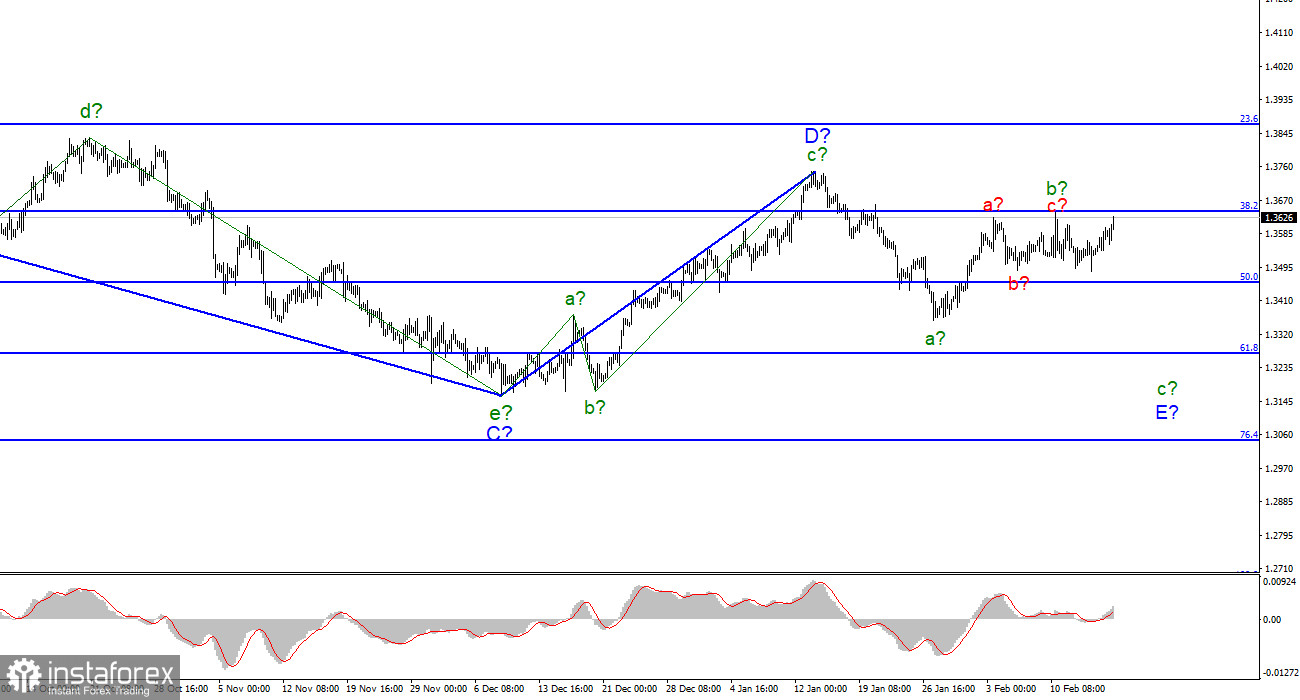

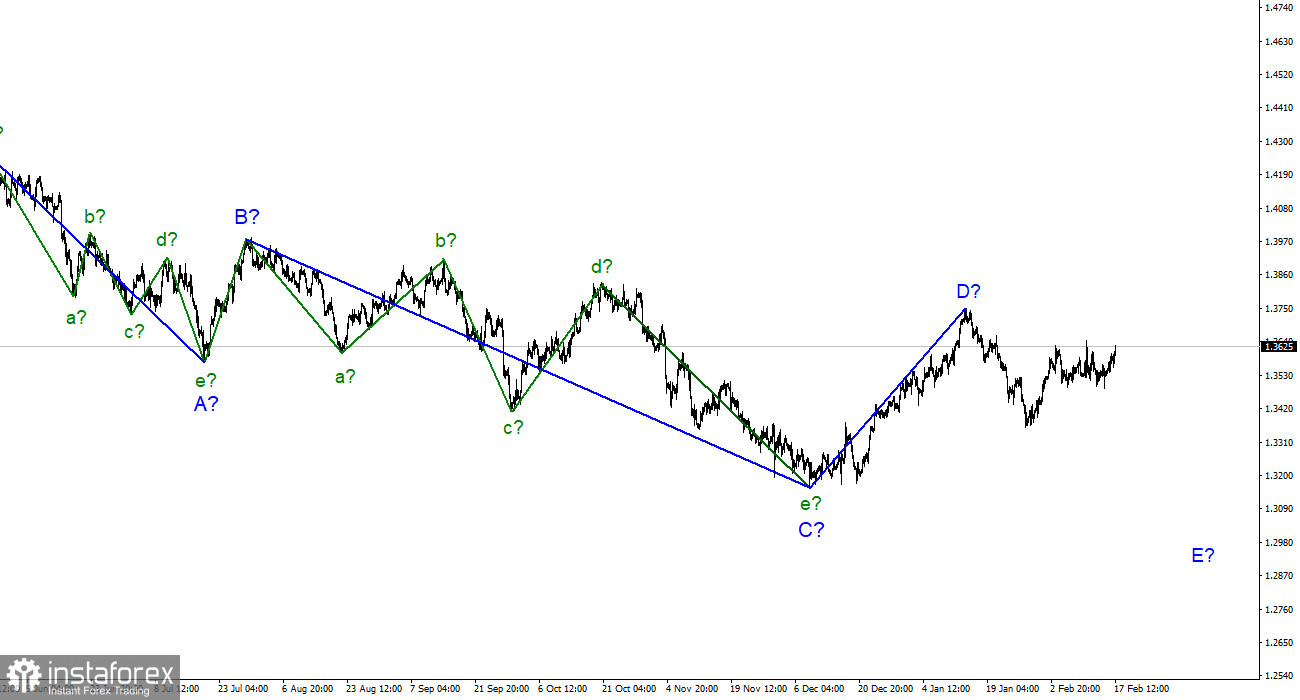

For the pound/dollar instrument, the wave markup continues to look very convincing, but in the near future, it may become somewhat more complicated. The increase in quotes last week complicates the expected wave b and it turns out to be longer than wave a. Since three internal waves are already being viewed inside wave b, this wave must be completed. However, it does not end, and the decline of the instrument does not begin. Based on this, I assume that wave b can take an even more extended form, a five-wave one, and more waves d and e will be built. However, in wave A, internal waves are not visible in E, so this complication of wave b looks strange. At the same time, a three-wave structure is visible inside wave D, so it cannot be the first impulse wave of a new upward trend segment. And the entire downward section of the trend, which originates on June 1, 2021, can be either three-wave or five-wave. Thus, the wave picture is ambiguous now, but I still tend to believe that another descending wave E will be built.

Important statistics did not interest the market.

The exchange rate of the pound/dollar instrument increased by 40 basis points during February 17. In the UK, an important inflation report was released this week, which showed its increase to 5.5% y/y. No important news from Britain is planned today and tomorrow, although a report on retail trade in January will be released tomorrow. However, earlier this week, the market did not pay attention to a similar report in the US, and also considered the FOMC protocol uninteresting. Thus, I observe the market's disinterest in the economic news background at this time. The internal wave structure of the upward wave becomes more complicated and does not look at all like an impulse wave. If this assumption is correct, then the decline of the instrument should resume in the coming days. However, there is no need to expect help from the news background now. Tomorrow, apart from the report on retail trade in Britain, there will be nothing interesting.

