EUR/USD

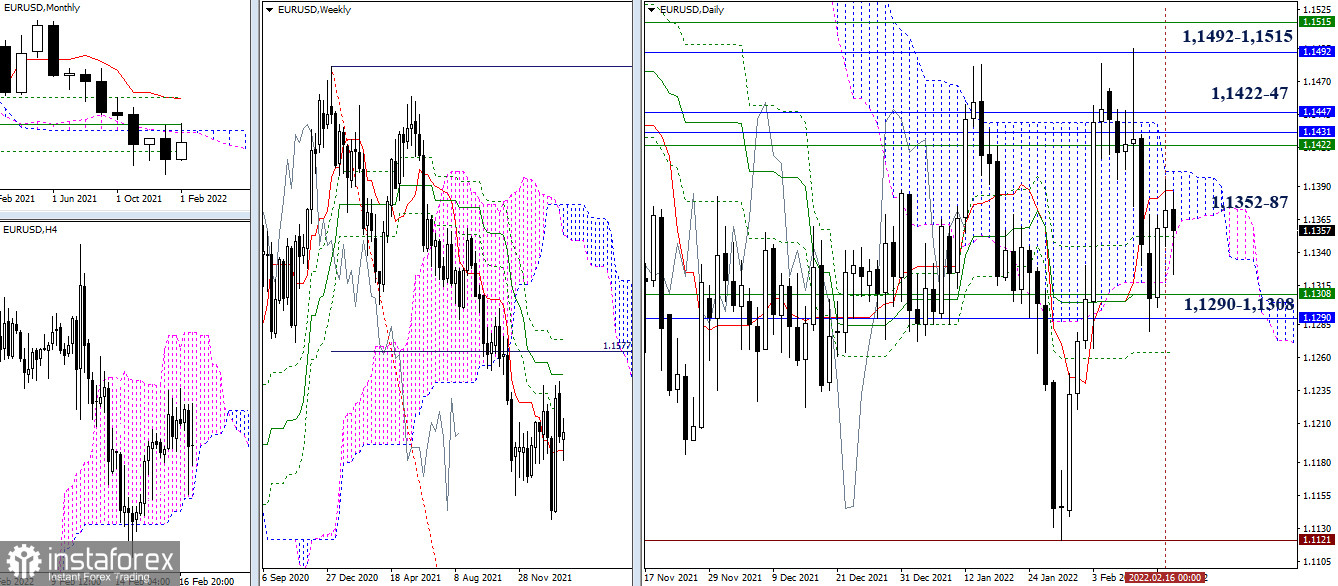

On Tuesday, the euro rebounded at the support around 1.1290 - 1.1308. However, after testing the daily levels above 1.1352-87, which exerted pressure on it, the euro slowed down. Consequently, the rebound halted. The next key targets remain the support at 1.1290 - 1.1308 (weekly short term trend + monthly Fibo Kijun) and resistance at 1.1422-47 (monthly cloud + weekly Fibo Kijun) and 1.1492 - 1.1515 (weekly and monthly medium term trends).

