The reaction of the markets to Russia's recognition of the Donetsk and Luhansk regions in eastern Ukraine as independent was surprisingly restrained. May oil futures rose to $ 95 per barrel, which is even lower than the levels of mid-February, demand for gold and the yen slightly increased, the euro within the side range, several commodity currencies even increased, that is, in general, investors do not see a large increase in risks yet.

The Russian stock market got the most, but this is not surprising. However, European trading platforms opened with a barely noticeable decline on Tuesday morning. US sanctions were announced against recognized areas, banning American companies from trading, as if investments had been received there before. It seems that agreement on yesterday's events was reached much earlier.

The economy has temporarily receded into the background, but little has changed for Australia and New Zealand - the main trends have remained the same, we expect gradual growth of both kiwi and Aussie.

NZDUSD

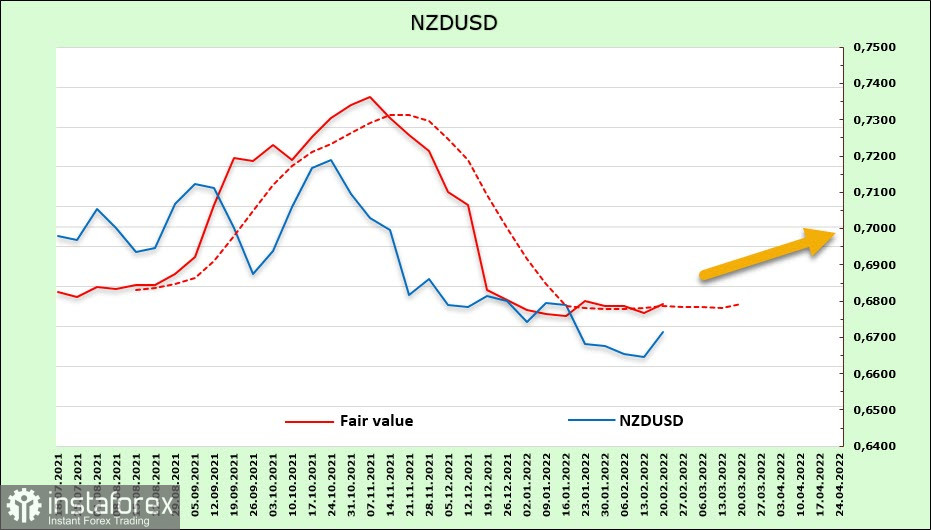

Market expectations for the RBNZ rate have not changed - it is expected that tomorrow the RBNZ will raise the rate by 0.25%, to 1%, and if the probability of an increase in the rate by 0.5% at once is not excluded, then most likely the RBNZ will not do this but will resort to less aggressive ways of influencing market expectations.

