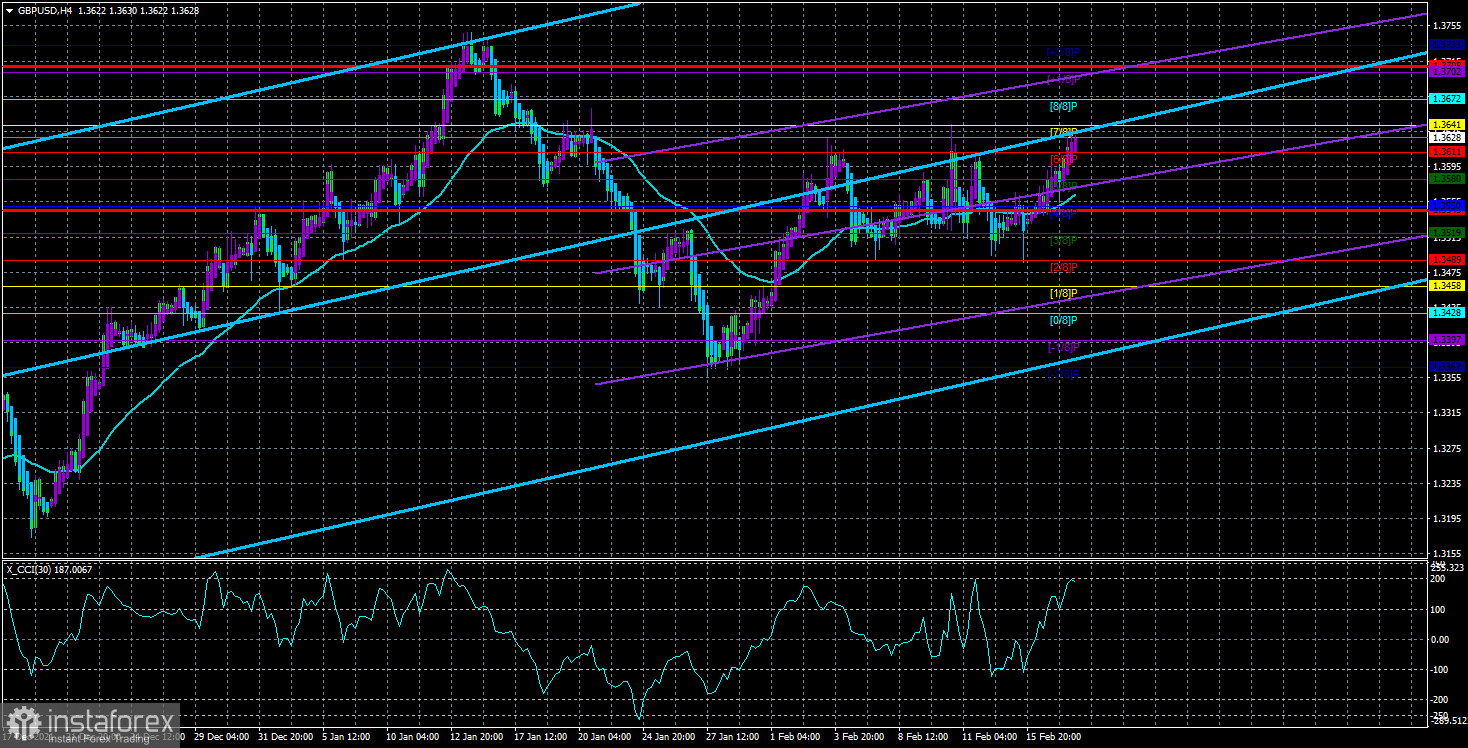

The GBP/USD currency pair continued to grow most of the day on Thursday and for the third time worked out the Murray level of "6/8" - 1.3611. Recall that approximately at this level is the upper limit of the assumed side channel in which the pair has been trading for a couple of weeks. Thus, it is possible that on the last trading day of the week, the fall in the quotes of the British currency will resume. Moreover, there are simply no really important macroeconomic or fundamental events right now. On Wednesday, the market cheerfully ignored an important report on inflation in the UK, and then an important report on retail sales in the US. And on Thursday, the market simply had nothing to react to, except geopolitics. The pair also performed an impressive somersault at night, dropping by 30 points in an hour. But what is important: the pound fell by only 30 points and the euro by 50. During the day, the pound rose much more than it fell, and the euro did not. That is, whatever factors currently affect the market and its mood, the pound still shows less tendency to fall against the dollar than the euro.

We have already talked about the reasons for this many times, and they have not changed recently. If you describe the situation very briefly, you will get a saying, as in advertising: "while you are talking, we are doing." The Bank of England has already raised the key rate twice, and the Fed is only saying that it is going to raise it in 2022. Markets are confident that now we are talking about 7 rate hikes this year, which means an increase at every Fed meeting. However, the Fed leaders themselves are in no hurry to confirm such statements. So far, the mood inside the central bank can be called quite neutral and cautious. Therefore, the market is doing very correctly that it does not react to all these "forecasts". We need to work on the fact, and not on ephemeral expectations.

The minutes of the Fed meeting did not give any new information.

