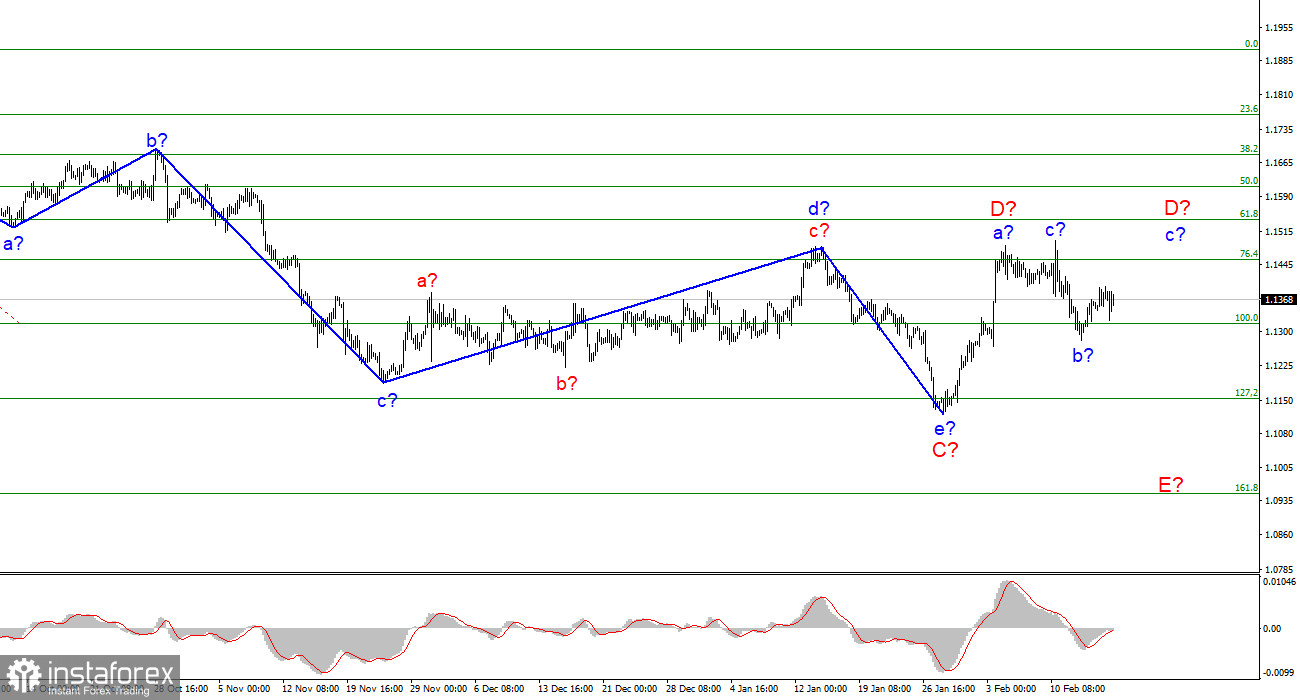

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes and now it no longer looks as unambiguous as before. Last week, there was a decline in quotes, which may be a wave E, or it may be a wave b-D. I believe that wave D is over, as the news background openly supports the rise of the US currency. Moreover, there are no clear internal waves inside wave C. Thus, they may not be inside wave D either. Based on this, I think that the probability that the instrument has moved to the construction of wave E is 80 percent. I give 20% of the probability that wave D will take a more complex form, three-wave, but even in this case, it may already be completed. There is also a backup option with the completion of the construction of a downward trend section. In this case, on January 28, the construction of a new upward trend section began. But the same news background now does not give any reason to expect that an upward section of the trend will be built. A successful attempt to break through the 1.1314 mark, which corresponds to 100.0% Fibonacci, will indicate that the market is ready for new sales of the European.

