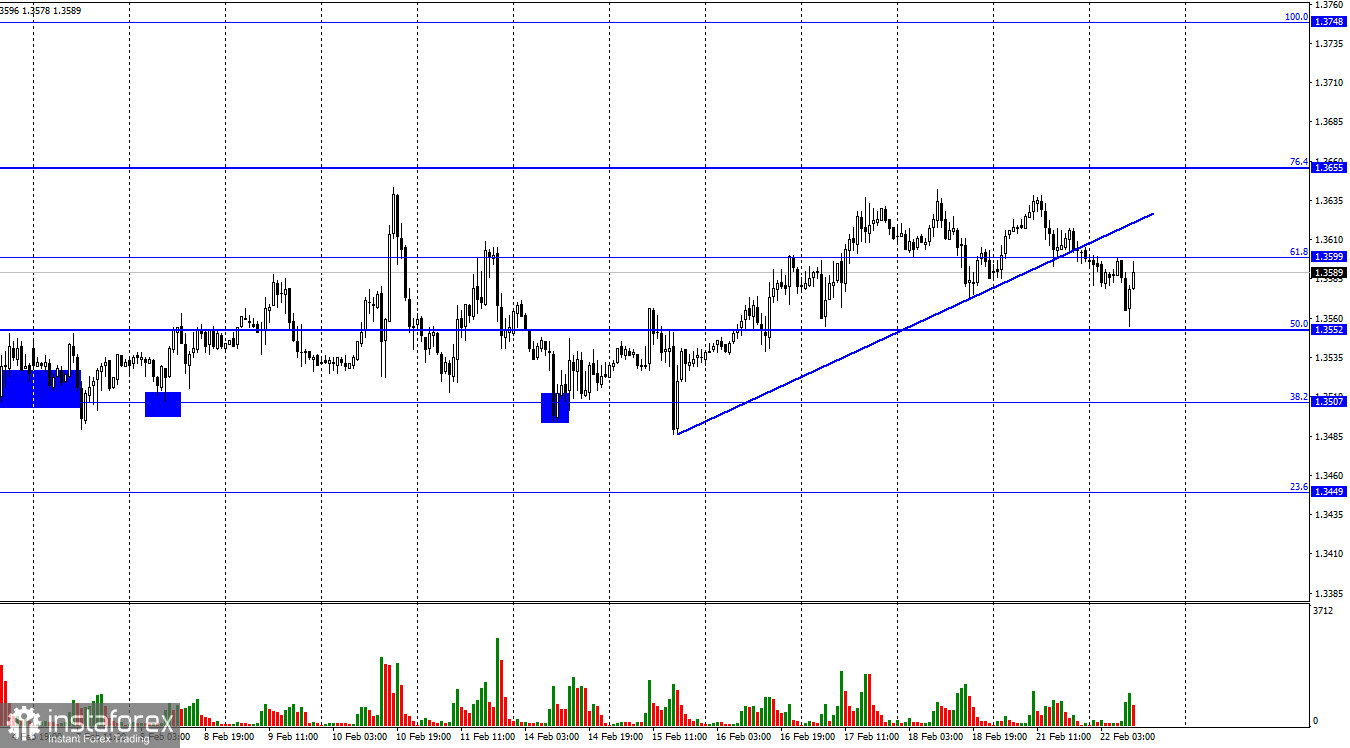

On Monday, the GBP/USD pair made a downside reversal on the 1-hour chart and consolidated below the ascending trendline. This means that quotes may continue to fall towards the next Fibonacci level of 50.0% at 1.3552. If the price closes below this level, then its next target will be the Fibonacci retracement level of 38.2% at 1.3507. I do not think that the information background has had any effect on traders recently. The market sentiment is clearly seen on the 4-hour chart. Since the pair is currently stuck in the sideways channel between 1.3457 and 1.3642, its trajectory almost resembles the one of the euro/dollar pair. This fact makes me doubt that the geopolitical factor or other events have anyhow influenced the market. Moreover, the economic data seems to be of no priority at the moment. Last week, there were several reports published both in the US and the UK but none of them had any effect on traders.

