To open long positions on GBP/USD, you need:

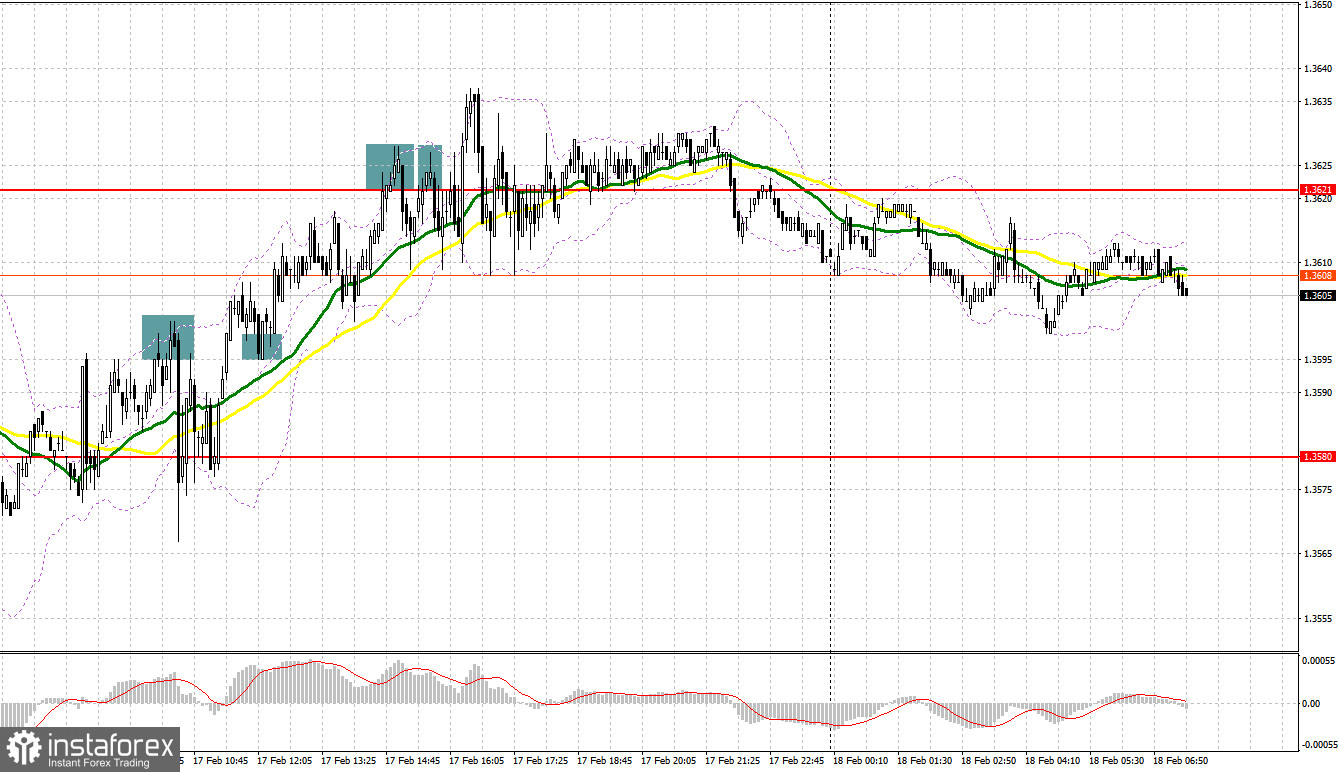

Yesterday, several signals were formed to enter the market. Let's take a look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the level of 1.3597 and advised you to make decisions on entering the market from it. The pound's recovery in the morning after the fall in the area of 1.3597 during the Asian session and a false breakout there led to a good entry point into short positions, but a thorough downward movement did not happen. A decline by 20-25 points from the pound, then re-growth and the 1.3597 test - this made it possible to move higher, and a consolidation with an update from top to bottom formed a good entry point into long positions. As a result, the upward movement was about 40 points. In the afternoon, I paid attention to the resistance of 1.3621. Several false breakouts of this level resulted in creating excellent entry points into short positions. However, the US fundamental statistics were not convincing, which did not allow the signals to be implemented properly.