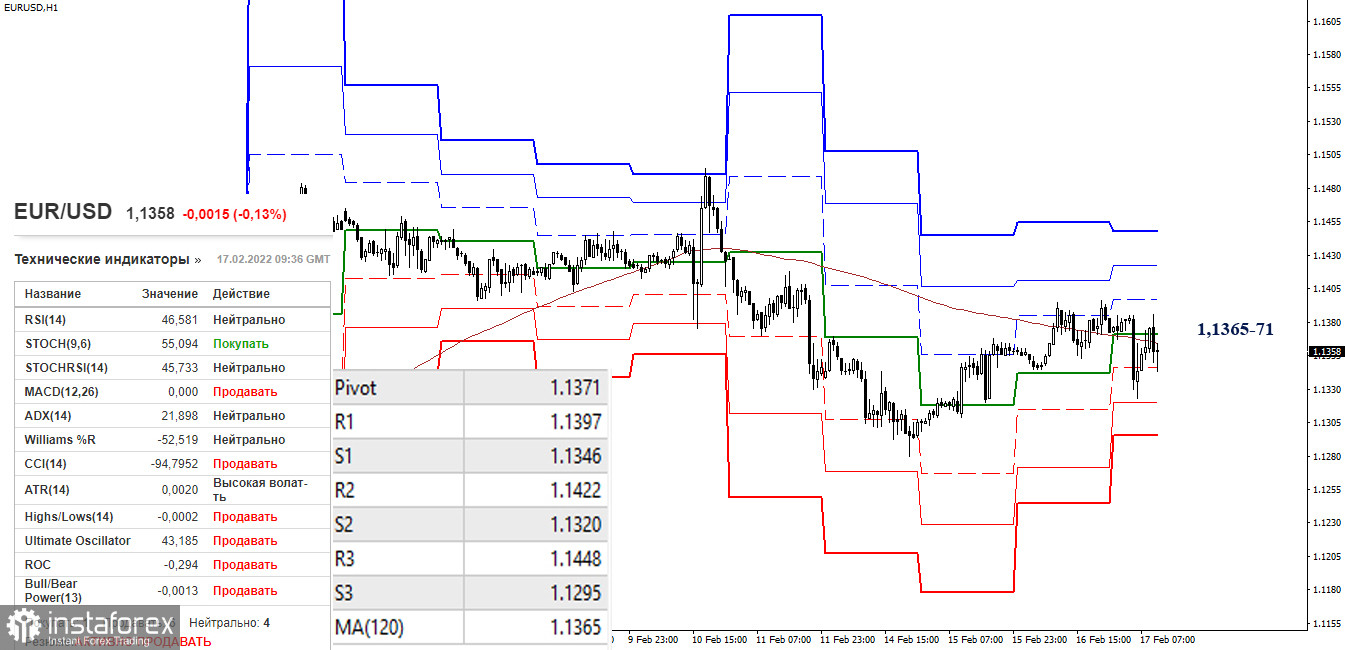

In the smaller time frames, the key level (weekly long-term trend) has been determining for the last two days. Today, it is located at 1.1365. A consolidation above the key level and a reversal of the moving average will change the current balance of forces and will strengthen the position of the bulls. Today, the bullish target within the day is the resistance of classic pivot levels 1.1397 - 1.1422 - 1.1448. Consolidation of key levels favorable to the bears and coming decline will provide a chance for the pair to resume a bearish scenario. Today, it is possible to indicate the support of classical pivot levels at 1.1346 - 1.1320 - 1.1295.

