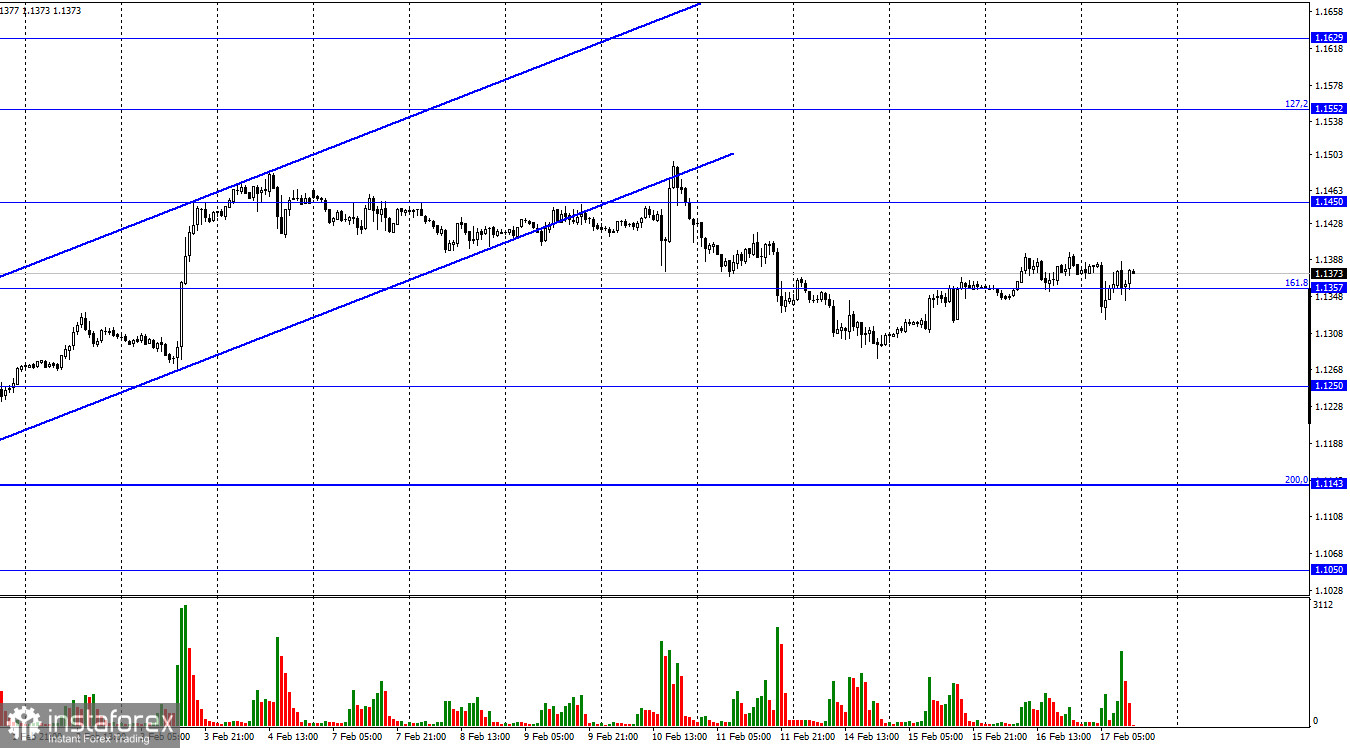

The EUR/USD pair closed above 1.1357, the 161.8% retracement level, on Wednesday. Today, the activity of traders is minimal, despite the rather important and strong informational background yesterday. In particular, the U.S. retail trade report and the minutes of the FOMC meeting were released. However, neither of these had any effect on the mood of traders.

It is also almost impossible now to say in which direction traders will continue to trade and who will have an advantage. There are no corridors on the hourly chart, and the 4-hour chart is in sideways. Thus, neither geopolitics nor economic news can force traders to trade.

Unfortunately, geopolitics does not grab the interest of traders. And it seems to me that the silence in the markets is just related to it. Traders simply do not want to risk the situation when it is completely unclear how the Ukrainian-Russian conflict will end.

This morning, news began to come from Donbass about battles between militants of the unrecognized republics of the DPR and LPR and the Ukrainian military. The nature of these battles is unknown. Negotiations between Moscow and the West have stalled, and one question is now hanging in the air: what is next?

