The British currency seems to be able to settle above 1.3600 despite the complete lack of visible reasons. After all, US statistics, despite the fact that the data did not come out as expected, was of a multidirectional nature, thereby offsetting itself. In particular, the number of initial applications for unemployment benefits, which should have been reduced by 5,000, increased by 23,000. The number of repeated applications, instead of decreasing by 2,000, decreased by 26,000.

Number of retries for unemployment benefits (United States):

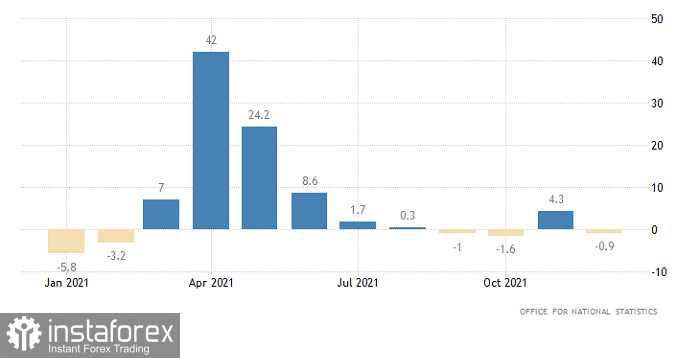

To all appearances, expectations related to the Bank of England's policy contribute to the moderate growth of the pound. In particular, there are strong assumptions that the British central bank will continue to raise interest rates. In addition, the forecasts for macroeconomic statistics are also quite good. Today, the UK will release data on retail sales, the decline of -0.9%, should be replaced by growth of 7.2%. Such an impressive growth will certainly inspire market participants and allow the pound to further strengthen its position.

Retail Sales (UK):

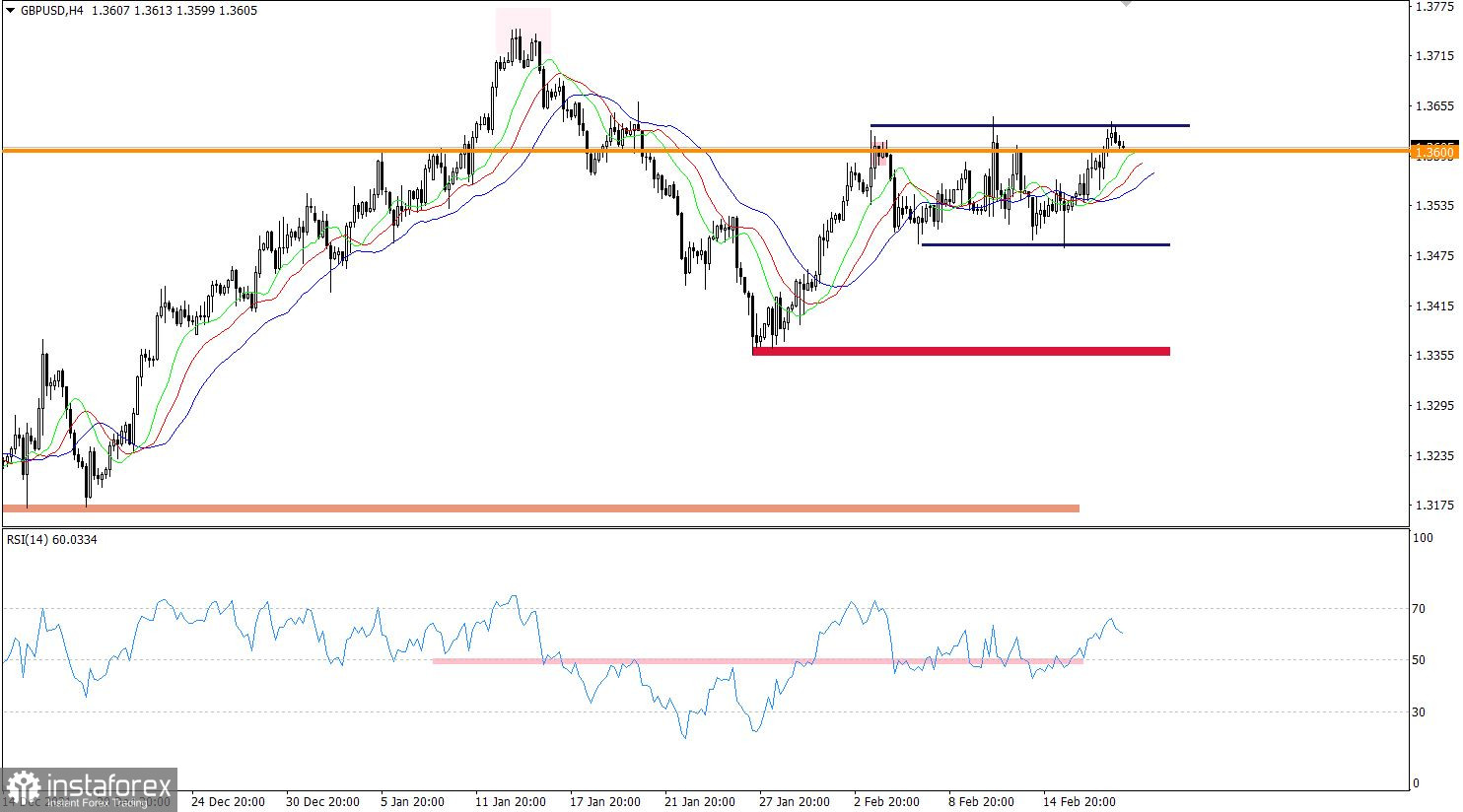

Despite the local breakthrough of the upper border of the horizontal channel at 1.3500/1.3600, the quote is still within its deviation. So, the values of 1.3480 and 1.3630 serve as signal levels. Keeping the price behind one of the levels in a four-hour period would signal the end of the flat. Until then, the horizontal channel remains in the market.

The RSI technical instrument in H4 is moving in the upper area of the 50/70 indicator, which signals a high interest in long positions.

At the same time, the Alligator H4 indicator indicates an upward move, but the signal is unstable due to the fact that the MA sliding lines are within the boundaries of the horizontal channel.

Expectations and prospects:

In this situation, traders pay special attention to price fluctuations within the upper limit of the flat, since a full-fledged signal to action may appear on the market from minute to minute. The upward move will be relevant if the price stays above 1.3630 in a four-hour period. This move may well bring traders back to the area of the local high on January 13th. The downward scenario in the flat structure will be relevant in case the price is stable below the 1.3600 level.

A complex indicator analysis provides a buy signal based on the short-term and intraday periods due to the price movement within the upper limit of the flat.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română