The US stock market was held in the "red zone" on Thursday. All major indexes and stocks of large companies fell synchronously in the morning. Since no important statistics were released in the States yesterday, we believe that this drop is due to geopolitics. However, it should be noted that there were several reports. The number of initial applications for unemployment benefits increased by 248,000 in the reporting week, which is higher than market expectations. At the same time, the Fed-Philadelphia manufacturing index fell from 23.2 to 16.0. There were also data on the laying of new foundations and the number of construction permits issued.

In general, the statistics were not so bad as to cause a fall in the stock market. In the evening, James Bullard, president of St. Louis, spoke. He expressed concern that the markets have lost faith in the Fed's ability to control inflation, so the rate should be raised at the next meetings in order to send the right signal to the markets. Bullard said that he does not support the view that inflation will begin to decline without the influence of the Fed, and also noted that there is no risk of a recession of the American economy with a rate hike. At the same time, the geopolitical situation in Ukraine is deteriorating, which could cause the stock market to decline.

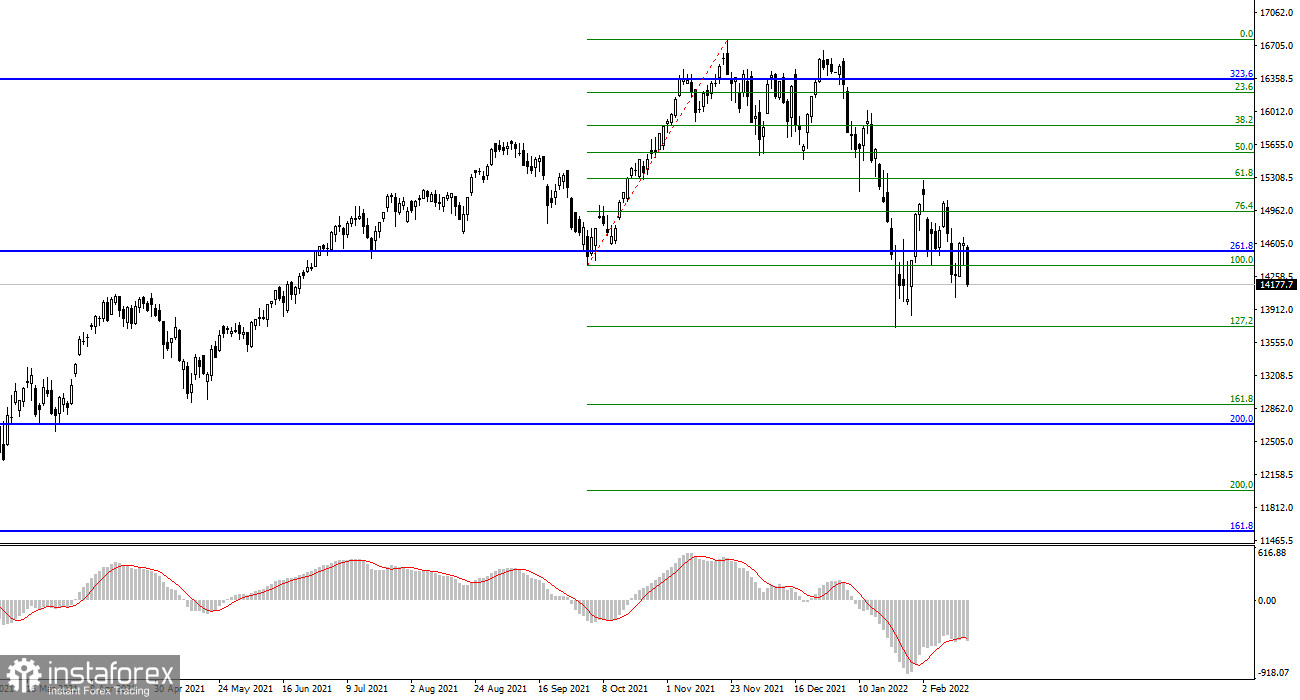

NASDAQ Composite Index

On Thursday, the NASDAQ Composite index plunged to 14177 and lost 400 points. The corrective set of waves continues to form, and much at this time depends on the geopolitical situation in Ukraine. There is no news of a de-escalation of the conflict, but the situation continues to deteriorate and escalate.