The market is in complete confusion

The euro/dollar instrument continued to trade with a small amplitude on Thursday. On Wednesday, the instrument's amplitude was 25 basis points, on Thursday - about 30. These are very weak movements, and they do not have a definite direction. Now the tool is moving horizontally. The wave pattern does not change and it is not possible to make any additions now. To my great regret, the main topic for the market remains the topic of geopolitics. Yesterday, the market cheered up for a while when Moscow announced the withdrawal of some troops from the Ukrainian border. However, after a few hours and over the next day, there were a lot of statements from the Secretary-General of NATO, American and European intelligence that there was no withdrawal of troops. Thus, the market fell into a stupor again. Against the backdrop of a difficult geopolitical situation, the market did not even pay any attention to the economic news background. Yesterday, a retail trade report was released in America, which was ignored, and the minutes of the FOMC meeting were published. Today, the reports were not so important, but they were also ignored. The entire world community and markets are closely monitoring the development of the situation in Ukraine, but there is no positive news. Negotiations are still in place, and on Thursday morning information began to arrive about the opening of fire between the Ukrainian military and the military of the DPR and LPR. Of course, such news could not contribute to improving the atmosphere in the foreign exchange market. Therefore, market participants are probably taking a cautious position now, waiting for the denouement. All the world's media are confident that the Russian invasion of Ukraine will begin before the end of February. Many believe that after the end of the Olympics in China.

General conclusions

Based on the analysis, I conclude that the construction of the descending wave C is completed. However, wave D can already be completed too. If so, now is a good time to sell the European currency with targets located around the 1.1153 mark, which corresponds to 127.2% Fibonacci, for each MACD signal "down". Another upward wave may be built inside wave D, but for now, this option is a backup. A successful breakout attempt of 1.1314 will indicate that the market is ready for new sales of the instrument.

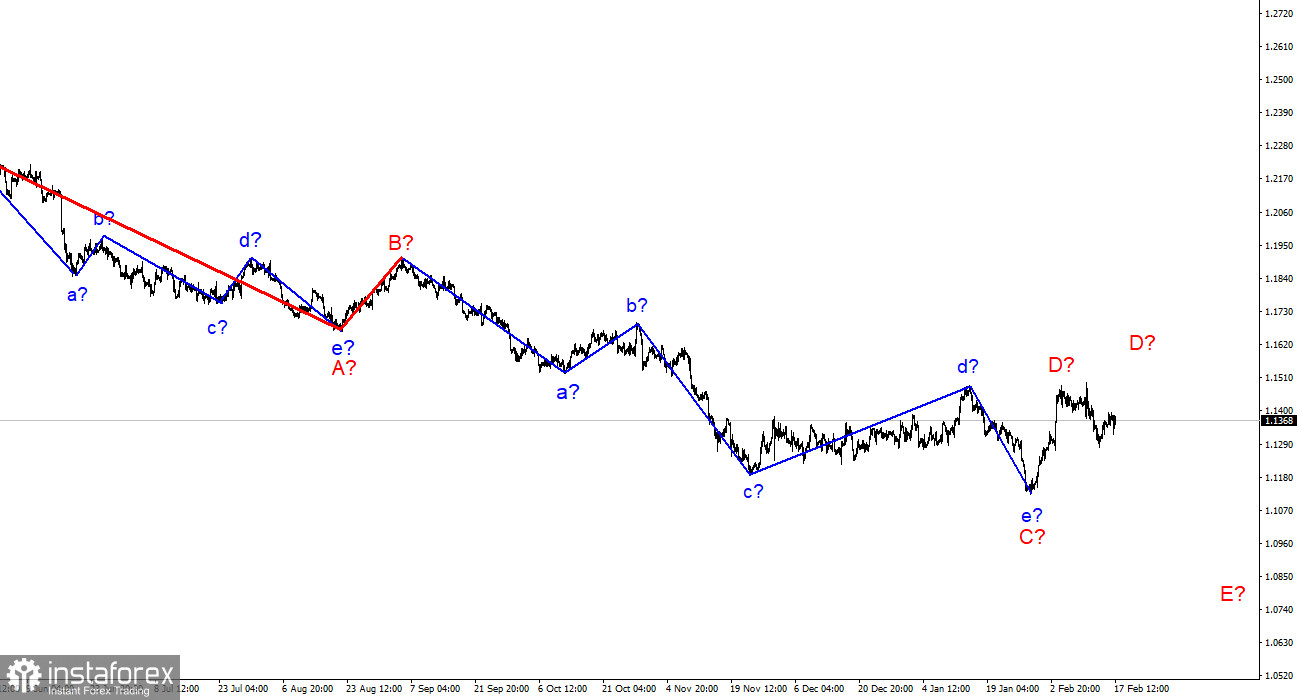

On a larger scale, it can be seen that the construction of the proposed D wave has now begun. This wave can be shortened or three-wave. Considering that all the previous waves were not too large and approximately the same in size, the same can be expected from the current wave. There is reason to assume that wave D has already been completed. Then the construction of wave E began.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română