In the meantime, the geopolitical crisis remains high on the agenda. However, the foreign exchange market seems to be downplaying this factor, unlike the crypto and stock markets that have recently plunged. The same is true about the Russian ruble. It might be that market participants refrain from active trading at the moment as they cannot predict how the Ukrainian-Russian conflict may end. The outcome of the conflict may be either another 8-year pause or a full-scale war. Tomorrow, traders will switch their attention from geopolitical news to the economy. In the morning, Governor of the Bank of England Andrew Bailey will give a speech. Markets are now closely monitoring every step the UK regulator takes as it has already raised the interest rate twice and is going to raise it to 0.75% at the next meeting. Bailey will therefore be expected to comment on this. If the governor confirms his intentions to tighten monetary policy, then the British pound may move higher.

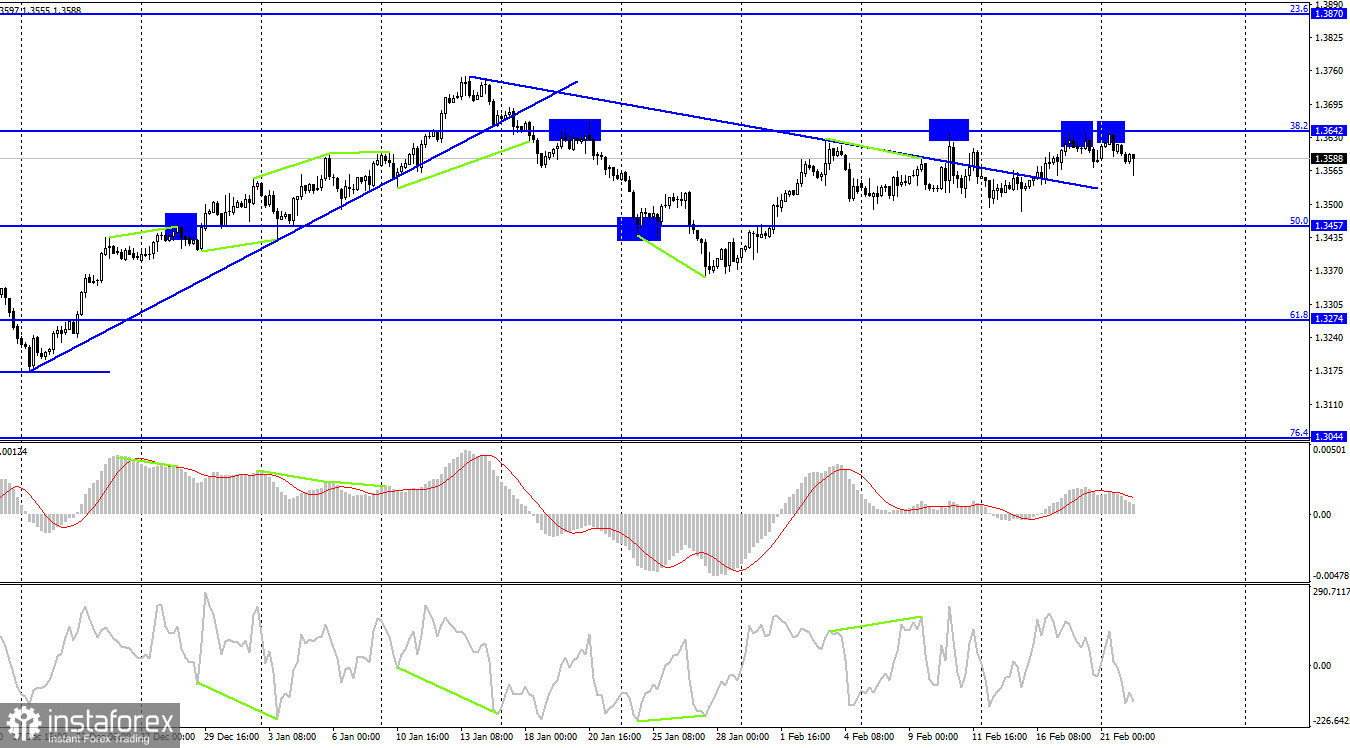

On the 4-hour chart, the pair returned to the 38.2% Fibonacci retracement level at 1.3642 and then rebounded from it. As a result of this reversal, the US dollar strengthened, and the pair started to fall towards the retracement level of 50.0% at 1.3457. Consolidation above 1.3642 will support the pound and will enable it to resume growth towards the next Fibonacci level of 23.6% - 1.3870. There are no emerging divergences observed in any of the indicators today.

