For long positions on EUR/USD:

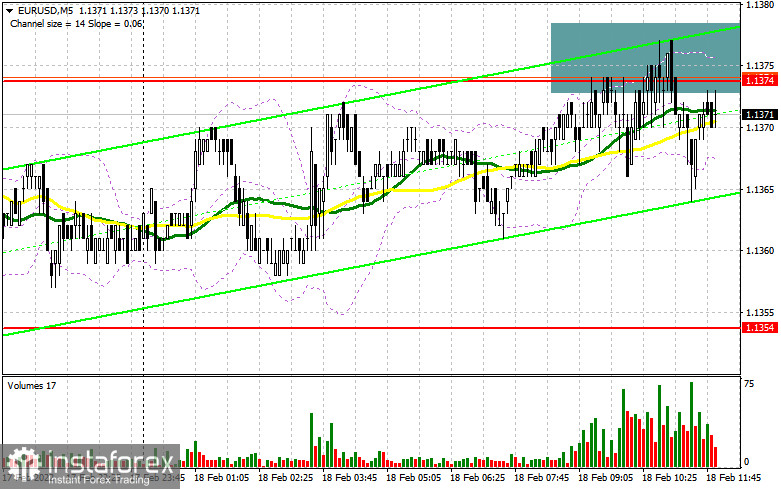

In my morning review, I highlighted the level of 1.1374 and recommended it as an entry point. Let's take a look at the 5-minute chart and see what happened there. In the first half of the day, the euro slightly advanced to this level and made a false breakout, thus forming a sell signal. Yet, the pair failed to develop a full-fledged downtrend. Low volatility and trading volume are defining the direction of the pair. It seems that traders are not willing to risk in the existing conditions. However, the technical picture has slightly changed in the afternoon although the strategy remained the same.

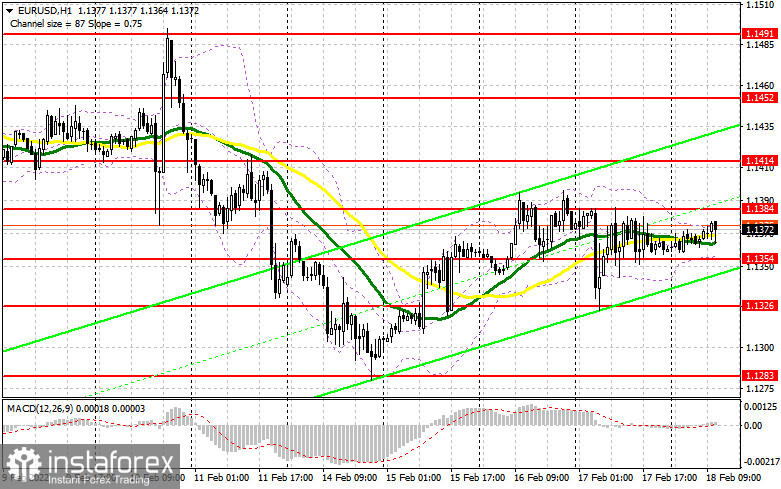

No significant fundamental events are expected during the New York session, so there is nothing surprising if the market stays flat for the rest of the day. The only thing worth paying attention to is statements by the Fed governors. We are talking about FOMC members Christopher Waller, John Williams, and Lael Brainard. Her statement regarding monetary policy could increase pressure on the US stock market, which will positively affect the US dollar. If the pair depreciates, only a false breakout of 1.1354 and a subsequent fall towards it will create the first entry point for long positions within the upward correction, which is still under threat. By the way, the quote may decline towards this level right after the publication of a strong existing home sales report and leading indicators in the US. Bulls need to protect this range in order to retain control over the lower boundary of the new ascending channel. For EUR/USD to recover, buyers need to act more aggressively and break through the new resistance level of 1.1384. A breakout of this range and its top-to-bottom test will generate another buy signal and create a possibility to recover to the area of 1.1414. At this point, the euro bulls may take a breather. Consequently, the pair may resume the bullish trend and head for new highs at 1.1452 and 1.1491 where I recommend taking profit. As the US-Russia-Ukraine geopolitical conflict is getting tenser, the demand for the US dollar may rise, so be careful with buying the euro at current highs. If the pair falls during the American session and there is no bullish activity at 1.1354, this can mean trouble for us. Therefore, it is better not to rush with buying the pair. Waiting for a false breakout at 1.1326 may be the best option. It is also possible to buy the pair immediately on a rebound from the level of 1.1283, or even lower at 1.1235, keeping in mind an upward correction of 20-25 pips within the day.

