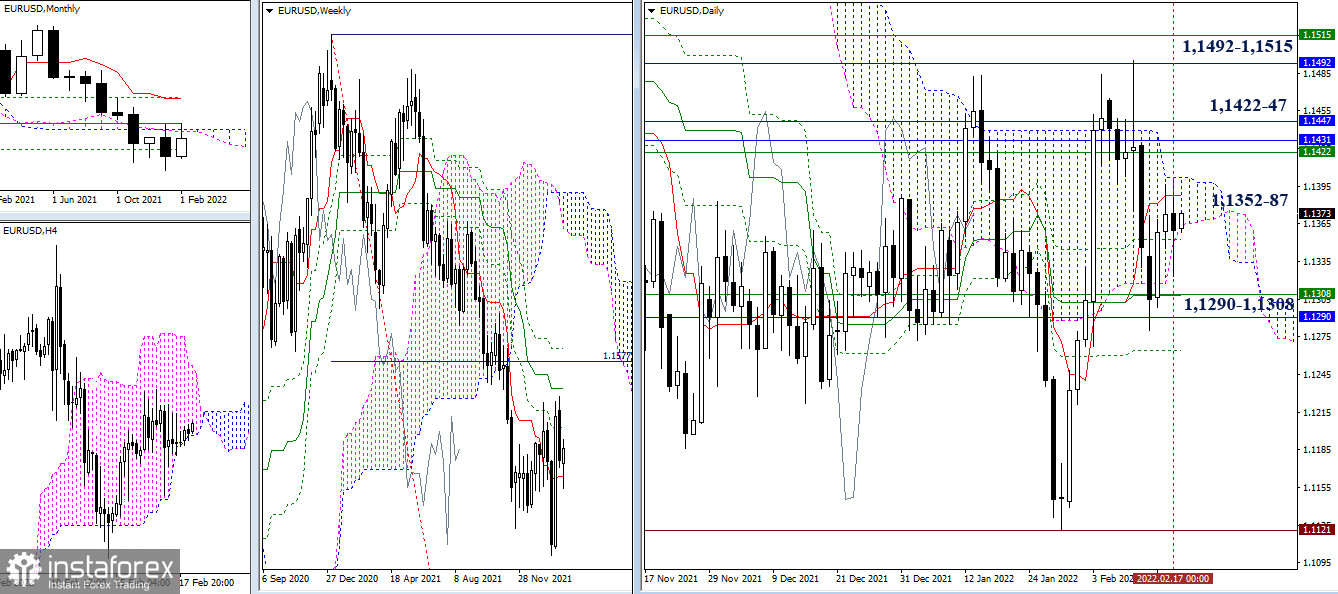

EUR/USD

There were no noticeable changes yesterday. The pair remained within the attraction and influence zone of daily levels (1.1352-87). The victory of the bulls in the current condition will allow us to return to the resistance levels of 1.1422-47 (monthly cloud + weekly Fibo Kijun), the breakdown of which will let the pair test the borders of 1.1492 - 1.1515 (mid-term trends of the week and month). In turn, the bears' immediate interests still rest on the support levels of 1.1290 - 1.1308 (weekly short-term trend + monthly Fibo Kijun).

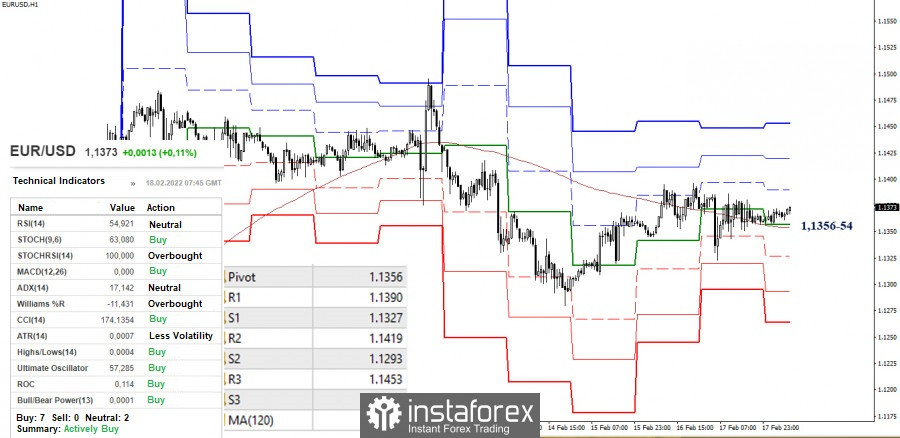

The analyzed technical instruments continue to maintain an advantage on the bullish side, but the bulls failed to take advantage of such a balance of power. There is a long lateral consolidation, the range of which is shrinking. The pivot points to develop the movement are the classic pivot levels: resistances at 1.1390 - 1.1419 - 1.1453 and supports at 1.1327 - 1.1293 - 1.1264. The key levels in the smaller timeframes currently form the center of gravity. They have joined forces at 1.1354 (long-term weekly trend) - 1.1356 (central pivot level).

