The start of Russia's special military operation for "denazification" and "demilitarization" in eastern Ukraine early Thursday led to the beginning of a collapse in world markets. Stock markets in the Asia-Pacific region fell more than 2.0% this morning. Futures for major European and U.S. stock indices are also noticeably declining.

The radical decision of the Russian Federation of the situation in eastern Ukraine led to a strong increase in prices for energy resources, in particular for oil. Oil grades WTI and Brent soared more than 5%. The dollar rose significantly against major currencies, with the exception of the yen. The price of gold jumped above the level of 1940.00 dollars per troy ounce. The ICE dollar index jumped to 96.56, but its growth is not so significant yet. U.S. government bond yields fell sharply amid purchases of these assets as protective ones, as did the dollar, yen, and gold. So the yield of the benchmark 10-year Treasury collapsed by more than 5%.

It is clear that the operation that has begun in the east of Ukraine will definitely have a strong negative impact on world markets. And now it is important to understand how long the fall should be expected and when it will stop.

We believe that the consolidated West will limit itself to verbal reports regarding the actions of the Russian Federation in Ukraine and economic sanctions, which means there will be no military clash. In this case, after the end of the military operation, stabilization in the markets should be expected, and with the start of the negotiation process between the Russian Federation and the United States, this will happen, apparently, quite soon.

It is likely that after the first shock on the markets, the situation may stabilize. The understanding that the conflict will not spread beyond the territory of Ukraine should reassure investors in Europe, North America, and the Asia-Pacific region. The shift of this problem into the background will again bring the subject of the upcoming Fed interest rate hike into the field of view. This is where interesting changes can happen. If earlier it was assumed that the Fed could immediately raise rates by 0.50% on March 16, then yesterday there was a clear correction of views. Now it is expected that rates will rise by 0.25%, but at each meeting of the regulator.

If this is indeed the case, then after the decrease in panic disorder in the markets, it will be possible to observe a recovery in demand for risky assets.

Forecast:

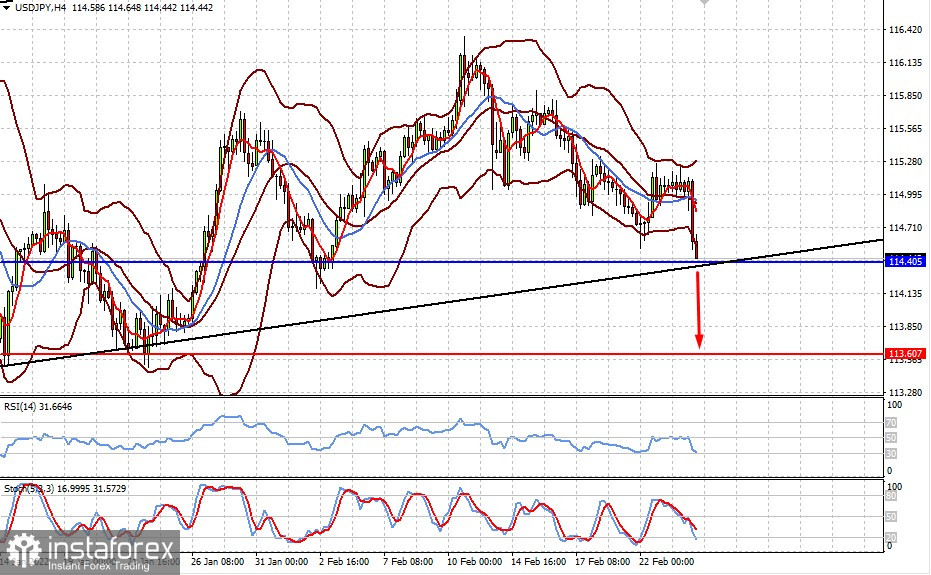

The USDJPY pair is trading above the level of 114.40. A break of this mark will lead to the continuation of the fall of the pair to 113.60.

Quotes of WTI crude oil soared above 95.00 on the wave of the escalation of the crisis in Ukraine. We believe that the price of this grade of oil will rise to the level of 100.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română