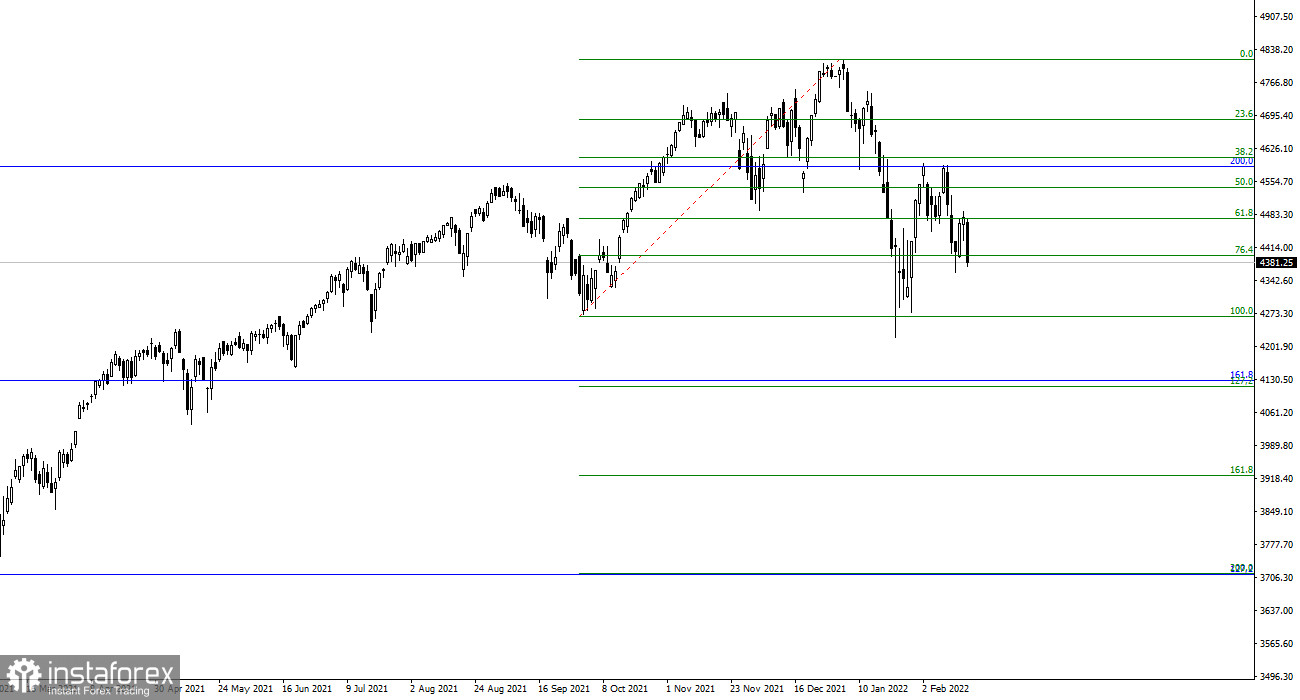

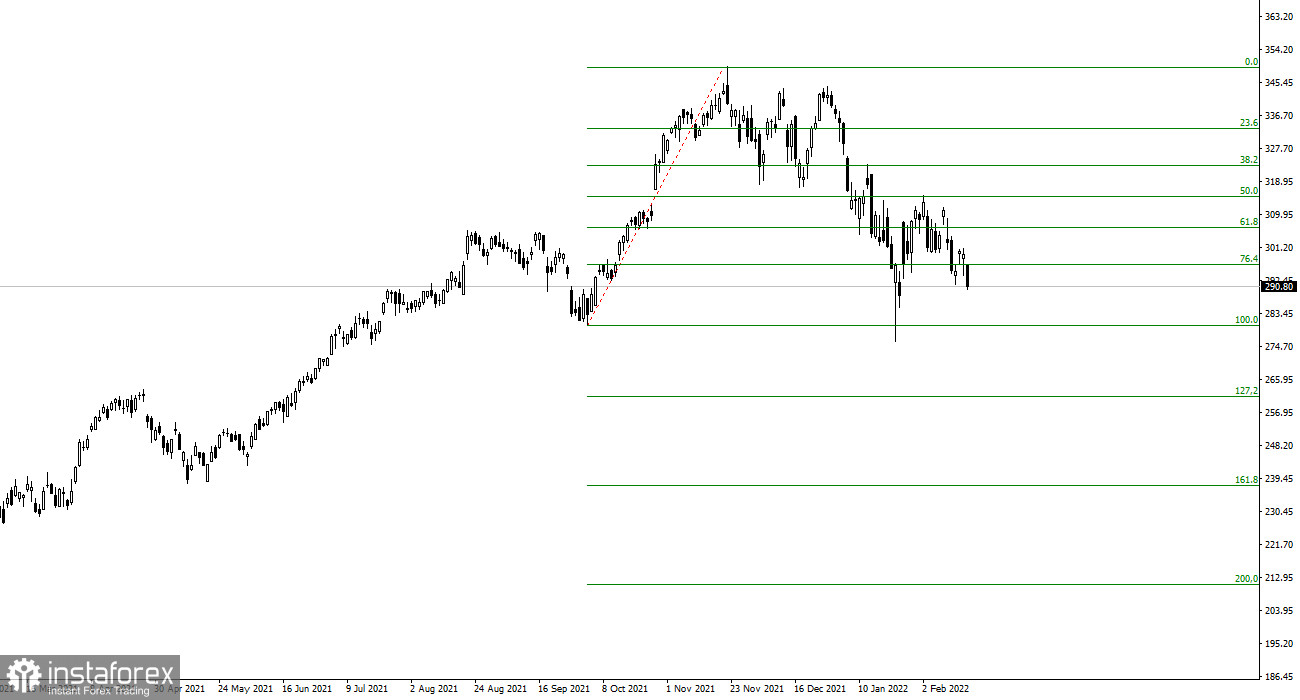

Standard & Poor's 500 index

The Standard & Poor's 500 dropped 89 points on Thursday and closed at 4381. Two failed attempts to break through the level of 4586, which corresponds to 200.0% on the major Fibonacci grid, led to new sales of the instrument, which will continue in the coming weeks. The Fed leaders did not give a reason to expect too rapid interest rate hikes soon, but such a risk is present, which, paired with geopolitics, reduces demand for shares.

