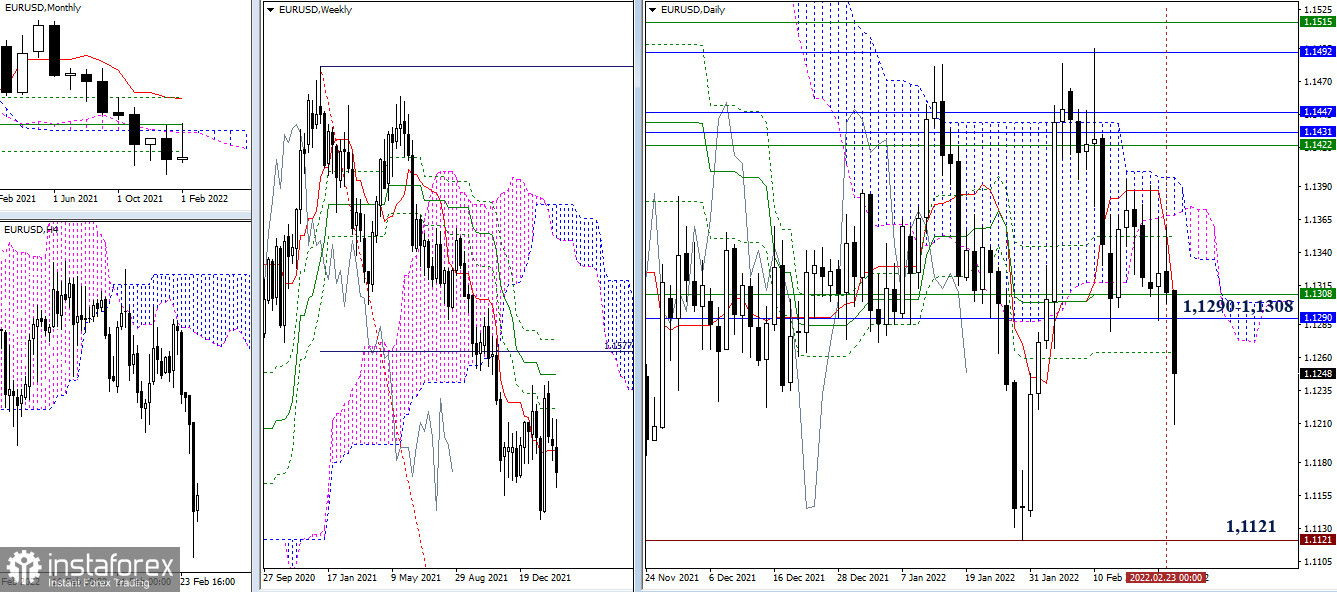

EUR/USD

Bears, who had been above the 1.1290-1.1308 supports for several days, took the offensive today. Overcoming the supports and securely fixing below will make the minimum extremum at 1.1121 the main bearish target and the restoration of the downward trend. Consolidation of levels 1.1290 – 1.1308 (weekly short-term trend + monthly Fibo Kijun) retains the role of the main frontier of bulls in this area.

