The GBP/USD currency pair on Monday continued to trade in the same mode as in the last few weeks. The pound sterling also rose at night trading and began to fall in the afternoon, although no macroeconomic information was also received from the UK. Thus, although the volatility of the pair was not high on Monday, such "swings" that have been observed on the pound for several weeks are a sign of panic in the foreign exchange market. The pound may be panicking because London is one of the most "loud" opponents of Russia in the negotiations on Ukraine. Boris Johnson has repeatedly voiced his proposals concerning Europe's rejection of the Nord Stream-2, the "exposure" and "disclosure" of all the possessions of Russian oligarchs in the UK, as well as the introduction of "tough" sanctions if Moscow continues to destabilize the situation in the Donbas and invades Ukraine. For example, the German Chancellor or the French president is much milder in their threats and expressions.

However, Boris Johnson does not climb into his pocket for a word. However, he never did. Thus, this explains the excessive restlessness of the British pound. It doesn't even make sense to consider any macroeconomic factors now. In the last two months, the pound has been strengthening, but in the last few weeks, this strengthening has turned into a flat. The market does not want to take risks and is waiting for clarification of the situation. In principle, now we can say that the Ukrainian-Russian conflict is moving smoothly in the direction of an "explosion". Over the past few weeks, the situation in the Donbas has deteriorated markedly, the evacuation of civilians has begun, shelling is carried out every day from both sides of the borders of the LPR and the DPR. Thus, the situation is only getting worse, and there are no signs of its settlement. This means that there may be unrest in the market. And when traders panic, the pair can move in any direction without any logic.

Boris Johnson continues to speak every day.

We have already noted earlier that everything that is happening in Ukraine and around Ukraine is even good for British Prime Minister Johnson to some extent. It is absolutely clear that if a war breaks out in Europe, even in the most remote region of Britain, it is unlikely to have a favorable impact on the British economy. Therefore, it can hardly be said that Boris Johnson is deliberately adding fuel to the fire, declaring almost every day that Russian troops are ready to invade Ukraine. However, at the same time, it should be noted that against the background of the Ukrainian-Russian conflict, attention is diverted from the figure of Johnson himself, especially in the British Parliament and in British journalism. And this is very good for Johnson, who in recent months has been under a barrage of criticism and calls to resign voluntarily amid the "coronavirus parties" scandal. Now we can talk about Ukraine and Russia every day and call on everyone to settle the conflict peacefully. And at the same time threaten Moscow with sanctions.

Johnson's latest statement said that London was ready to impose much more serious sanctions against Russia in the event of its invasion of Ukraine than initially expected. Johnson is already talking about banning Russian companies from trading in pounds and dollars, which "will deal a very serious blow to Russia." According to Johnson, "Putin should not be allowed to get away with everything." "Intelligence reports continue to indicate that Russia is planning the largest war in Europe since 1945," Johnson said. In general, the geopolitical situation continues to be extremely tense. So far, there are no signs that the situation is improving. On the contrary, battles between militants of unrecognized territories and the Armed Forces of Ukraine continue to be fought in the Donbas. True, no one goes into open combat, just as no one crosses the border of the LPR and the DPR.