***

GBP/USD

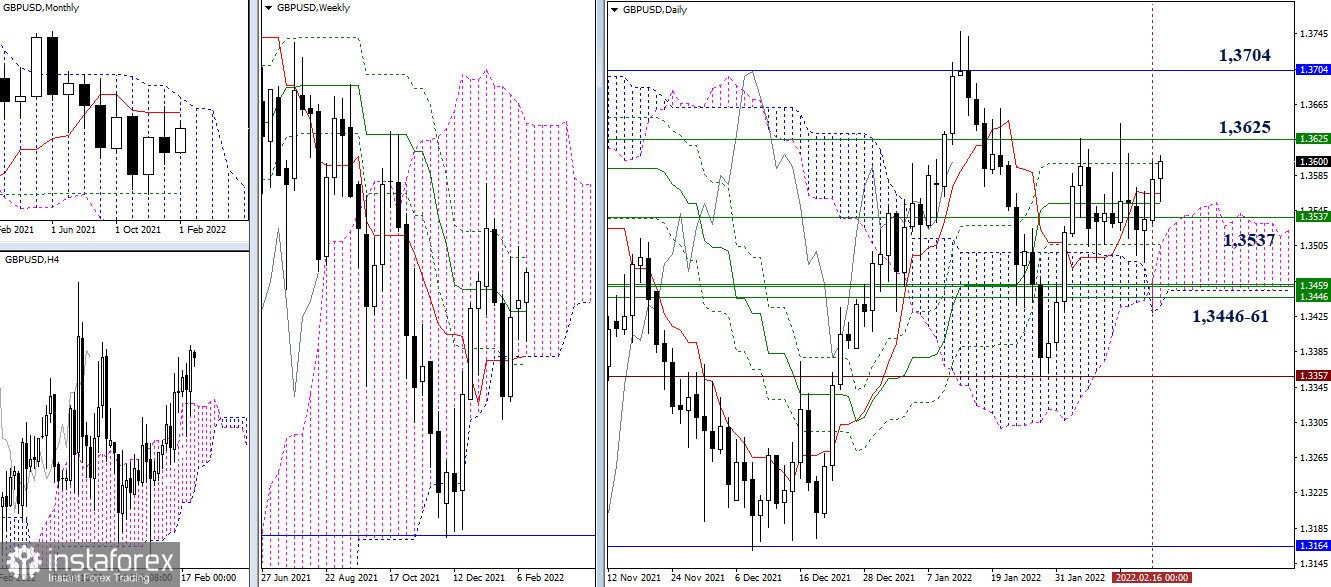

The pair has been within a consolidation range since last week. The daily levels (1.3553-65-99) and weekly medium-term trend (1.3537) are favorable to the pair. In case the pair breaks the consolidation range, the key levels to strengthen the bulls will be 1.3625 (a final level of the weekly dead cross) and 1.3704 (a monthly short-term trend), while several weekly levels 1.3446-61 on the low boundary of the daily cloud (1.3454) are important for the bears.

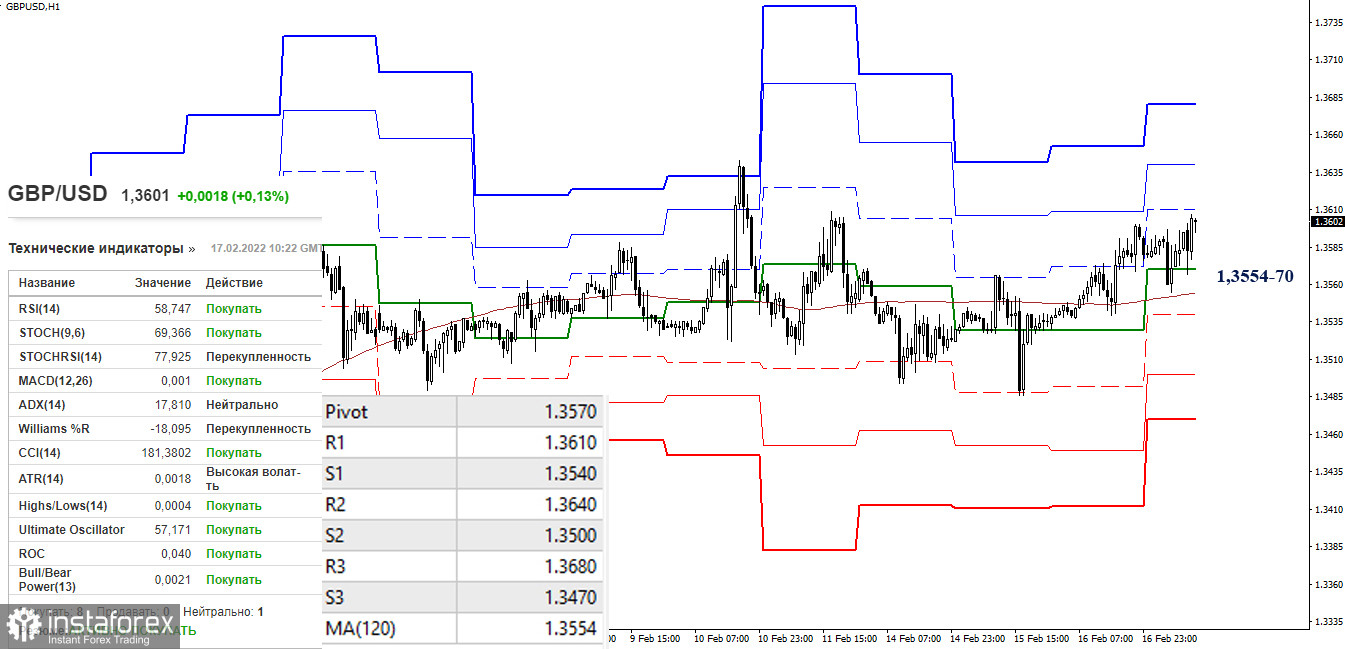

The situation has changed again in the smaller time frames. The bulls managed to reach the key levels. Today, they are located near 1.3554-70 (central pivot level + weekly long-term trend). Therefore, currently the bulls have the advantage. The resistance of the classic pivot levels 1.3610 - 1.3640 - 1.3680 is considered their reference points within the day. A loss of 1.3554-70 and reversal of the moving average will again change the current balance of forces. However, only the players' activity will indicate how effective the changes will be as the pair is now within a consolidation range of the higher time frames. The support of the classic pivot levels is set at 1.3540 - 1.3500 - 1.3470.

***

In the technical analysis of the situation, the following instruments are used:

higher time frames - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română