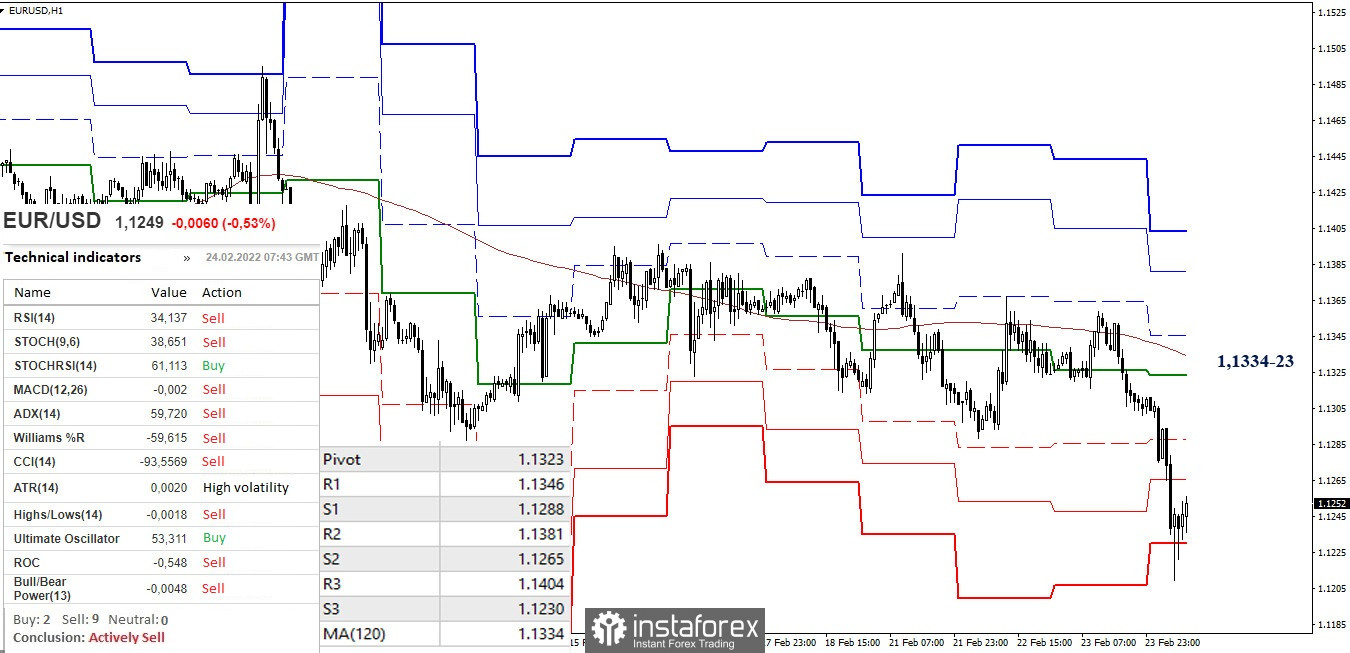

In the lower timeframe, the decline has already led to a test of the lower support of the classic pivot points (1.1230). All analyzed technical instruments support the bears, they have achieved large-scale results. Maintaining the results achieved is now important for shorts. In case of a correction, first of all, intraday resistance in the lower timeframe will be provided by 1.1265 (S2) and 1.1288 (S1). The key levels responsible for the balance of power today are 1.1334-23 (central pivot point + weekly long-term trend).