All other topics have now faded into the background. Only geopolitics. Let me remind you that just a few weeks ago, all the media were discussing the possible resignation of Boris Johnson due to the fact that he and 50 more of his colleagues were having fun in Downing Street during several "lockdowns" at once. The fun continued even on the eve of the funeral of the husband of the Queen of Great Britain. Even earlier, the topic of Brexit and new negotiations between Brussels and London was discussed, since the protocol on the Northern Ireland border was recognized as ineffective by the UK, but at the same time completely suits the European Union. New negotiations are needed, which are currently not being conducted due to the deterioration of the situation in Ukraine. In general, all attention is now occupied by Ukraine and Russia, and at any moment news of such a plan may arrive that the market simply will not be able to ignore them. I hope that this news will not be about the de-escalation of the conflict.

General conclusions.

The wave pattern of the pound/dollar instrument assumes the construction of a wave E. The construction of the proposed wave b is completed, or this wave is not b. The instrument made an unsuccessful attempt to break through the 1.3645 mark, and wave b acquired a three-wave appearance. Already today or tomorrow, another attempt to break through this level may take place, but there is no continuation of the increase in quotes yet, so now I believe that a wave c-E will still be built. Therefore, I advise now selling with targets located around the 1.3272 mark, which corresponds to 61.8% Fibonacci, until a successful attempt to break through the 1.3645 mark.

On the higher scale, wave D also looks complete, but the entire downward section of the trend does not. Therefore, in the coming weeks, I expect a resumption of the decline of the instrument with targets below the low of wave C. Wave D turned out to be a three-wave one, so I cannot interpret it as wave 1 of a new upward trend segment.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română