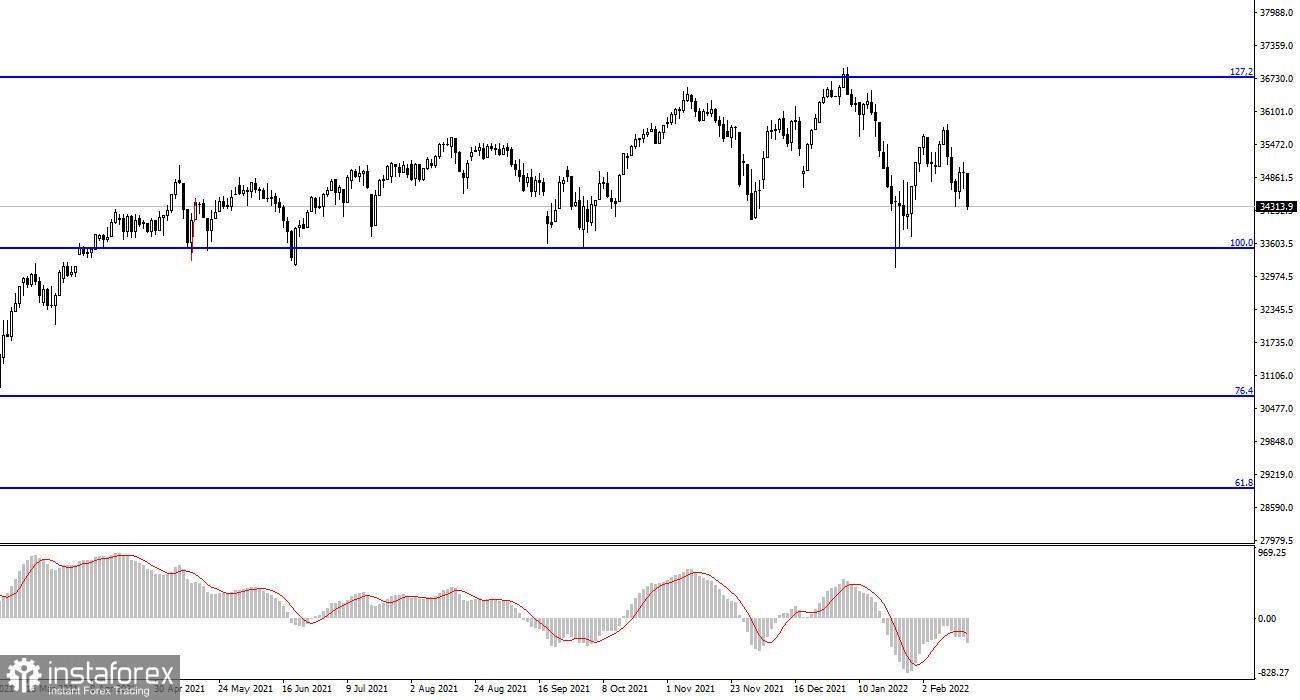

Dow Jones index

The Dow Jones index suffers the least from geopolitical news and the Fed's plans to raise interest rates, but it lost about 600 points on Wednesday and fell to 34313. This index has built the weakest corrective wave structure so far, but it is falling in the same way as other indices.