For short positions on EUR/USD:

In the morning, bears did their best to keep the price below 1.1374 and retain control over the market. Yet, major market players made no attempts today to put pressure on EUR/USD. Even though the new resistance level of 1.1384 has been formed, we can still use the sell signal generated in the morning and expect the euro to fall in the afternoon as long as the quote is trading below this range. If the pair grows on weaker-than-expected data from the US, bears will need to defend the resistance at 1.1384 to maintain market control. A false breakout along with statements made by the Fed officials about a more aggressive rake hike will serve as a signal to open short positions with the downward target at 1.1354. This level acts as intermediate support from where a bigger sell-off may start. A breakout of this range and its test from bottom to top will create an additional signal to open short positions with the prospect of further lows at 1.1326 and 1.1283. A more distant target will be the area of 1.1235 where I recommend taking profit. However, such a rapid drop in quotes may happen only if the conflict between Russia and Ukraine escalates further. In this case, demand for safe-haven assets will surge. If the euro rises and there is no bearish activity at 1.1384, it is better to wait with selling the pair. The best option is to open short positions on a false breakout at 1.1414. You can sell EUR/USD immediately on a rebound from 1.1452, or even higher at 1.1491, considering a downward correction of 15-20 pips.

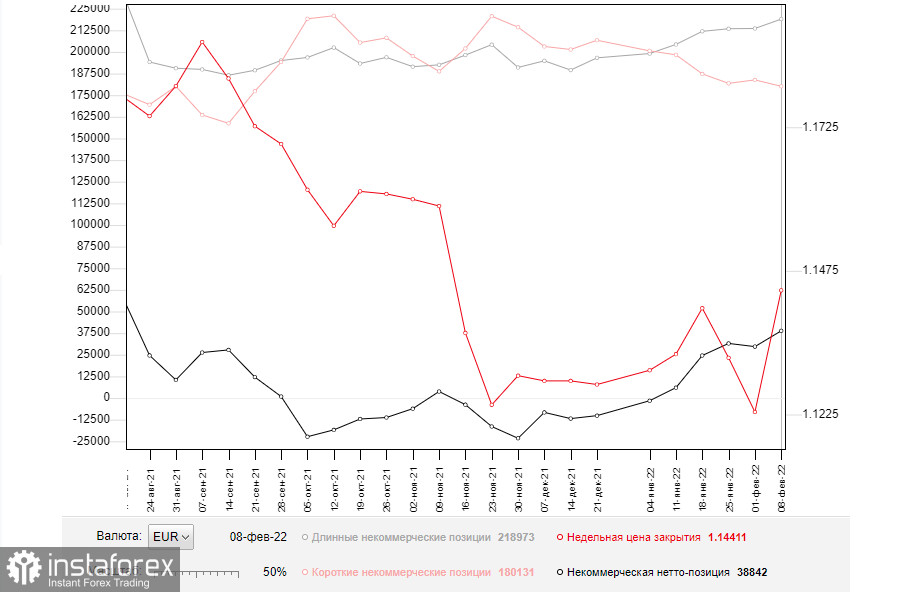

COT report

The COT (Commitment of Traders) report for February 8 revealed a rise in the number of long positions and a decrease in short ones. This report already reflects the results of the ECB meeting. For your reference, ECB President Christine Lagarde reiterated that the regulator would act more aggressively if the inflation issue did not improve. Last week, ECB officials took a wait-and-see stance, and a technical reversal in the bull market led to a decrease in the EUR/USD pair. Demand for risk assets also fell due to escalating tensions between Russia and Ukraine. However, the main reason behind the pair's decline is the Fed's actions regarding interest rates. On February 14, the UE regulator held an emergency meeting and did not disclose the results. This step fueled market fears over inflationary pressures in the United States. Some economists expect the central bank to take aggressive measures and raise the rate by as much as 0.5% in March this year versus a 0.25% that was previously planned. This is a bullish signal for the US dollar. The COT report shows that long positions of the non-commercial category of traders rose from 213,563 to 218,973, while short positions decreased from 183,847 to 180,131. This suggests that traders continue to add long positions with every decline of the European currency. This week, the total non-commercial net position went slightly up and amounted to 38,842 against 29,716. The weekly closing price got higher and amounted to 1.1441 against 1.1229 a week earlier.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates market uncertainty.

Please note the time period and prices of moving averages are analyzed only for the H1 chart which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

Due to low volatility, there are currently no signals from this indicator.

Description of indicators:

• A moving average determines the current trend by smoothing volatility and noise. 50-day period; marked in yellow on the chart;

• A moving average determines the current trend by smoothing volatility and noise. 30-day period; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA, 12-day period; Slow EMA, 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long position opened by non-commercial traders;

• Short non-commercial positions represent the total number of short position opened by non-commercial traders;

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română