Bitcoin's plunge below the support of 38,429.77 has dented the optimism of market participants. In a recent interview with CNBC, Huobi co-founder Du Jun voiced a gloomy forecast saying that the biggest cryptocurrency is unlikely to demonstrate any bullish run until 2025. The expert also warned about a possibility of a "crypto winter".

Du Jun expects a new bullish run to start no sooner than in 2024 after the BTC halving will lead to a two-fold decrease in mining rewards.

The history repeats

Let us recall that Bitcoin reached its first-ever peak of 20,000 USD in December 2017. Consequently, the rates plunged to 3,000 USD.

A new upward move started in late 2020, just a few months after a mining reward was cut to 6.25 BTC from 12.5 BTC.

Huobi co-founder, however, admits it would be hard to predict future price performance based on certain unexpected events that can influence the market conditions as described in The Black Swan by Nassim Taleb. Still, Du Jun believes Bitcoin is entering the bearish cycle.

Holders don't rush to sell

Despite the bearish talks, long-term investors in bitcoin weren't unnerved by the last week's decline according to IntoTheBlock, an analytical agency. The volatility spikes were caused by a fuss created by short-term speculators.

The analytical agency noted a peculiar correlation: the balance of short-term traders who held BTC for under a month was moving in parallel with prices.

These traders sold 8.7% of their assets in the recent week, which amounted to a hefty sum of 1.55 million BTC. To compare, the data by CoinMarketCap shows a fall in BTC price of 11.59% over the past seven days.

What lies behind holders' calmness

According to IntoTheBlock, most BTC holders are long-term investors. More than half, 57% of them hold the coins for nearly a year. Only 7% are owners for less than a month while 36% of investors hold their assets for over a year.

So why holders don't hurry to sell now? Three Arrow Capital CEO Su Zhu compared the current behavior of BTC investors with its latest cycle in 2018.

Su Zhu thinks investors fear repeating past mistakes, i.e. they don't want to get rid of the crypto too early. Some investors regretted selling their coins between 2018 and 2019 when BTC was traded at the bottom.

Last hope

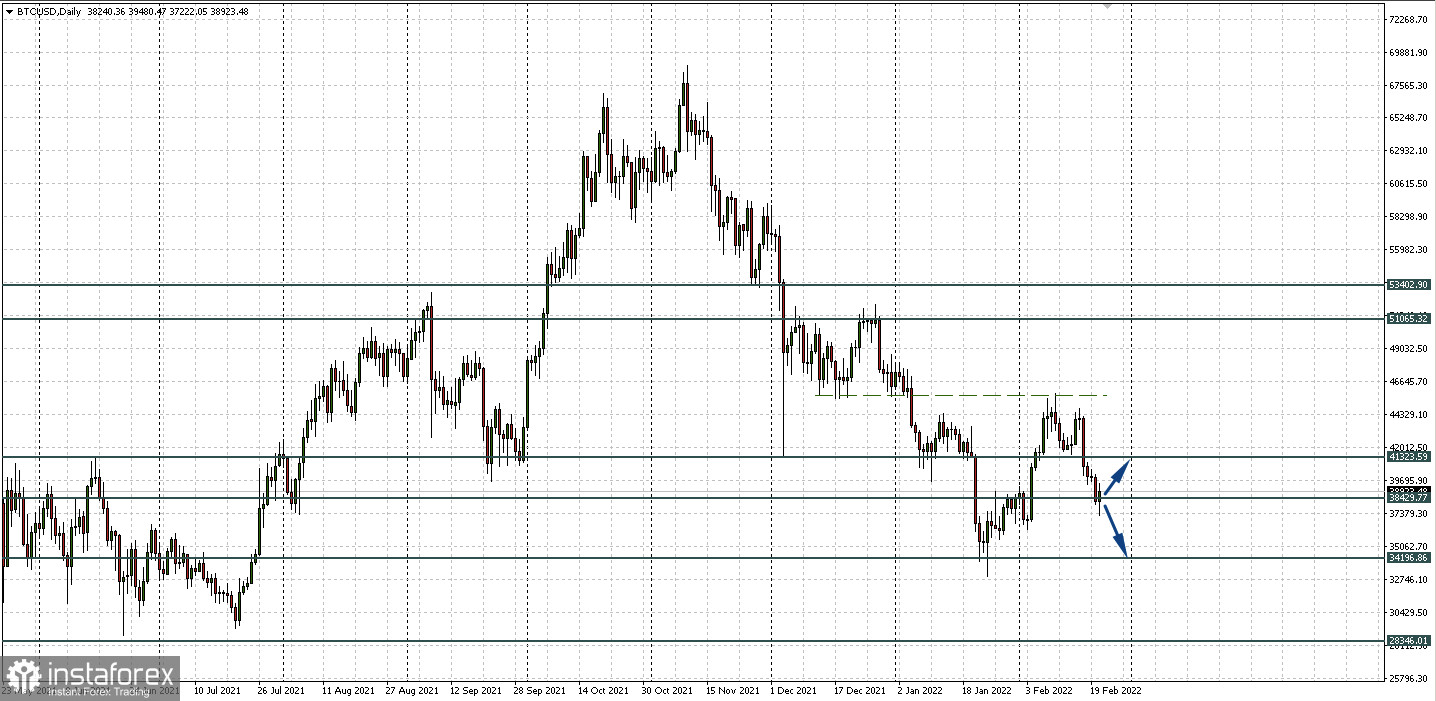

Market participants pinned hope on the BTC quotes reaching and breaking the resistance of 45,744.38 and forming an inverse Head and Shoulders pattern. But the price failed to do that. More than that, the price reversed and formed a Double Top signaling a reversal of a short-term uptrend.

The next target level lies at 38,429.77. The last hope for Bitcoin is located in an area near 29,000. To reach it, the cryptocurrency will have to challenge January's support at 34,196.86.

Cautious short-term traders may wonder what strategy to use in the near future. For now, there is no definite price direction in regard to the horizontal line at 38,429.77. So, there are two possible scenarios: either the price falls to 34,196.86 or rebounds to the local resistance at 41,323.59.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română