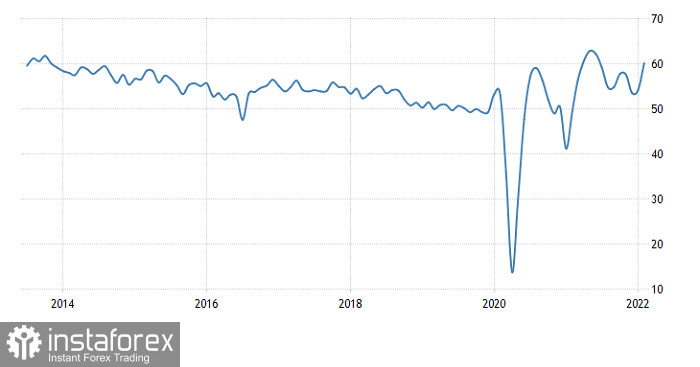

Although yesterday, there was a weekend in the US, the market activity was very high. Usually, the market gets stuck when the US celebrates national holidays. Early on Monday, the pound sterling was confidently gaining in value amid very strong PMI data. Only the manufacturing PMI figures may slightly disappoint traders. The indicator should have risen to 57.6 points from 57.3 points. Instead of this, it remained unchanged. Meanwhile, the services PMI surged to 60.8 points from 54.1 points, whereas economists had expected a smaller increase to 55.5 points. As a result, the composite PMI jumped to 60.2 points from 54.2 points instead of climbing to 55.3 points.

UK Composite PMI

However, in the second part of the day, the market situation changed dramatically. The US dollar began rapidly gaining in value amid the recognition of the independence of Luhansk and the Donetsk People's Republic. The fact is that the US immediately announced a new package of sanctions against Russia that should have been implemented on Tuesday. Against this background, the wave of panic swept over the market. Investors cannot predict future market changes and try to minimize risks.

The situation in the European continent may go out of control at any moment. That is why European assets immediately became highly risky. Since no one can imagine how the situation may change, investors decided to avoid risky assets. The background will hardly alter until the US announces new sanctions. Judging by the situation with Crimea, it will be Western Europe that will suffer more than others.

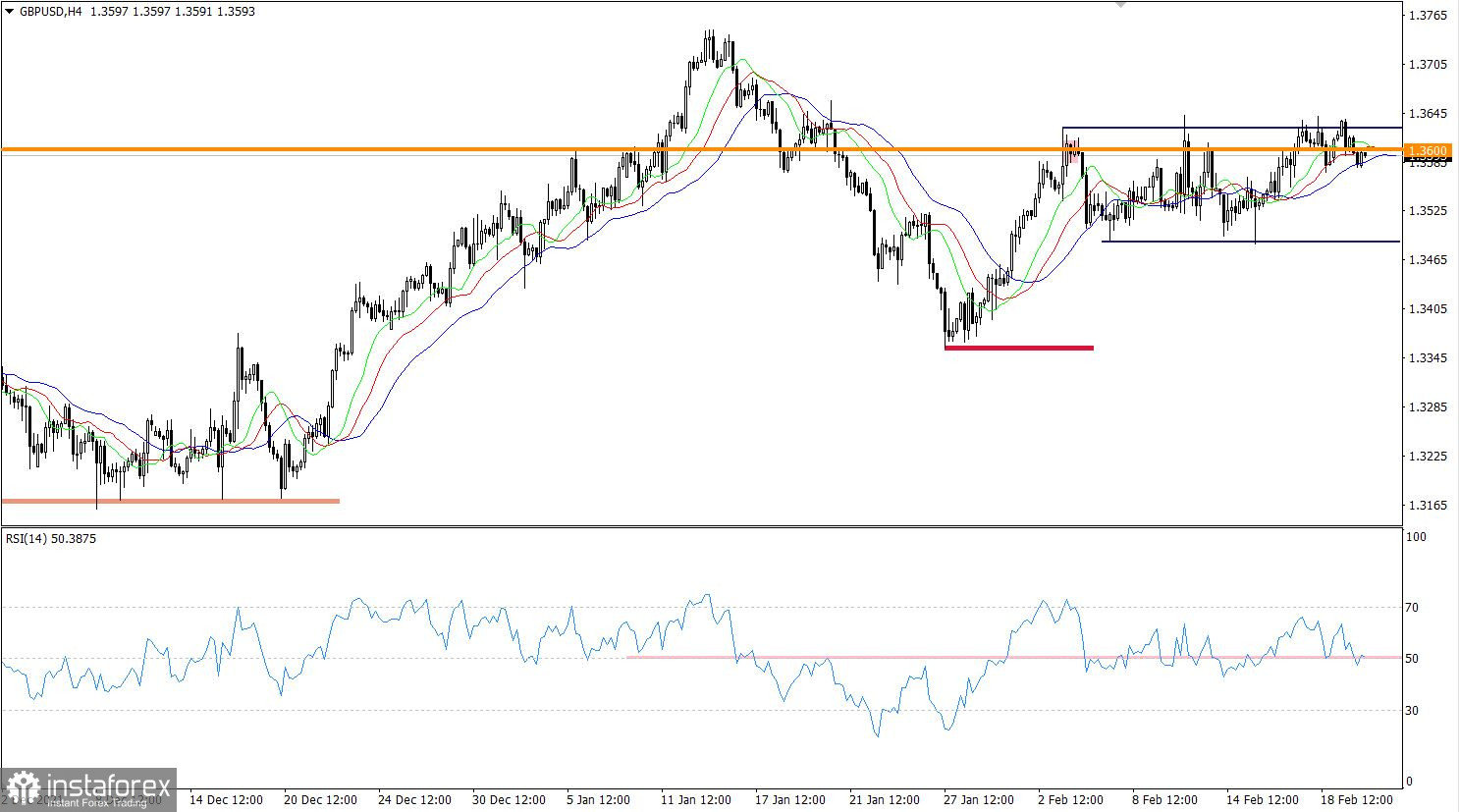

The pound/dollar pair has been hovering near the upper limit of the sideways channel for several days in a row. The pair has been trading between the levels of 1.3580 and 1.3630. This points to uncertainty among market participants, which may lead to the accumulation process.

On the four-hour chart, the RSI technical indicator is moving along line 50, thus proving uncertainty. If the indicator fixes below line 50, the market sentiment will change to the bearish one. In this case, the number of short positions may increase.

In the same period, the Alligator's moving averages intersect each other, pointing to stagnation.

Outlook

Against the backdrop, traders should pay attention to the range of 1.3580/1.3630. The fact is that speculators are also focused on the channel. The price fixation beyond either limit on the four-hour chart may result in the outgoing impulse. As a result, the pair may break the range and climb to the highest level recorded in January. The pair may also drop towards the range of 1.3600/1.3500.

In terms of the complex indicator analysis, we see that technical indicators are signaling sell opportunities on the short-term and intraday periods amid the price fixation below 1.3600.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română