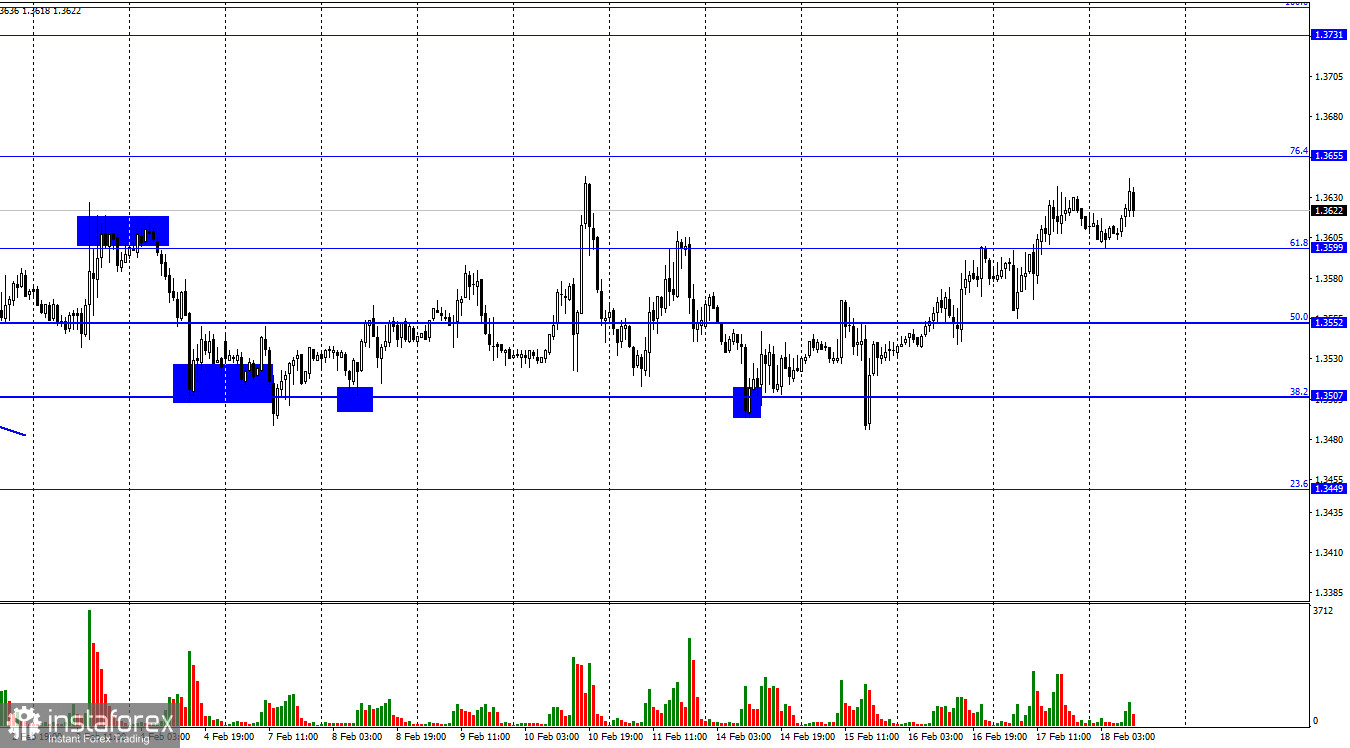

On the hourly chart, the GBP/USD pair continued to grow on Tuesday and closed above the 61.8% Fibonacci level at 1.3599. Currently, the quotes are rising towards 76.4% Fibonacci level at 1.3655. At the moment, the euro and the pound are trading mixed. It would seem clear if they had different news backgrounds. However, there was no news from the EU and the UK, the euro was hovering, while the pound rose by several dozens of points yesterday. Such a difference lies in the traders' sentiment. It looks like there are no reasons for such imbalance. Traders, for some reason, do not want to trade the EUR/USD pair, but they are ready to trade the GBP/USD pair. Geopolitics is hardly the reason for the growth of the pound, as the global situation worsens day by day and it would be more logical to see the growth of the US currency these days.

The UK is making new statements almost every day about a possible Russian invasion in Ukraine and has even published a possible map of an attack by Russian troops. The US also echoes this statement, which considers the threat of invasion to be very high. Russian authorities continue to claim that they are conducting exercises and are not obliged to report on their troop movements. There is a lot of fuss around this topic, most of the opinions, judgments, and news are fake. I don't see a connection between the rise of the pound and geopolitics right now either. The graphical picture is not less confusing than the news background. In February, the pair was trading between 1.3507 and 1.3630, touching the lower and upper boundary of this range. Now, the pair is trading near the upper boundary, so I can expect a reversal in favor of the USD and fall towards 1.3507. However, any news, which concerns geopolitics and is not obviously fake, can make traders panic.