The Russian Federation concentrated a huge army near the border of Ukraine but did not achieve what it wanted, since no one in Ukraine or in the West abandoned the idea of Ukraine joining NATO. Ukraine continues to receive financial and military assistance from many countries of the world. The February 16 invasion did not happen, but at the same time, Russian troops are unlikely to stand on the border for another year or two, waiting for a decision at the highest political level to be found.

Moscow has stressed that it will not attack anyone and conducts routine exercises on its territory. The West, on the other hand, reports daily new dates for a possible Russian invasion of Ukraine. In general, the situation is very unstable and dangerous. No matter how panic happens in the markets.

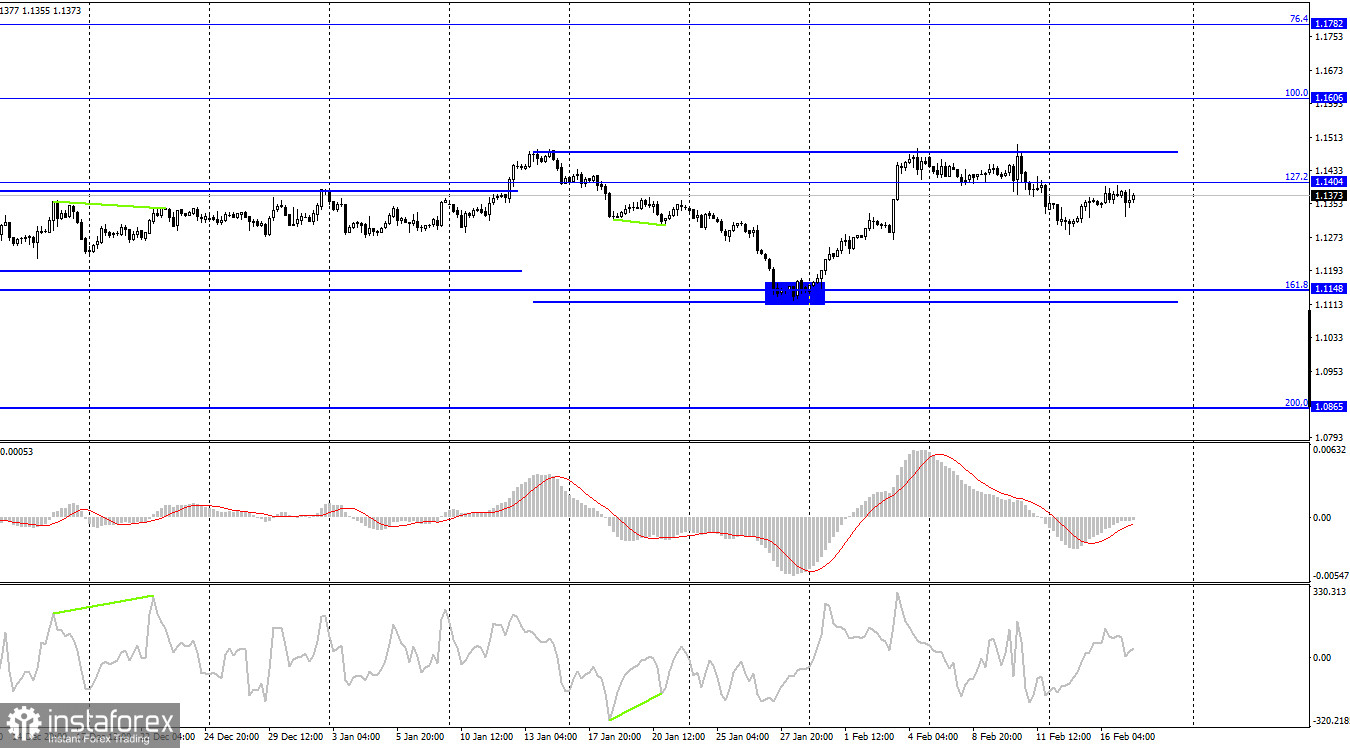

On the 4-hour chart, the pair closed below 1.1404, the 127.2% retracement level, and may continue to fall in the direction of 1.1148, the 161.8% Fibonacci retracement level. There are no emerging divergences in any indicator today, and they are not required with the current information background. The new side corridor characterizes the mood of traders as neutral. Now there is no advantage for either the bulls or the bears.