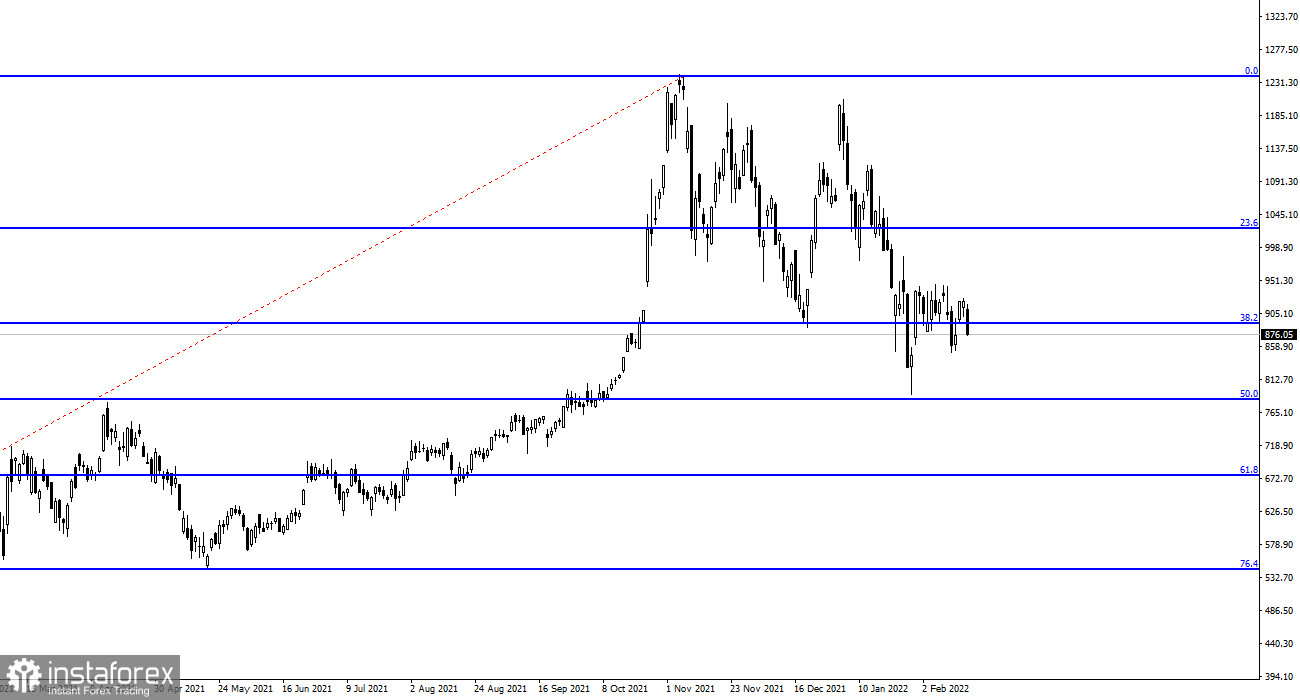

Tesla

Tesla shares declined by $47, reporting to $876. Sales of the company's shares are preserved for the time being since the geopolitical situation in Ukraine remains difficult. We believe that two key factors influencing the stock market – geopolitics and the Fed's rate hike will continue to reduce demand for indices and stocks.

