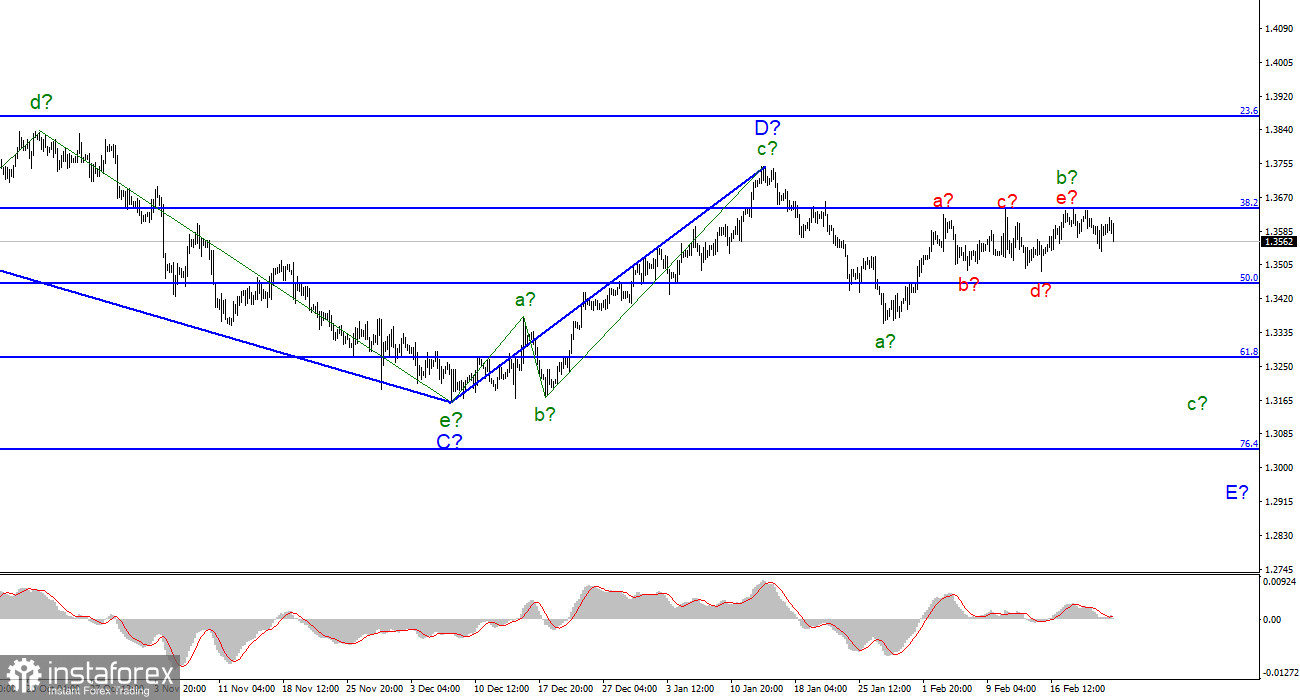

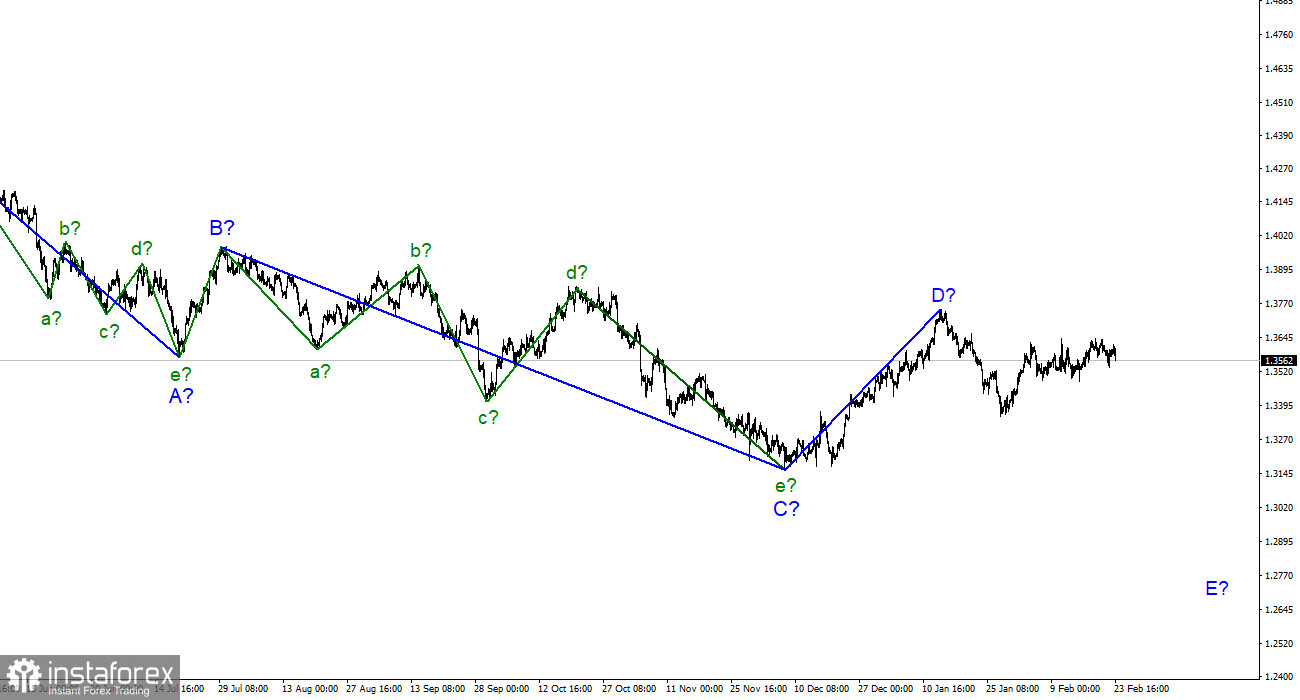

For the pound/dollar pair, the wave layout continues to look very convincing. However, in the short term, it may become more complicated. An increase in the quotes in recent days has changed the expected wave b. It turned out to be longer than wave a. As there are already five internal waves inside wave b, this wave should be completed now. A decline of the pair from highs over the past two days could indicate the beginning of the construction of a new downward wave. A three-wave structure is clearly visible inside wave D. So, it is unlikely to be the first impulse wave of a new upward trend segment. The entire downward section of the trend, which originated on June 1, 2021, may be either three-wave or five-wave. I believe that it will turn out to be a five-wave. Hence, another wave E will be added to the layout. The pair made several unsuccessful attempts to break through the 1.3644 mark, which corresponded to the Fibonacci retracement level of 38.2%. It means that speculators are not ready to open long positions on the instrument.

GBP falls following BoE policymakers' statements

The pound/dollar pair decreased by 30 pips on February 23. It was quite a modest decline. Market activity remains low. Almost every day, the instrument slightly rises and then drops. Today, the pair slid by 70 pips from the intraday high. Before that, it was climbing. The Bank of England presented the report on the monetary policy in Parliament this morning. Several members of the regulator delivered their speeches, including Andrew Bailey. Most of them talked only about inflation and the need to stop its acceleration. Deputy Governor for Markets and Banking David Ramsden made clear statements. However, they disappointed market participants. Ramsden was one of four committee members who voted to raise the key rate by 50 basis points at once at the last