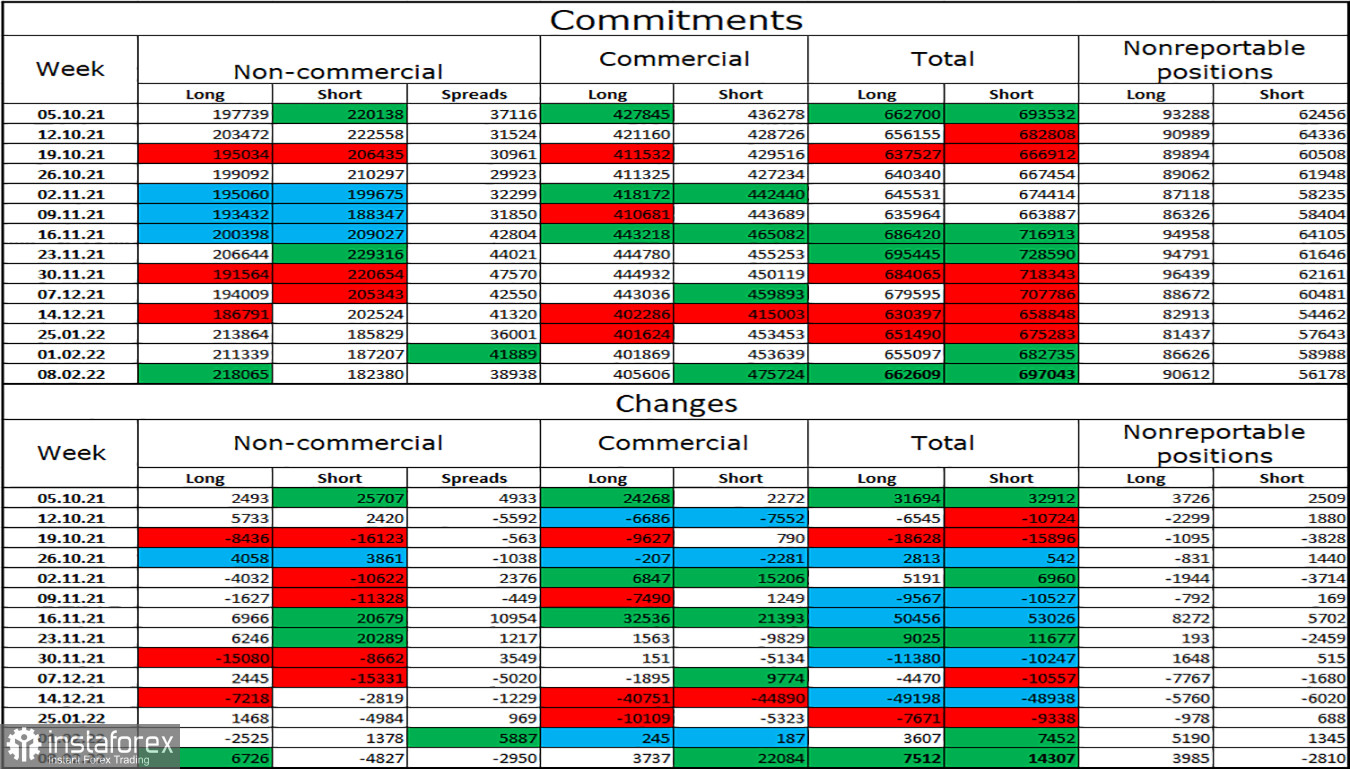

Commitments of Traders (COT) report:

Last reporting week, speculators opened 6,726 long contracts and closed 4,827 short contracts. This means that their mood has become more bullish. The total number of longs focused on their hands is now 218K and shorts are 182K.

Thus, in general, the mood of the non-commercial category of traders is characterized as bullish. This would enable the European currency to count on growth, if not for the information background, which now fully supports the U.S. currency. I believe that this week's COT reports can be neglected, as the situation in the world is tense and the mood of major players can change rapidly.

U.S. & EU New calendar:

U.S. - Initial Jobless Claims (13:30 UTC).

On February 17, the calendars of the European Union and the United States are almost completely empty. There will be only one less important report in the U.S., which will surely be ignored. The information background today will be weak or absent.

EUR/USD Forecast and Advice to Traders:

I recommend selling the pair with targets at 1.1357 and 1.1250 if the price closes below 1.1404 on the 4-hour timeframe. These trades can now be kept open. I do not recommend buying now, as the probability of a continuation of the fall is too high.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română