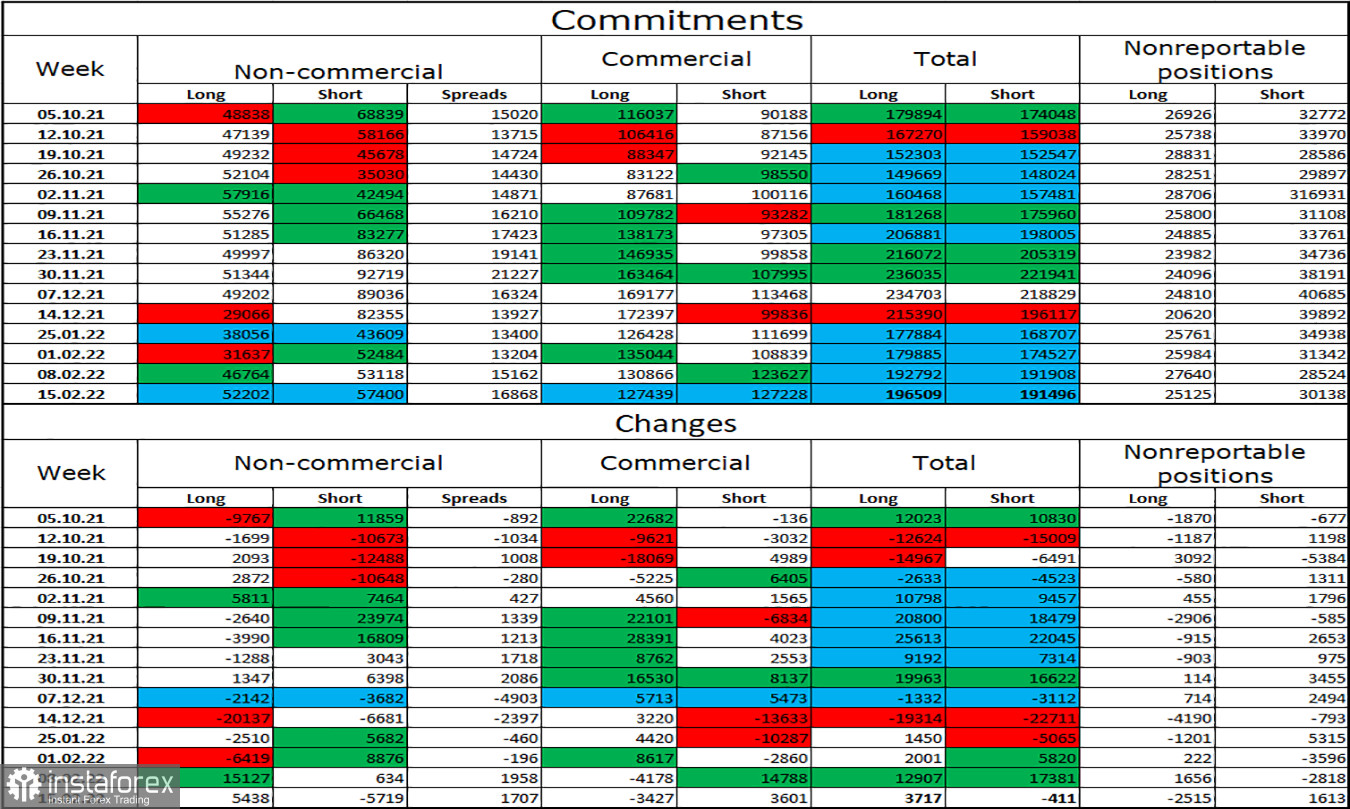

Commitments of Traders (COT) report:

The sentiment of the non-commercial category of traders has changed dramatically over the last reporting week. In the past two weeks, traders were adding more long positions, the number of which increased by 20,000. Last reporting week, they were also getting rid of short contracts. All this serves as evidence of increasing bullish sentiment among major players. At the same time, the overall market sentiment remains bearish as the total number of long contracts does not exceed the total number of short ones. However, the pound has shown modest gains in recent weeks which comes in line with COT reports.

Economic calendar for US and UK:

US - Manufacturing PMI (14-45 UTC).

US - Services PMI (14-45 UTC).

On Tuesday, the economic calendar for the UK is completely empty.The overall information background will be weak as the US will publish a number of reports that are unlikely to impress traders. Besides, Forex shows little reaction to geopolitics, so I do not expect any strong movements today.

Outlook for GBP/USD and trading tips

I would recommend selling the pound as there was a rebound from the level of 1.3642 on the 4-hour chart. In addition, the pair consolidated below the trendline on the H1 chart with the targets at 1.3599 and 1.3552. Buying GBP will become possible in case the quote closes above 1.3642 with the target at 1.3731.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română