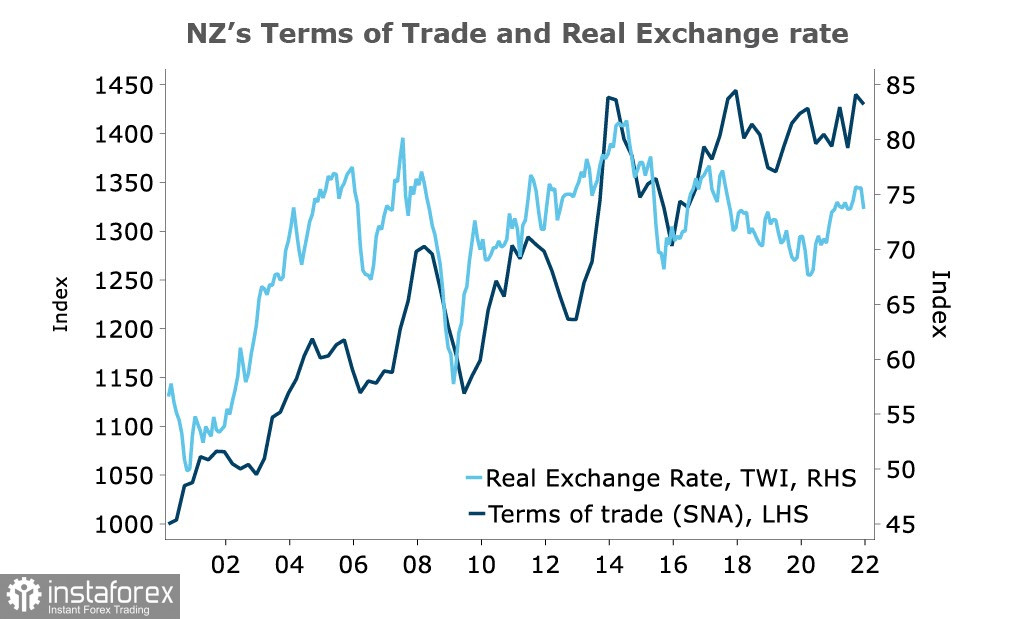

Inflation expectations for the next 5 months have risen from 2.17% to 2.30%, the unemployment rate is stable, the yield of 10-year bonds has rolled back from the maximum on February 16 (+2.88%), which indicates the market consensus on the rate. An increase of 0.25% will not be perceived as hawkish, the kiwi is likely to remain near the current range with little chance of growth. New Zealand's trade balance deteriorated from a surplus of 3.8 billion in Q4 2019 to a deficit of 4.25 billion in Q3. 2021, however, the terms of trade, which correlate with the exchange rate, suggest that on this side, the kiwi has growth potential.

After being disappointed by the change in the RBNZ position, investors got rid of a significant part of long contracts on NZD, in the futures market, according to the CFTC, the bearish position remains (-620 million), the weekly change of +70 million is insignificant. At the same time, the estimated price has stopped falling, there is reason to assume that the bearish potential has been exhausted or is close to exhaustion.

There is a small chance that the positive will increase, NZDUSD will try to get to the middle of the channel, 0.6820/30, this is the nearest resistance, then 0.6886, there are no grounds for a more pronounced growth yet. A resumption of the decline is less likely.

AUDUSD

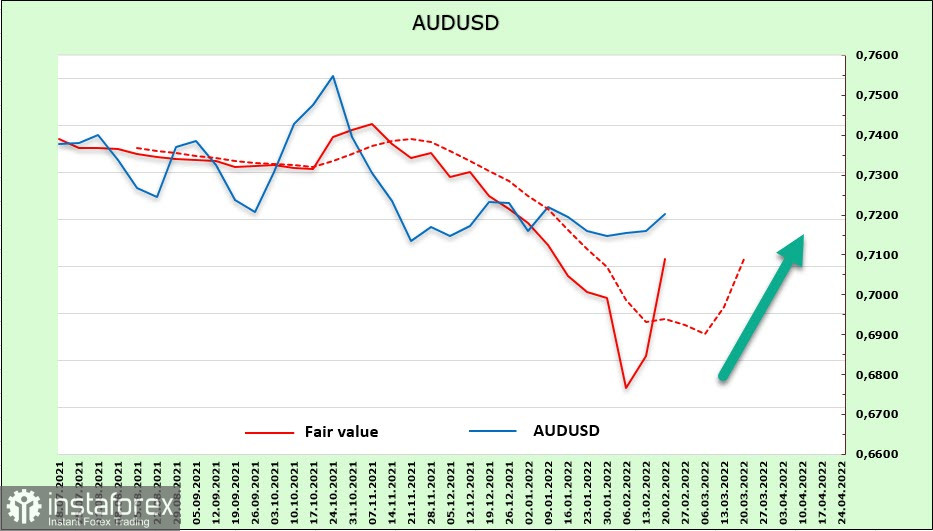

Rising commodity prices and a gradual exit from COVID restrictions give the Australian economy an additional boost, which, in turn, pushes the RBA to take steps to normalize monetary policy "sooner rather than later." The PMI in the service sector, instead of the expected decline from 46.6p to 42.6p, suddenly rose to 56.4p, the industrial PMI also rose above forecasts (57.6p versus 56.1p), which allows us to count on both further growth in the GDP and improvements in the labor market. Which in turn will put additional pressure on inflation expectations.

The settlement price turned up, although, as follows from the CFTC report, investors are in no hurry to raise rates on the growth of AUD. The net short position increased by 73 million to -6.2 billion over the week, the accumulated bearish advantage is second only to the yen. At the same time, the reversal of the estimated price gives reason to assume that the AUD may start to grow at any time.

AUDUSD is still inside the bearish channel, a double bottom has formed on the daily chart, with a simultaneous reversal of the estimated price, it can be assumed that a test of the upper limit of the channel is being prepared approximately in the 0.7300/20 zone. In case of a successful breakdown, the next resistance is 0.7440/60. The probability of a turn to the south is low.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română