Microsoft

Microsoft shares continue to decline after a failed attempt to break through the $ 314 level, which equates to 50.0% Fibonacci. The nearest target is $280. Yesterday, the losses amounted to $9. All the main instruments of the stock market are now in the construction of corrective waves and all react to the news background in the same way, so we can expect approximately the same dynamics of their movement.

Apple

Apple stock is doing its best in a new crisis, whose cost declined by $4 on Thursday and is now at $168. However, the stock is still very close to its most recent high at $182.74.

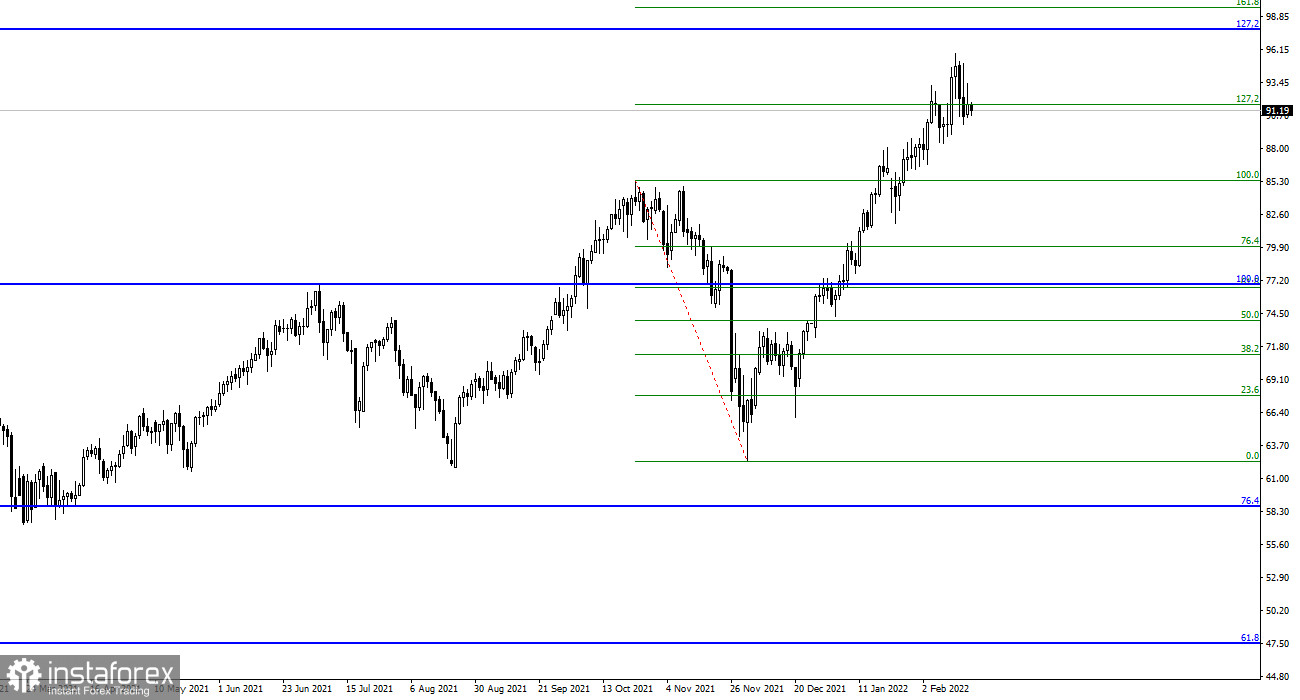

Oil

Oil is the only instrument supported by geopolitical concerns. Its cost has not changed yesterday and currently stands at the level of $91 per barrel. Any deterioration in the geopolitical situation may lead to the oil's new growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română