***

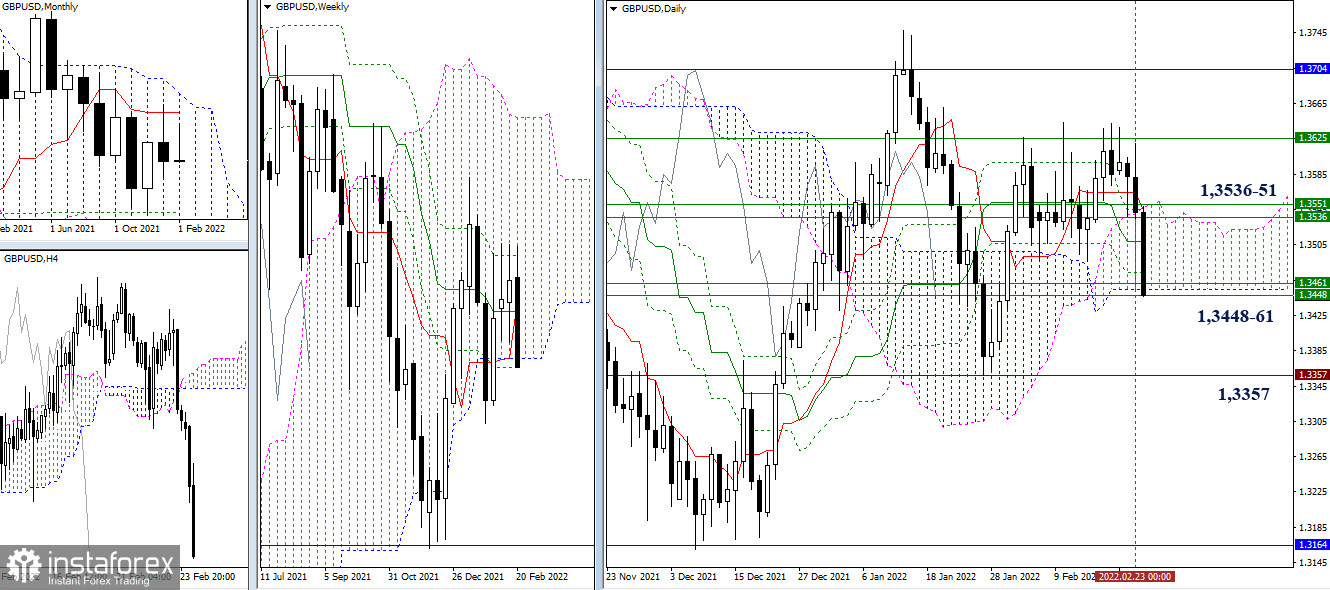

GBP/USD

Bears continue to decline and are now testing the accumulation of levels in the area of the accumulation of weekly levels 1.3446-61 at the lower boundary of the daily cloud (1.3454). Consolidation below will form a new downward target - the target for the breakdown of the daily cloud. After passing 1.3446-61, the next closest reference will be the support of the minimum extremum (1.3357).

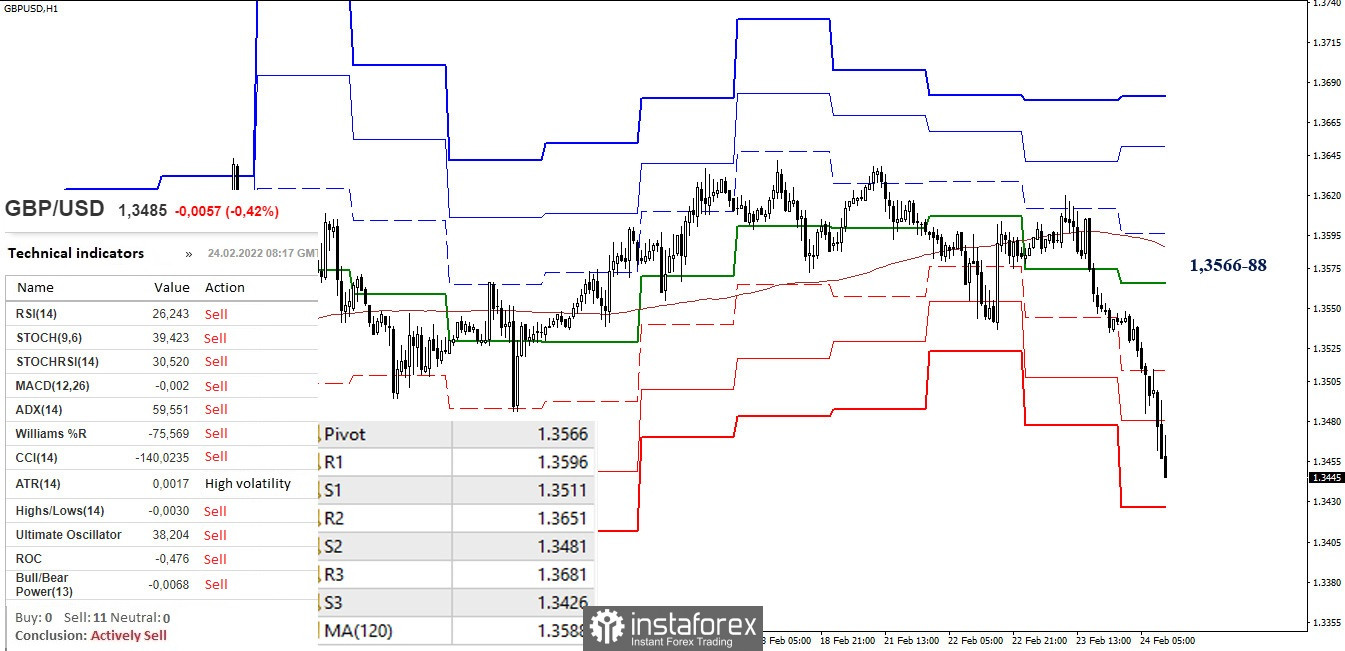

In the lower timeframe, the advantage is on the side of the bears. They continue to decline, forming new lows. The final support of the classic pivot point (1.3426) is approaching. The levels passed earlier, in case of an upward correction, will now act as resistances 1.3481 (S2) - 1.3511 (S1).

***

Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as Classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română