When raising the main interest rates, one always asks the question: will the national economy withstand the tightening of monetary policy? Judging by the latest statistics for Britain, it is within its power. Data on the labor market, inflation, retail sales, and business activity showed that everything is in order with the economy. Therefore, the expectations of the derivatives market for an increase in the repo rate to 2% by the end of 2022 and signals that it can be raised immediately by 50 basis points at one of the next two meetings of the Bank of England, look plausible.

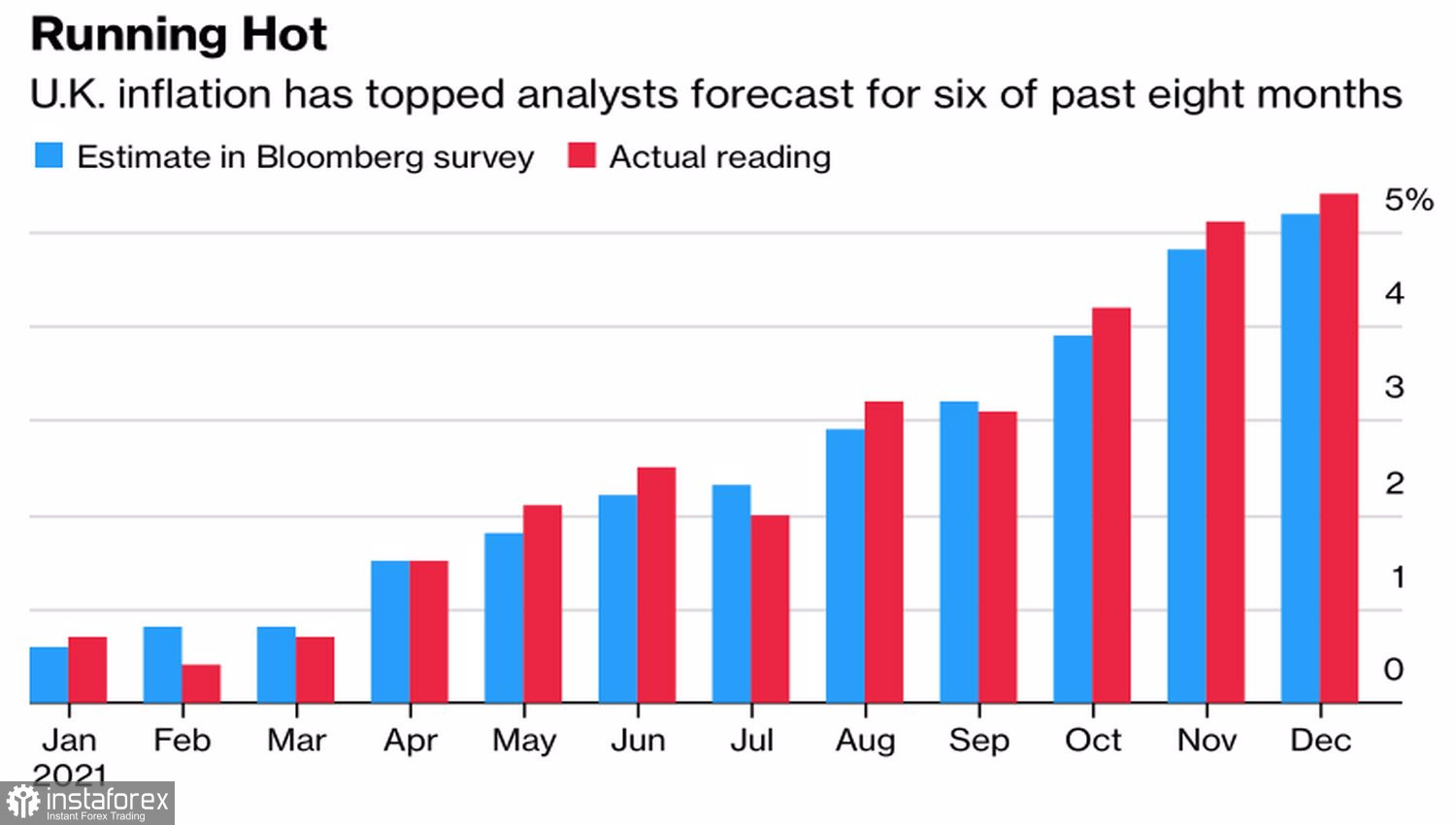

The ratio of vacancies to the number of people employed in Britain reached an all-time high, and average wages rose by 3.7% in the fourth quarter. An impressive figure that fuels inflation. In January, consumer prices accelerated to 5.5%, beating Bloomberg's forecasts and adding fuel to the fire of expectations of BoE tightening in March. Inflation has beaten economists' estimates six of the last eight times, including the last three months.

Forecasted and actual value of inflation in Britain

Now, some doubt that BoE Governor Andrew Bailey and his colleagues will act aggressively at the next MPC meetings, which, against the backdrop of restrained comments from authoritative FOMC members and news about the de-escalation of the conflict in Eastern Europe, allows GBPUSD to grow. New York Fed President John Williams sees no argument in favor of raising the federal funds rate by 50 basis points in March, and Governor Lael Brainard believes that, judging by the reaction of financial markets, monetary tightening has already begun. Her comments suggest that the central bank should not go too far with monetary restrictions.