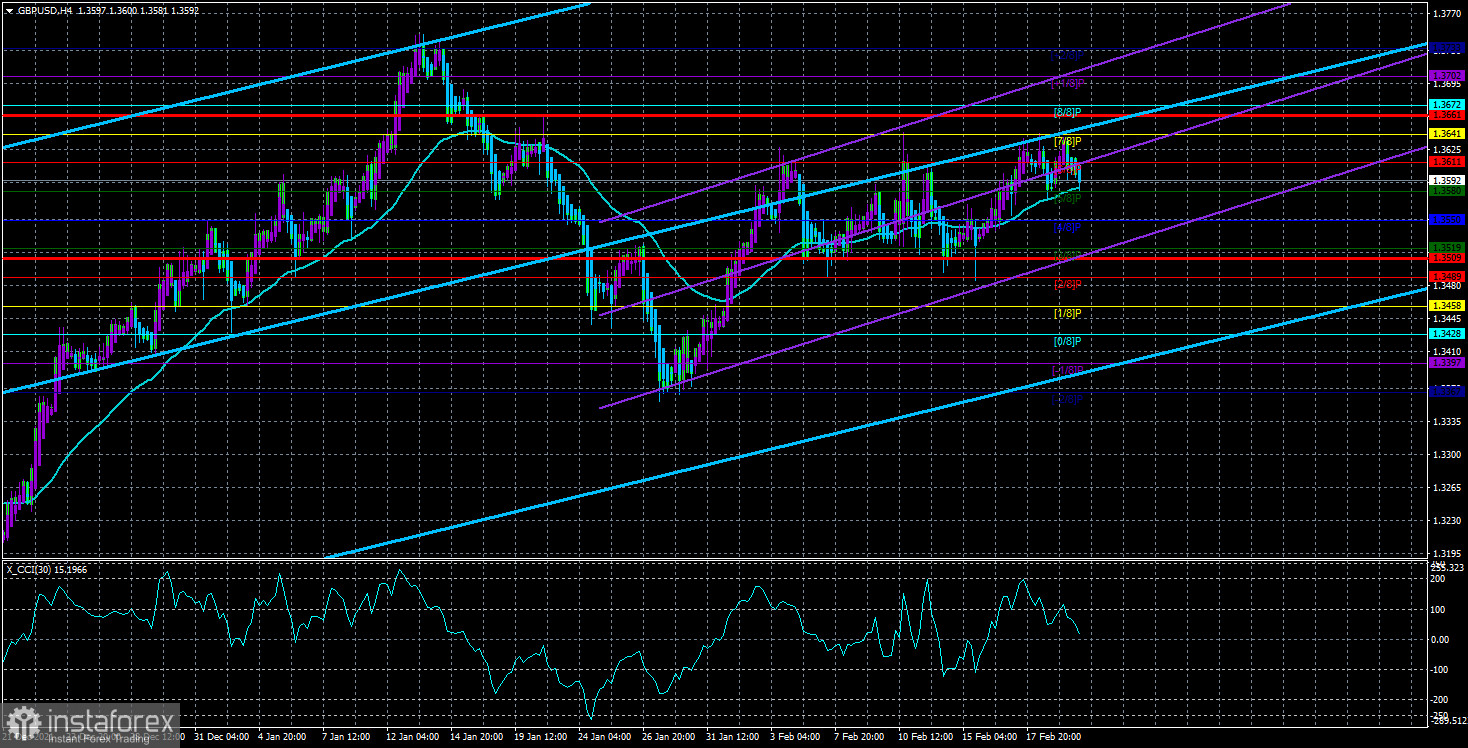

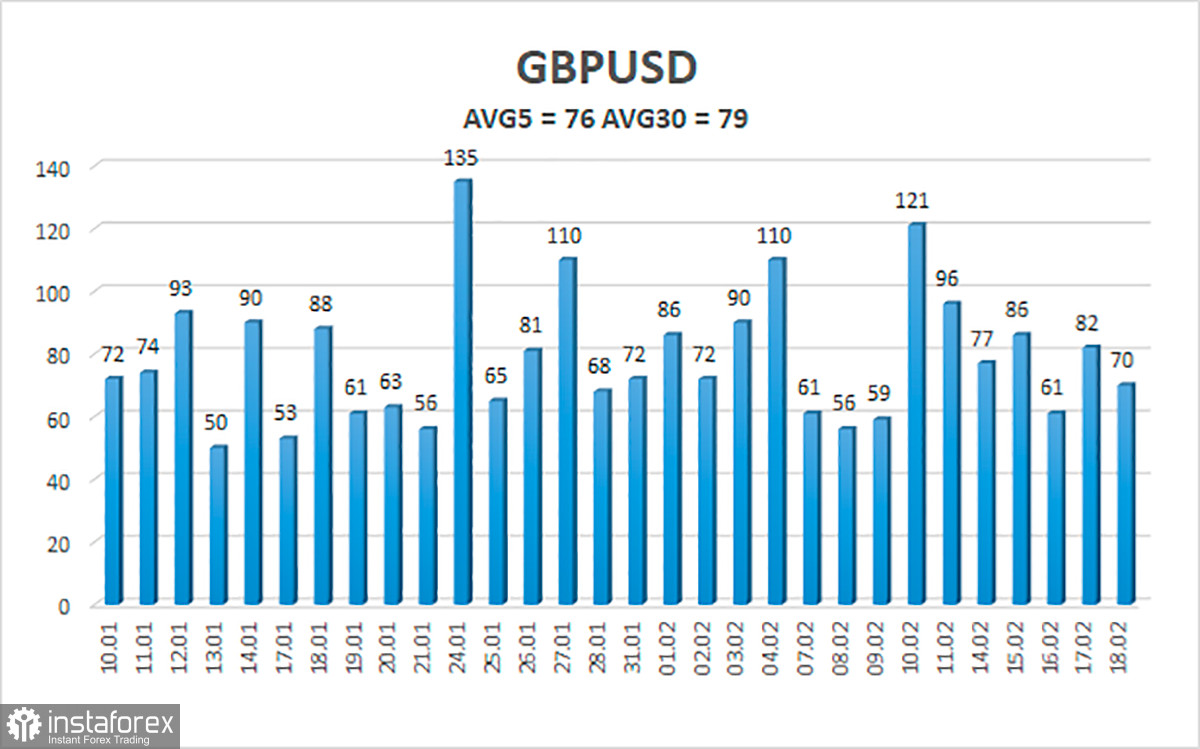

The average volatility of the GBP/USD pair is currently 76 points per day. For the pound/dollar pair, this value is "average". On Monday, February 21, thus, we expect movement inside the channel, limited by the levels of 1.3509 and 1.3661. The reversal of the Heiken Ashi indicator downwards signals a new round of upward movement within the framework of the "swing".

Nearest support levels:

S1 – 1.3580

S2 – 1.3550

S3 – 1.3519

Nearest resistance levels:

R1 – 1.3611

R2 – 1.3641

R3 – 1.3672

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to trade near the moving in the "swing" mode. Thus, at this time, it is possible to consider long positions with targets of 1.3641 and 1.3661 in case of a rebound from the moving, but one should take into account the high probability of a flat and a hike to 1.3489. It is recommended to consider short positions if the pair is fixed back below the moving average, with targets of 1.3519 and 1.3489.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română