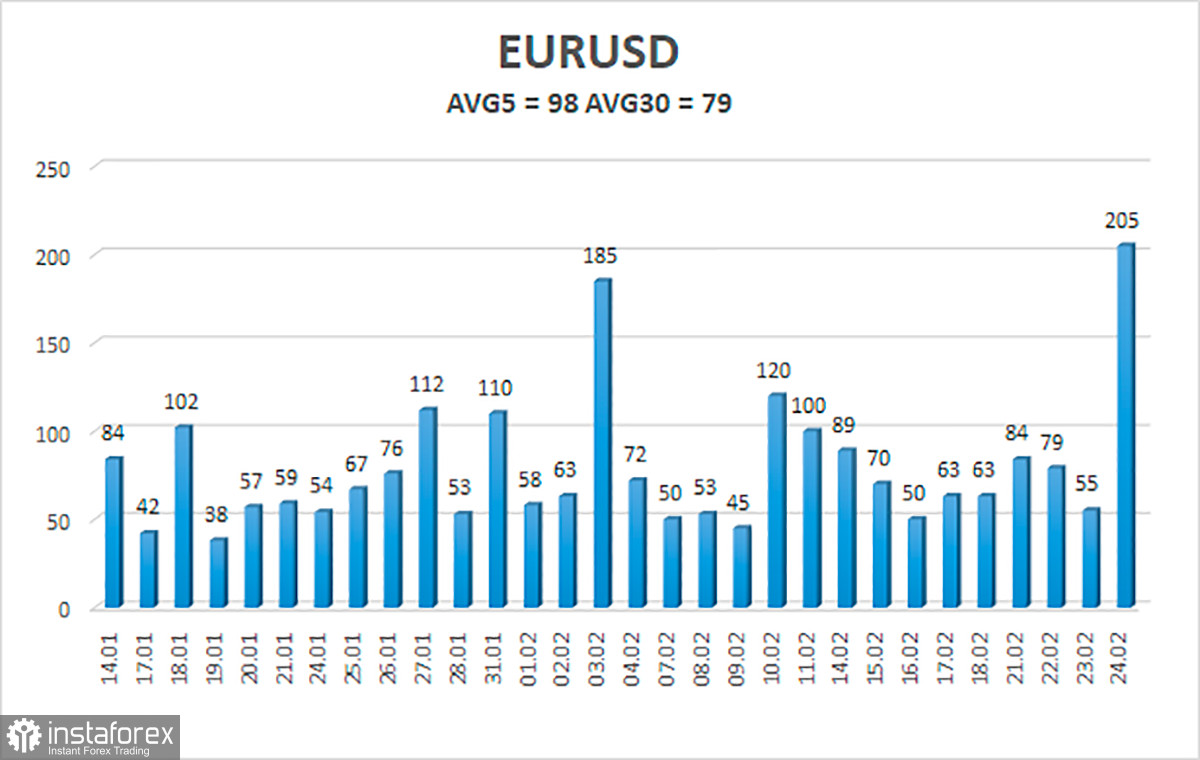

The volatility of the euro/dollar currency pair as of February 25 is 98 points and is characterized as high. Thus, we expect the pair to move between the levels of 1.1074 and 1.1270 today. An upward reversal of the Heiken Ashi indicator will signal a round of upward correction after a powerful collapse.

Upcoming support levels:

S1 - 1.1230

S2 - 1.1169

S3 - 1.1108

Nearest resistance levels:

R1 - 1.1292

R2 - 1.1353

R3 - 1.1414

Trading recommendations:

The EUR/USD pair started a strong downward movement. Thus, now you can stay in short positions with the targets of 1.1108 and 1.1074 until the Heiken Ashi indicator turns up. Long positions should be opened not earlier than the price taking above the MA with targets of 1.1353 and 1.1414. However, the price is now too far from the moving average line.

We recommend to familiarize yourself with:

Overview of the GBP/USD pair. 25 February. Boris Johnson urges Europe to abandon Russian gas and oil.

Forecast and trading signals for EUR/USD on February 25. Detailed analysis of the movement of the pair and trading transactions.

Forecast and trading signals for GBP/USD on February 25. Detailed analysis of the movement of the pair and trading transactions.

Explanations for illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should now trade.

Murrey levels are target levels for movements and corrections.

Volatility levels (red lines) - a likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română