The strength of the UK economy is evident not only in the labor market and inflation, but also in the growth of retail sales by 1.9% MoM in January, which is the best monthly dynamics since April, as well as in positive business activity. In February, the UK Services Purchasing Managers Index rose to an 8-month high of 60.8, indicating that leisure and entertainment companies have recovered from the shock associated with another wave of COVID-19.

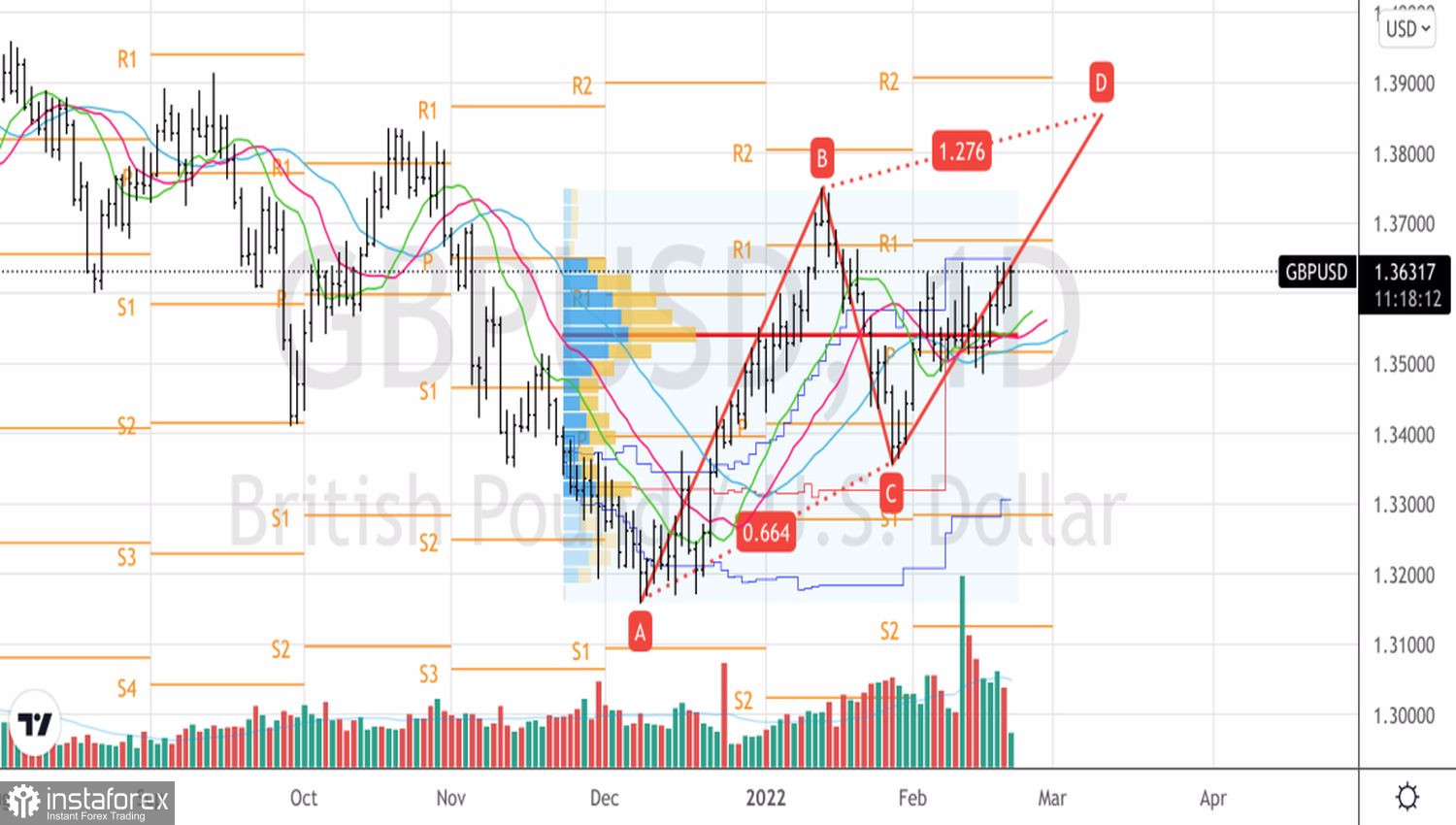

It is obvious that neither strong macro statistics nor expectations of an aggressive monetary restriction by the Bank of England could help the GBPUSD bulls if it were not for the rumors about the de-escalation of the conflict in Eastern Europe. Added to the information about the meeting of high-ranking U.S. and Russian officials on the Ukrainian issue on February 24 was the news that France almost organized a summit with the participation of U.S. President Joe Biden and Russian President Vladimir Putin. The White House has already confirmed the participation of its president in the meeting, and if the Kremlin does the same, the GBPUSD pair will rush to 1.38 and higher.

Technically, breaking through the resistance at 1.3645 as the upper limit of the fair value and 1.3675 as the pivot levels will allow the GBPUSD bulls to continue the rally. We use successful tests to build up long positions on the pair formed under the previous recommendation when it falls below 1.35. Marks 1.3800 and 1.3855 serve as intermediate targets for the upward movement.

GBPUSD, Daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română