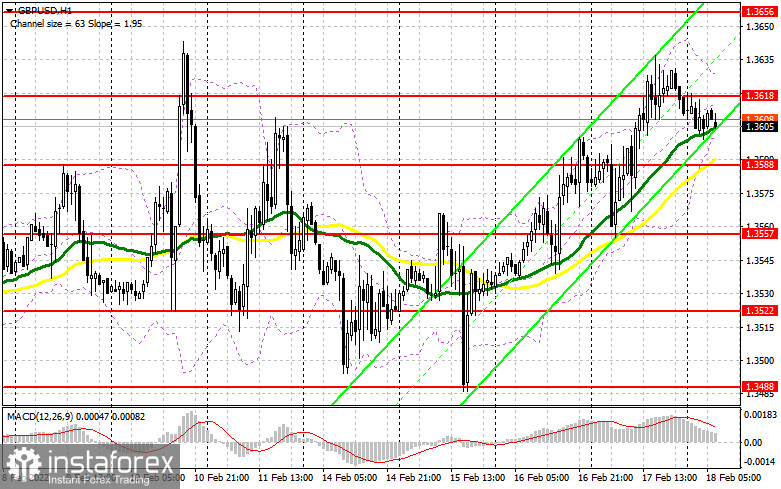

Today, traders have something to focus on – they will receive fundamental data on retail sales in the UK, which can act as a catalyst for a new bull market. Most likely, bulls will continue to actively fight for the nearest resistance of 1.3618, as they failed to settle above yesterday's results. It is important to protect the support of 1.3588 during the European session, where the moving averages are playing on the bulls' side. You can consider long positions from 1.3588 only after the pair has fallen against the background of weak statistics and the formation of a false breakout. This will definitely lead to a new wave of growth in the resistance area of 1.3618. A breakthrough and a test of this range from top to bottom, as well as a sharp jump in retail trade volume taking into account fuel costs in January of this year – all this creates another buy signal with the pair recovering to a new February high of 1.3656. A more distant target will be the 1.3694 area, where I recommend taking profits. In case GBP/USD falls during the European session and the bulls are not active at 1.3588, nothing terrible will happen. A slight downward correction will be beneficial. Before buying, you need to make sure that the big players are still present in the market and all this growth is more stable and does not relate to speculative insinuations. When falling below 1.3557, I advise you to wait for the test of the next major level of 1.3522. Forming a false breakout there, by analogy with what I analyzed above, will provide an entry point into long positions. You can buy the pound immediately on a rebound from 1.3488 – the lower limit of a wide horizontal channel, or even lower - from a low of 1.3446, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

Although the bears managed to protect 1.3618, they failed to achieve any larger correction – this indicates that traders are not willing to sell the pound even at current highs. Apparently, everyone is waiting for the February highs to be updated and a number of speculators' stop orders to be taken out. Protecting the resistance of 1.3618 for the first half of the day is a very big deal, since it is undesirable to release the pound higher – this will definitely lead to an update of the local high and maintain the upward trend for the pair. Forming a false breakout at 1.3618 and weak data on January retail sales growth in the UK creates an excellent entry point into short positions. In this case, you can count on the return of the bear market with a decline in the area of intermediate support at 1.3588, formed by yesterday's results. There are also moving averages that play on the bulls' side – so bears can perform two tasks at once with one blow. A breakthrough and test of this range from the bottom up will provide another entry point into short positions with the goal of falling to 1.3557 and 1.3522. You can count on the implementation of this scenario during the speech of representatives of the Federal Reserve, who will talk a lot about the economy and monetary policy. A more distant target will be the 1.3488 area, where I recommend taking profits. If the pair grows during the European session, as well as if the bears are not active at 1.3618, it is best to postpone short positions to a new high of this month – 1.3656. I also advise you to open short positions there in case of a false breakout. You can sell GBP/USD immediately for a rebound from 1.3694, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for February 8 showed a sharp increase in both short and long positions. The latter turned out to be much more, which led to a reduction in the negative value of the delta. However, the negative value still remained - this is a direct hint that bears control the market. It should be understood that this report already takes into account the results of the Bank of England meeting, at which interest rates were decided to be raised. But this did not provide much help to the pound, since everyone really understands that such changes in policy were made neither from a good life, but in the fight against high inflation. Given that the British economy is currently going through hard times and at any moment the pace of economic growth may seriously slow down - the increase in rates did not lead to a rapid increase in the British pound. The geopolitical events around Russia and Ukraine, as well as the Federal Reserve's decisive actions regarding future interest rates in March of this year - all this puts pressure on the bulls and is an additional deterrent to the bull market for GBP/USD. Some traders expect that the US central bank may resort to more aggressive actions and raise rates by 0.5% at once, rather than by 0.25% — this will become a kind of bullish signal for the US dollar. The COT report for February 8 indicated that long non-commercial positions increased from 29,597 to 44,709, while short non-commercial positions jumped not so much - from 53,202 to 53,254. This led to a sharp reduction in the negative non-commercial net position from -23,605 to -8,545. The weekly closing price rose from 1.3444 to 1.3537.

Indicator signals:

Trading is conducted above the 30 and 50 moving averages, which indicates an attempt by the bulls to continue the pair's growth.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a fall, the lower border around 1.3600 will provide support. Crossing the upper limit in the area of 1.3625 will lead to a new wave of growth of the pound.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română