meeting. However, he unexpectedly announced that a modest tightening would be enough for the Bank of England to stop inflation. Ramsden said that inflation would fall to 2% over the next two years. Analysts believe that by the middle of 2023, the interest rate will rise to 2%. "The word 'modest' is significant here though - I do not envisage Bank Rate rising to anything like its pre-2007 level of 5% or above, let alone to the kind of levels we used to see before the MPC was formed in 1997," Ramsden noted. Thus, the Bank of England is likely to conduct a gradual tightening of monetary policy. Unlike the Fed, the Bank of England will raise the key rate at a slower pace. By the summer of 2022, the Fed's interest rate may be higher. If so, the US dollar I sure to take advantage of it. The pound sterling decreased following such statements.

Conclusion

The wave layout of the pound/dollar pair signals the construction of wave E. The construction of the proposed wave b is completed, or this wave is not b. The instrument made two unsuccessful attempts to break through the 1.3645 mark, and wave b took a five-wave form. The decline in the quotes is projected to continue in the coming days. I assume that the construction of a wave c in E has begun. Therefore, it is recommended to open short positions with the target level located at 1.3272, which corresponds to the Fibonacci retracement level of 61.8%. It is better to close short positions if the price breaks through the 1.3645 mark. Otherwise, new adjustments should be made to the wave layout.

On the larger timer frame, wave D also looks complete. However, the entire downward trend section is still unfolding. Therefore, in the coming weeks, the pair is likely to resume a downward movement to the target level below the low of wave C. Wave D turned out to be a three-wave one, so it is unlikely to be wave 1 of a new uptrend section.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română