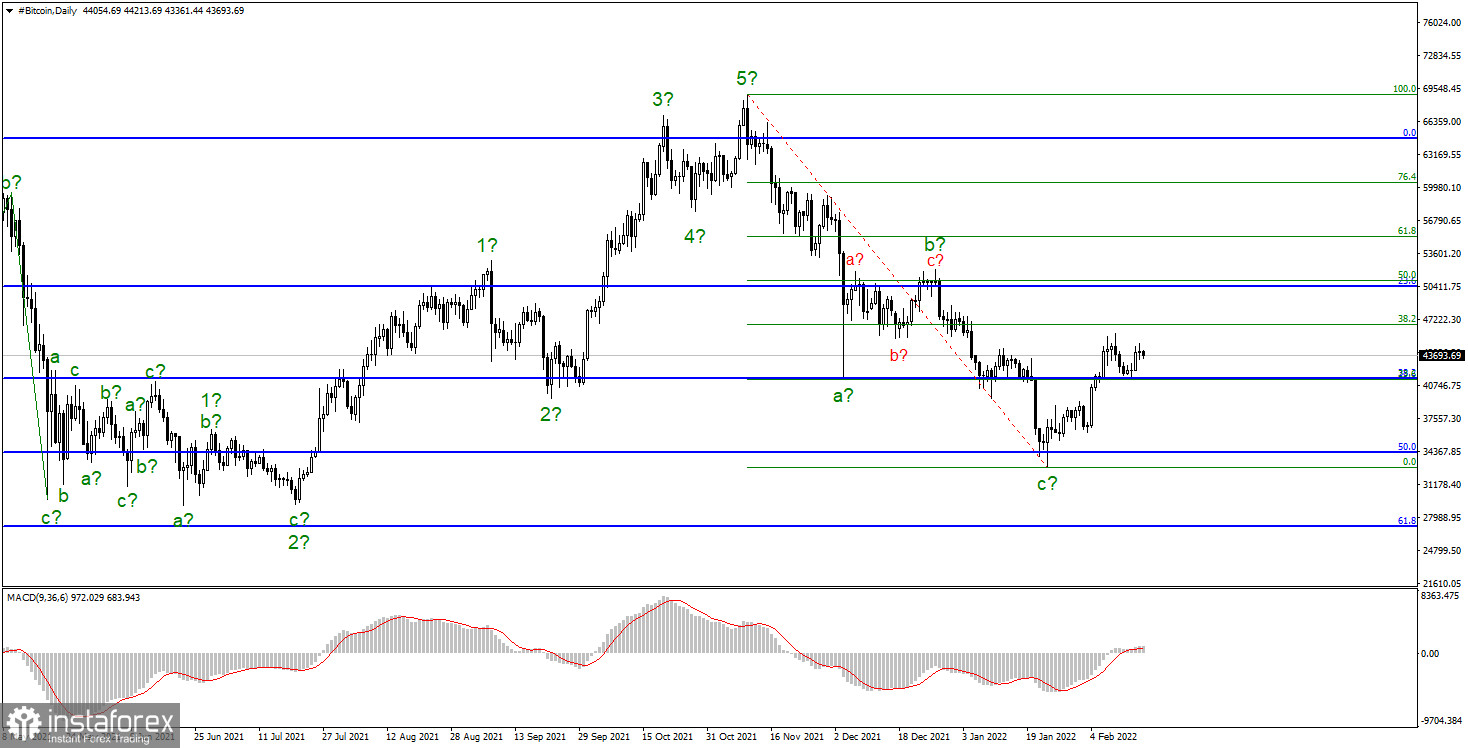

Bitcoin failed again to continue the upward trend on Tuesday. After successfully trying to break through the level of $41,318, which corresponds to 382% Fibonacci, the main digital asset clearly feels out of place. However, it should be noted that all the markets currently feel out of place. First of all, this is due to geopolitics, which has become very seriously aggravated in recent weeks. The crisis in Ukraine has not been resolved. At the same time, negotiations in the West and the Russian Federation have been suspended, as their leaders have already publicly expressed their points of view, and they differ radically. Thus, the whole world is now waiting for who will take the next step and what it will be. Washington and EU countries believe that the geopolitical tension around Ukraine will continue, although it was stated that military exercises are ending and some units have already gone to their usual places of deployment. But this is not confirmed yet. The cryptocurrency market, which is very painfully experiencing geopolitical aggravations, is now in a state of waiting. Therefore, we should not expect Bitcoin's growth any time soon.

- PlanB released a new Bitcoin forecast

As usual, the market is full of predictions about how much Bitcoin will cost in a month, a year, or 5 years. Yesterday, the opinions of two respected traders were introduced, and today, it was reported that an analyst with the nickname PlanB has published a new Bitcoin forecast for the current year. However, this "new forecast" does not differ so much from the "old forecast", which predicted a rise to $100,000 before the end of 2021. At the moment, PlanB believes that Bitcoin will rise to the same level, but by the end of 2022. It is difficult to say where such confidence comes from, given the very weak news background for the cryptocurrency market. It can be recalled that not only the Fed but also many other central banks intend to raise interest rates, which always creates danger for risky assets. And it's hard to find a more risky asset than Bitcoin.

- It's all the Baby Boomers' fault

Fundstrat CEO Thomas Lee shared a very interesting opinion. He accused the so-called "baby boomer" generation of not investing in Bitcoin, which is why the price of the cryptocurrency is not rising. If "baby boomers" start investing in it, then the cryptocurrency could rise to $200,000. It should be noted that "Baby Boomers" are people born between 1946 and 1964. That is, those who are now about 60 years old or more. Lee said that almost $100 trillion in the US belongs to those people over 60 who treat Bitcoin like a toy and do not trust it. This CEO might as well blame the starving children of Africa for not being interested in cryptocurrencies.

The downward trend section continues to form. A failed attempt to break through the level of $34,238, which corresponds to 50.0% on the upper Fibonacci grid, allowed the quotes to start leaving the lows reached. However, it is still too early to talk about the end of the downward section of the trend. It can take a five-wave form and continue its construction with targets near $29,117 and $26,991, which equates to 0.0% and 61.8% Fibonacci within wave e. So far, the wave marking does not imply the construction of a new downward wave. There is not a single signal for this, and the corrective set of waves a - b - c looks quite complete, so the option of building a new upward trend section from the current levels can also be considered. There is a 30% probability for this, but a news background is needed. To sell Bitcoin, new downward signals are needed – unsuccessful attempts to break through levels located above the current rate, or a reversal of the MACD indicator. In general, any signs that the upward wave that is currently being built is already done.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română