Analyzing trades on Thursday

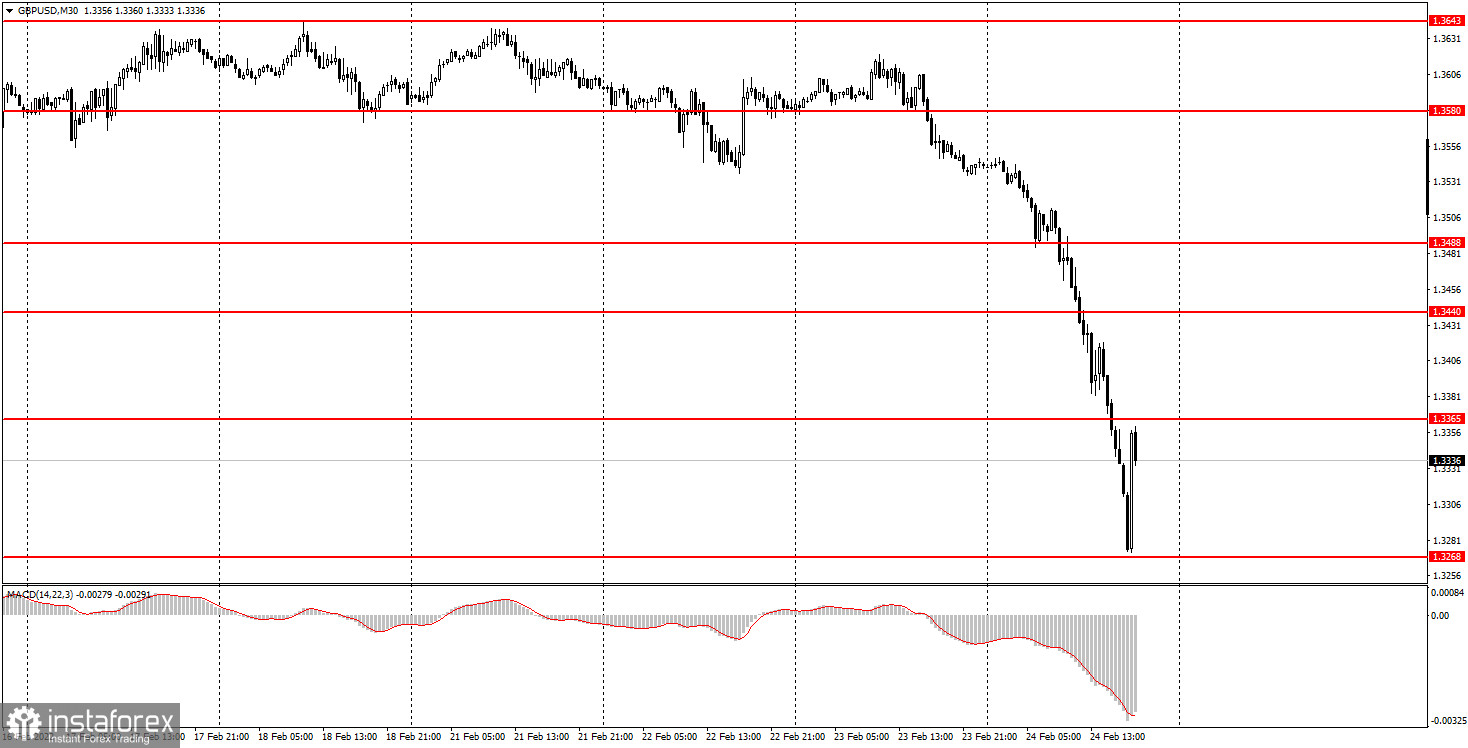

GBP/USD on 30M chart

On Thursday, GBP/USD plunged by almost 300 pips. The drop started on Wednesday afternoon but continued within the sideways channel. However, on Thursday, this was a full-scale collapse due to the war in Ukraine. As a result, the pound/dollar pair ended up at the level of 1.3268 and started its first correction of the day. Much has already been written about the military operation carried out by Russia in Ukraine. We just want to highlight the fact that today's collapse was provoked entirely by this event. Therefore, it cannot be considered a trend. Markets have got into a panic, so movements can be completely unpredictable. Today the pair tumbled by 300 pips and tomorrow it may recover by the same amount. We expect the pair to continue to fall at least after a short break. There was no macroeconomic background today. No one paid attention to Andrew Bailey's speech. And the report on US GDP for the fourth quarter in the second estimate was completely ignored by markets.

