Today was a turbulent day indeed. However, bitcoin has somehow managed to stay above the support at 34,000. According to the network data, large bitcoin investors did not rush to withdraw their assets for selling despite an escalation of the Russia-Ukraine conflict. Reserves of bitcoin exchanges did not increase.

Investors are not selling off their coins. Why is the price falling then?

CryptoQuant think tank noted no significant increase in the bitcoin reserves. This measure indicates the total amount of bitcoins stored in the wallets of all cryptocurrency platforms.

A rise in crypto reserves rise usually means a rise in the net flow of coins to exchanges because investors transfer their crypto assets. Such a tendency has a bearish effect on cryptocurrencies as holders withdraw their assets to sell them.

On the other hand, a fall in reserves indicates that crypto exchanges experience a massive outflow. It can be a bullish sign because investors usually withdraw their coins to keep them safe and hold.

Still, today the price was falling. Probably, most crypto holders already have their coins on crypto exchanges, ready to sell them if the situation gets even worse.

Forget about stability, a plunge is possible any minute

The other side of the coin is that strong bearish moves are usually followed by an equally strong rebound. However, this effect is unlikely to appear soon.

There have been no massive flows yet. Therefore, those who store coins in their private wallets keep calm and don't rush to transfer their bitcoins to exchanges for selling them.

CryptoQuant does not rule out that the situation may change any minute. At the moment of writing, BTC holders remained restrained.

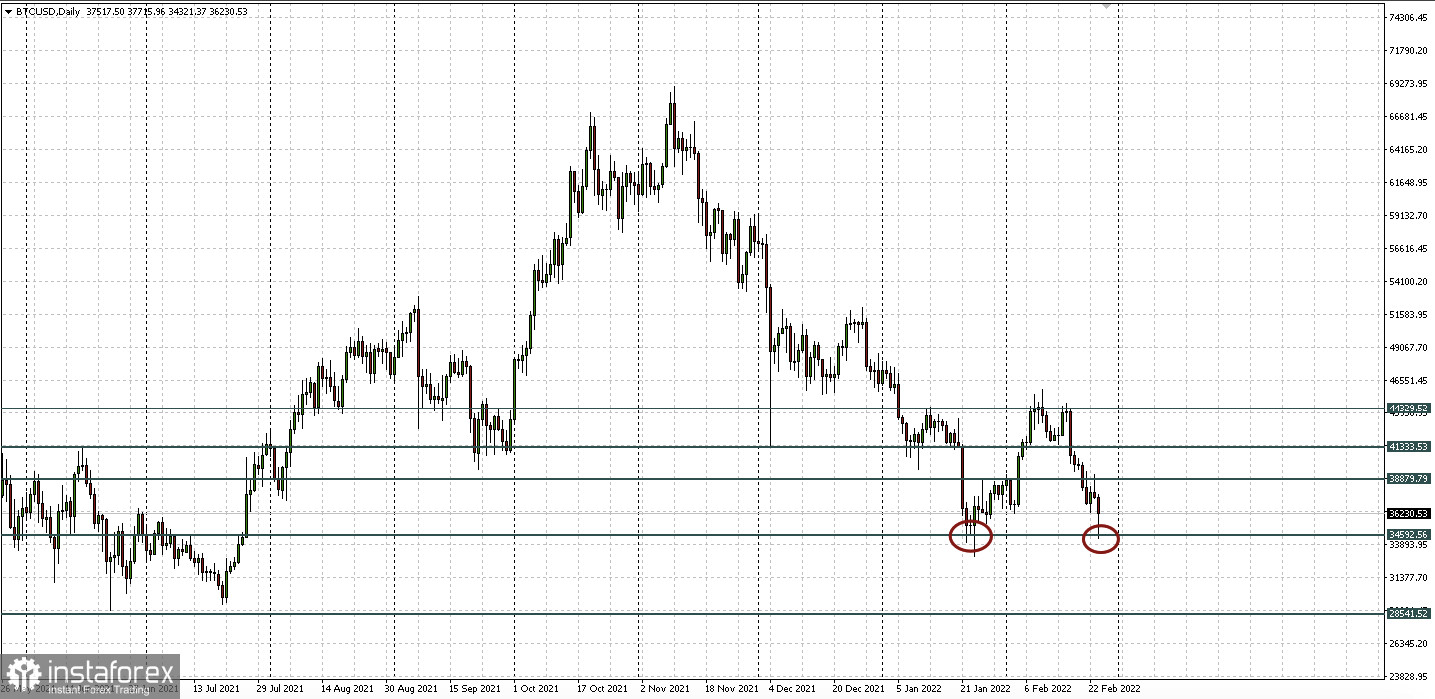

From a technical point of view, the fact of BTC holding above the support at 34,000 is just a matter of time. Anyway, the daily candlestick has not closed yet.

My technical view remains the same. I expect a plunge to strong support at 28,000. If this level is broken, a further plunge will be imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română