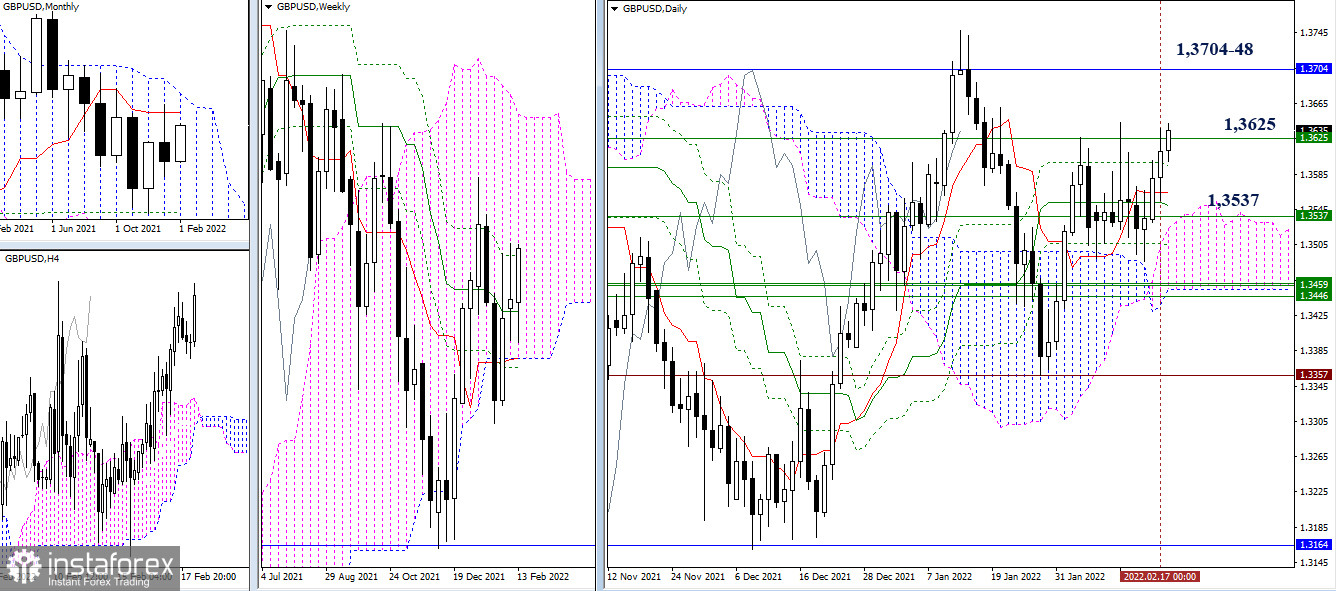

GBP/USD

The pound stayed around the borders of the last week's movement, but bulls have been trying to prove their advantage for most of the week. The week will be closed today. If the bulls manage to consolidate their result and close the week above the final level of the weekly dead cross Ichimoku (1.3625), then further growth and strengthening of bulls can be expected. Their next targets are 1.3704 (monthly short-term trend) and 1.3748 (highest extreme). On the contrary, the nearest supports can be noted in the accumulation zone of daily levels and a weekly medium-term trend (1.3537).

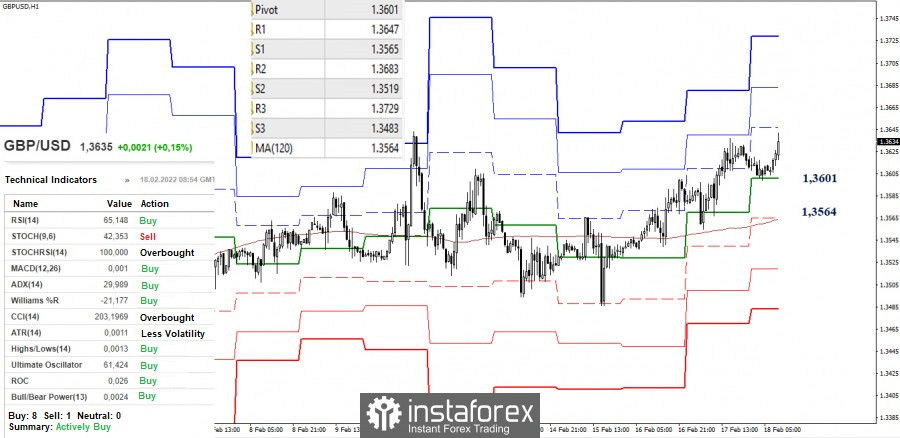

The bulls have the advantage in the smaller timeframes. They continue to rise and form an upward trend. The pivot points to resume the intraday upward movement are the resistance of the classic pivot levels (1.3647 - 1.3683 - 1.3729). The key levels here are now acting as support levels set at 1.3601 (central pivot level) and 1.3564 (weekly long-term trend). A consolidation below it will change the current balance of power. Today, other downside targets are located at 1.3519 (S2) and 1.3483 (S3).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română