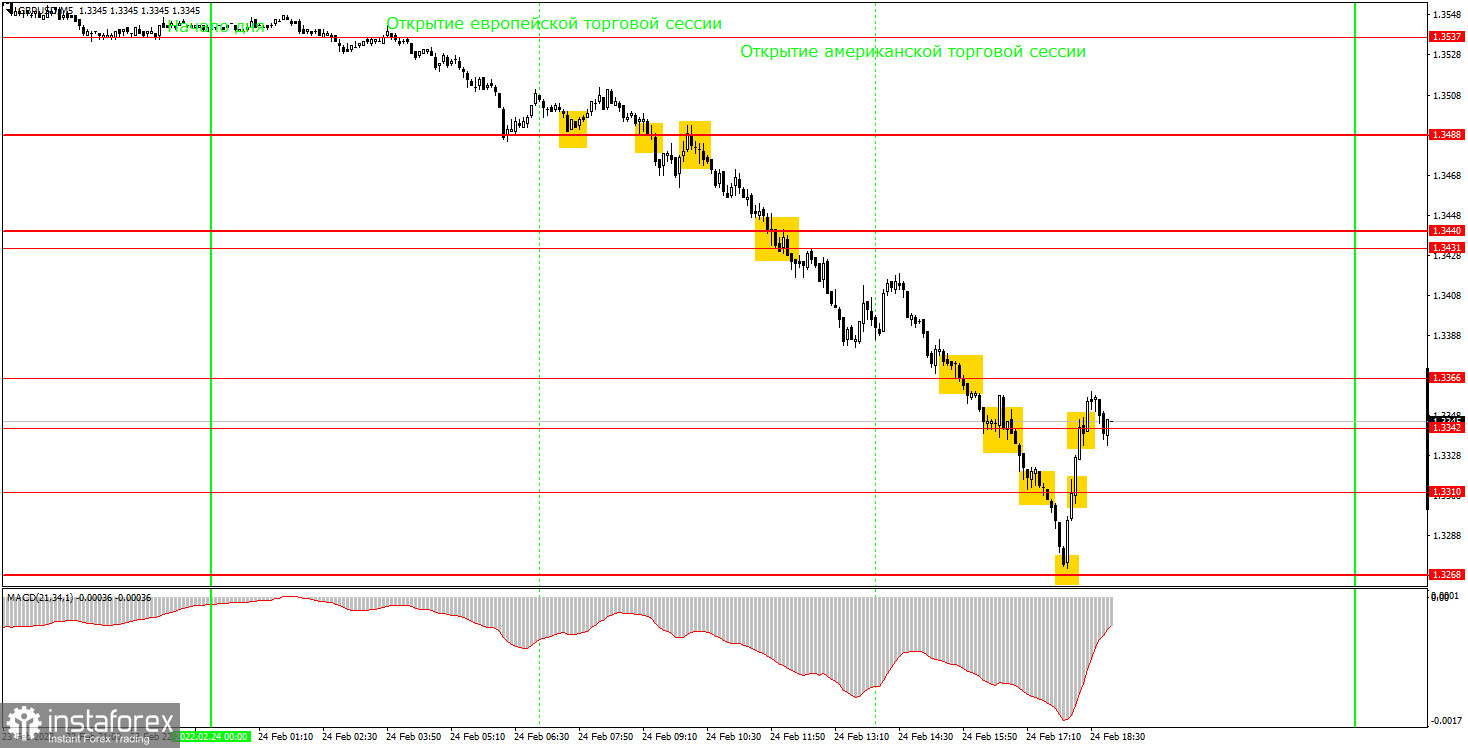

GBP/USD on 5M chart

On the 5-minute time frame, I had to zoom out the chart to fit the entire movement in the illustration because it was very strong. The pair started to fall at night, and the first trading signal to sell was formed when the pair broke through the level of 1.3488. As in the case with the euro, it was not recommended to stay bullish on the pair given the geopolitical events. Subsequently, the pair overcame the levels of 1.3440, 1.3431, 1.3366, 1.3342, and 1.3310 and stopped only near the level of 1.3268, from which the pair rebounded. Traders should not have rushed to follow this rebound immediately. However, when the price went above the level of 1.3310, short positions should definitely have been closed. No buy positions should have been opened even though after a rebound from the level of 1.3268, a strong upward movement started. It was possible to earn 150 pips on a short position.

Trading tips on Friday

On the 30-minute time frame, the pair left the sideways channel. Despite a rapid fall, there is no trend at the moment as well as no trendline or channel. The fall of the pound sterling can easily continue on Friday with the same intensity. At the same time, the pound may start to grow even more rapidly. Now it is extremely difficult to predict the movements of the pair as the market is shocked. How long this shock will continue largely depends on events in Ukraine. On the 5-minute chart on Friday, it is recommended to trade at the levels of 1.3172, 1.3241, 1.3268, 1.3310, 1.3342, 1.3366, 1.3431-1.3440, 1.3488, 1.3537, and 1.3580. When the price passes 20 pips in the right direction, you should set a Stop Loss to breakeven. There are no interesting events planned on Friday in the UK and a few minor reports will be published in the US. However, the market, which is in a panic now, is unlikely to pay any attention to macroeconomic statistics at all. The best thing to do now is to closely follow the geopolitical news and hope for an early easing of the Ukrainian-Russian military conflict.

Basic rules of the trading system

1) The strength of the signal is determined by the time it took the signal to form (a rebound or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on a false signal (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

5) You can trade using signals from the MACD indicator on the 30-minute time frame only amid strong volatility and a clear trend that should be confirmed by a trendline or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that can be found on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română