The minutes of the last FOMC meeting were published late on Wednesday. We can immediately say that it turned out to be a "dummy". No new or important information was contained in this report. Fed members once again noted the negative impact of the pandemic on inflation and supply chains, lamented the rise in energy prices and the mismatch of demand for goods and services to supply, and the shortage of labor. It was also noted that "it's time to start raising the rate, as inflation may continue to accelerate." In general, all that we have already heard more than once. Only concrete actions are missing. Therefore, there was no market reaction to this protocol.

Meanwhile, there is no new data from the chief newsmaker Boris Johnson, who successfully replaced Donald Trump in this post. In recent days, Johnson has simply scattered comments concerning Ukraine and the Russian Federation, threatening Moscow with all sorts of sanctions and the "exposure of Russian possessions" in London and Britain as a whole. Boris Johnson also gave a new forecast on the possible date of the Russian invasion of Ukraine. Now the British Prime Minister believes that Moscow will order an invasion within two days. In general, the British Prime Minister does not contribute to easing tensions in any way, but also only adds fuel to the fire. What is noteworthy is that no one is panicking in Ukraine, and the public has even stopped paying attention to every new forecast about the invasion. No one denies the fact of the presence of Russian troops on the border with Ukraine, but, as they say in Odesa, these are two big differences: stand on the border and conduct exercises, and start a full-scale war. Therefore, so far we can only state the hysteria that has developed around the situation, which requires only negotiations and mutual concessions.

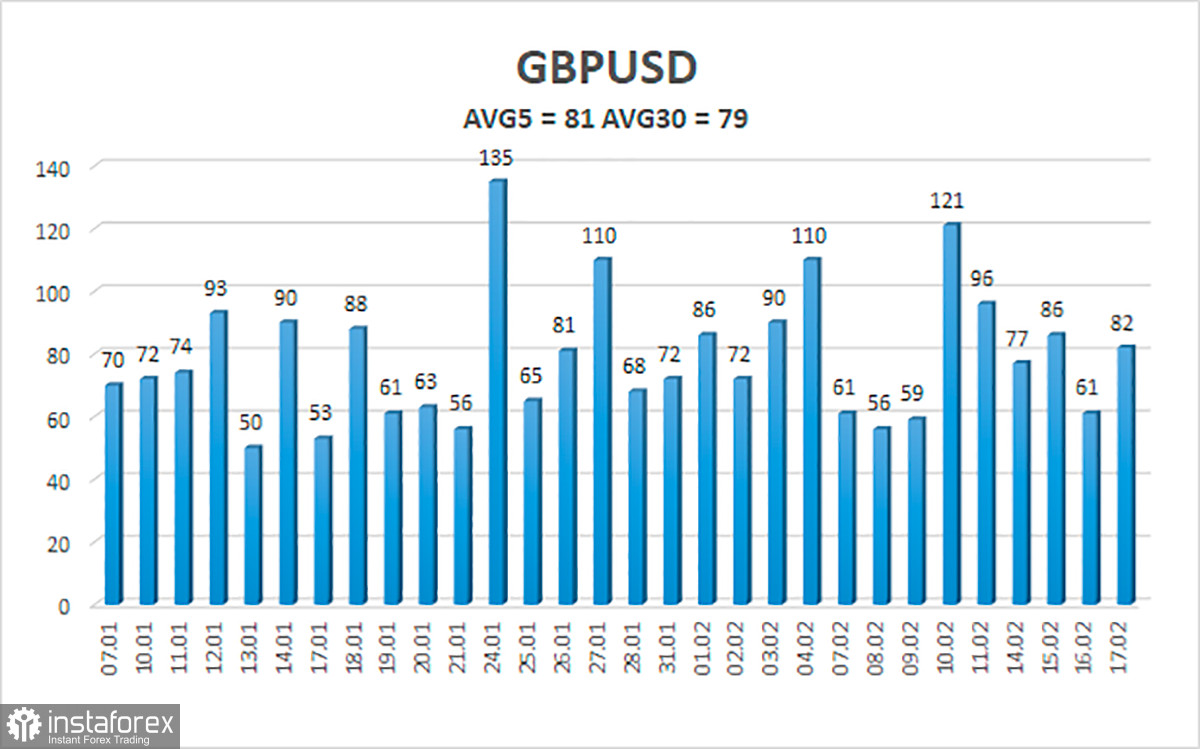

The average volatility of the GBP/USD pair is currently 81 points per day. For the pound/dollar pair, this value is "average". On Friday, February 18, thus, we expect movement inside the channel, limited by the levels of 1.3545 and 1.3708. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement within the framework of the "swing".

Nearest support levels:

S1 – 1.3611

S2 – 1.3580

S3 – 1.3550

Nearest resistance levels:

R1 – 1.3641

R2 – 1.3672

R3 – 1.3702

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to trade near the moving in the "swing" mode. Thus, at this time, it is possible to stay in long positions with targets of 1.3672 and 1.3702 until the Heiken Ashi indicator turns down, but the high probability of a flat should be taken into account. It is recommended to consider short positions if the pair is fixed back below the moving average, with targets of 1.3519 and 1.3489, but you should also be wary of a flat.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română