On the 4-hour chart, the GBP/USD pair has consolidated above the descending trend line and rose to the 38.2% Fibonacci level at 1.3642. The pair's rebound from this level is likely to bring gains to the US dollar and some decline towards the 50.0% Fibonacci level at 1.3457. The pair's fixation above the Fibo 38.2% level at 1.3642 may increase the chances of further growth towards the next level of Fibo 23.6% at 1.3870. There are no emerging divergences today.

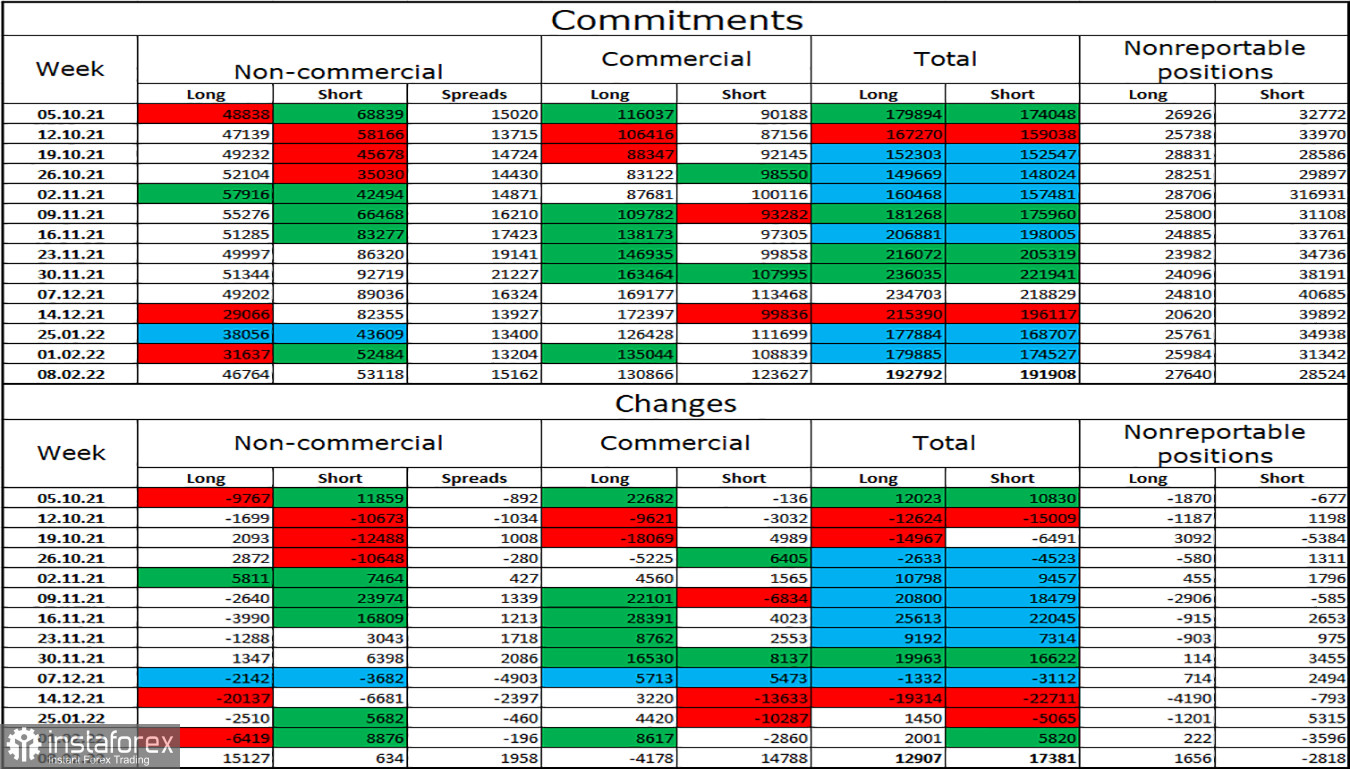

Commitments of Traders (COT) report:

The sentiment of Non-commercial traders has changed sharply again during the last reporting week. If a week earlier traders were increasing the number of Short contracts, now they are busy increasing the number of Long contracts, which increased by 15127. This is a vivid sketch of how quickly the sentiment of the major players and, accordingly, the entire market changes. The general traders' sentiment now is bearish, because they have more Short contracts on their hands. However, traders' sentiment changes very quickly, and the news background this week may contribute to an even more rapid change of it.

Economic calendar of the United States and the United Kingdom:

UK - Retail Sales With Auto Fuel (07-00 UTC).

The UK retail sales report for January was released on Friday. The reading exceeded traders' expectations. The slight rise in the pound could be attributed to that. There are no more important news and reports scheduled for today.

GBP/USD forecast and recommendations for traders:

Today, I would recommend selling the pound if there is a rebound from the 1.3642 level on the 4-hour chart, with targets at 1.3599 and 1.3552. On the hourly chart, I do not recommend looking for signals now. I recommend buying the pound if it closes above the level of 1.3642, with the target at 1.3731.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română